Have you ever sat in front of your computer, staring at a stock price, wondering if today is the “right” day to buy? Maybe you saw a headline about a big tech company like Microsoft or Nvidia dropping in price and thought about waiting just one more day to see if it goes lower. This guessing game is what experts call “timing the market,” and for most people, it is a recipe for stress and missed opportunities.

The truth is that even the most seasoned professional investors on Wall Street struggle to predict exactly when the market will hit rock bottom or peak. For a beginner, trying to guess these movements is like trying to catch a falling knife. Instead of stressing over daily price swings, there is a much simpler, more effective strategy used by successful long-term investors. It is called dollar-cost averaging.

This strategy is the ultimate “set it and forget it” tool for building wealth. By shifting your focus from “when” to buy to “how much” to invest consistently, you take the emotion out of the process. Whether the market is up, down, or moving sideways, dollar-cost averaging keeps you moving toward your financial goals without the headache of watching the news every hour.

What Exactly Is Dollar-Cost Averaging?

At its simplest level, dollar-cost averaging is the practice of investing a fixed amount of money into a particular investment on a regular schedule, regardless of the share price. Instead of trying to dump a huge lump sum into the market all at once, you break your investment into smaller, equal pieces that you contribute every week, month, or pay period.

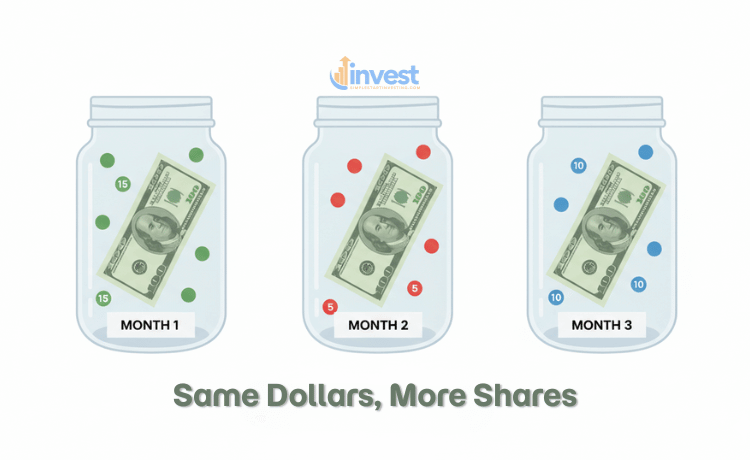

Think of it like a subscription service for your future self. Just as you pay a set amount for a streaming service every month, you “pay” your investment account. Because you are investing the same amount of dollars every time, you naturally end up buying more shares when prices are low and fewer shares when prices are high. Over time, this averages out the cost you pay for your total investment.

A Real-World Example with a Popular Stock

Let’s look at a hypothetical situation involving a well-known company like Costco. Imagine you decide to invest 400 dollars every month into Costco stock.

In the first month, the stock price is 100 dollars per share. Your 400 dollars buys you exactly 4 shares.

In the second month, the market dips, and the price of Costco drops to 80 dollars per share. Because you are still investing 400 dollars, your money now buys you 5 shares. You got a “discount” because the price was lower.

In the third month, the stock recovers and jumps to 200 dollars per share. Your 400 dollars now only buys you 2 shares.

By the end of three months, you didn’t have to guess when the price was lowest. You simply kept going. You ended up with a collection of shares bought at various prices, creating a balanced average cost that didn’t depend on you being “right” about the market’s direction on any specific day.

Why Beginners Often Get It Wrong

One of the most common misunderstandings beginners have is the belief that they must wait for a “market crash” to start investing. They see a stock like Tesla or Amazon trading at an all-time high and think, “I’ll wait until it drops 20% before I put my money in.”

This mindset leads to a dangerous trap called “analysis paralysis.” While you are waiting for that 20% drop, the stock might actually go up another 30%. By the time it finally “drops,” the price might still be higher than it was when you first started watching it. By waiting, you missed out on the growth that happened in the meantime and the dividends the company might have paid out.

Another common mistake is the “all-or-nothing” approach. A beginner might save up 5,000 dollars and wait for the “perfect moment” to invest the whole amount. If they happen to buy on a day when the market is at a peak, and the price drops the next week, they often panic. Seeing a large sum of money decrease in value quickly can lead to “panic selling,” where the investor sells their shares at a loss just to stop the “pain” of seeing the numbers go down.

Shifting the Mindset: Time in the Market vs. Timing the Market

The financial logic you need to adopt is this: Time in the market is more important than timing the market. Wealth is built through the power of compounding over years and decades, not by making a lucky trade on a Tuesday afternoon. When you use dollar-cost averaging, you are prioritizing “time in the market.” You are ensuring that your money is working for you as soon as possible, rather than sitting in a low-interest savings account waiting for a “perfect” moment that may never come.

The Psychological Advantage: Removing Emotion

Investing can be an emotional rollercoaster. When the news reports that the economy is struggling, or you see red numbers across your portfolio, the natural human instinct is to run and hide. Conversely, when everything is booming, people get “FOMO” (Fear Of Missing Out) and want to dump all their money in at the very top.

Dollar-cost averaging acts as an emotional guardrail. It turns your investing into a mechanical process. Since you have already decided to invest 200 dollars or 500 dollars every month, you don’t have to make a new decision when the market is volatile.

If the market is crashing, your DCA plan tells you: “Keep buying. You are getting more shares for your money right now.” If the market is soaring, your DCA plan tells you: “Keep buying. You are maintaining your discipline and building your position.”

This consistency is the hallmark of a successful investor. It prevents you from making impulsive decisions based on fear or greed, which are the two biggest enemies of long-term wealth.

How to Set Up Your Own Strategy

Starting a dollar-cost averaging plan in the U.S. market is easier today than it has ever been. Most major brokerage platforms—such as Fidelity, Charles Schwab, or Vanguard—allow you to set up “automatic investments.”

- Choose Your Frequency: Decide if you want to invest once a week, twice a month (perhaps on paydays), or once a month.

- Pick Your Amount: Choose a dollar amount that you are comfortable with. It should be an amount you won’t need to pull back out if an emergency arises. Even 50 dollars a month is a great place to start.

- Select Your Investment: For many beginners, choosing a broad Index Fund or an ETF (Exchange Traded Fund) that tracks the S&P 500 is a popular choice because it gives you a piece of the 500 largest companies in the U.S. all at once.

- Automate It: Link your bank account and set the system to pull the money and buy the shares automatically.

By automating the process, you remove the “decision fatigue.” You no longer have to log in and manually click “buy,” which is often the moment where fear creeps in and stops people from following through.

Common Questions About Dollar-Cost Averaging

Is it better than investing a lump sum?

Mathematically, if you have a large amount of money sitting ready (like an inheritance), some studies suggest that putting it all in at once can lead to higher returns because the market tends to go up over the long term. However, for the vast majority of people who earn their income through a monthly salary, dollar-cost averaging is the only practical way to invest. More importantly, the psychological peace of mind it provides is often worth more than a few extra percentage points of potential return.

Does this work in a declining market?

Actually, a declining market is where dollar-cost averaging shines the brightest. When prices are falling, your fixed dollar amount buys more and more shares. When the market eventually recovers—as the U.S. market has done after every single downturn in history—you will have a much larger “stack” of shares that will grow in value.

Can I do this with individual stocks like Apple or Walmart?

Yes, you can. Many modern brokerages offer “fractional shares,” which means if you want to invest 100 dollars into a stock that costs 200 dollars, you can simply buy half a share. This makes dollar-cost averaging accessible for almost any stock or fund, regardless of how high the price per share is.

Things to Keep in Mind

While dollar-cost averaging is a powerful tool, it does not guarantee a profit or protect against a loss in a declining market. Since it involves continuous investment, you should consider your ability to keep investing through periods of low price levels.

Also, keep an eye on transaction fees, though most major U.S. brokerages now offer commission-free trading for stocks and ETFs. If your platform charges a fee for every trade, frequent small investments could eat into your returns. In that case, you might choose to invest once a month rather than once a week.

Always remember that regulations and tax laws regarding investment accounts (like IRAs or 401ks) can change. It is a good idea to stay updated on the latest IRS guidelines or speak with a qualified financial professional to ensure your strategy fits your specific tax situation.

Building a Legacy, One Step at a Time

Wealth is rarely the result of a single “lucky break.” It is almost always the result of discipline, patience, and a solid system. By embracing dollar-cost averaging, you are choosing a system that values consistency over guesswork.

You don’t need to be a math genius or a stock market wizard to succeed. You just need the discipline to keep going, month after month, year after year. While everyone else is stressing over the daily news and trying to time their entries, you can rest easy knowing that your wealth is being built steadily, one “average” purchase at a time.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investment involves risk, and past performance is no guarantee of future results.