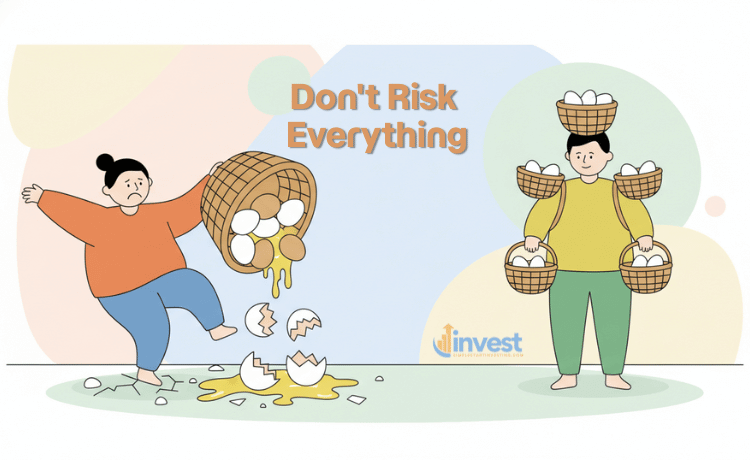

Think about your last trip to the grocery store. If you only bought ten cartons of eggs and nothing else, your dinner options would be very limited. Even worse, if you tripped on your way home, you might lose every single meal you planned for the week.

In the world of money, we call this “concentration risk.” When you put all your money into just one company or one single type of investment, you are essentially carrying a very fragile basket of eggs. Investment diversification is the strategy of spreading your money across different areas to protect yourself from a single accident.

If you are just starting out, you might feel overwhelmed by the thousands of stocks and bonds available. You might wonder if you should just buy the famous tech companies everyone talks about. However, understanding how to spread your risk is the single most important skill you can learn this year.

What is Investment Diversification?

At its heart, investment diversification is a safety net. It is the practice of spreading your money among various types of investments to reduce the impact of any single one performing poorly. The goal isn’t necessarily to make the most money possible in one day, but to make sure you stay in the game for the long run.

The 4-Step Explanation of Diversification

Step 1: Simple English Explanation Imagine you are building a team for a long-distance race. If you only hire sprinters, your team will be fast at the start but will get tired quickly. If you only hire hikers, they will finish the race but will be very slow. A diversified team has sprinters, hikers, and steady joggers. They balance each other out so the team always keeps moving forward.

Step 2: Real-World American Example Let’s look at two different investors. Sarah puts all 10,000 dollars into a single high-growth tech stock like Tesla (TSLA). Meanwhile, Mark splits his 10,000 dollars. He puts 2,500 dollars into Tesla, 2,500 dollars into a stable grocery giant like Walmart (WMT), 2,500 dollars into a healthcare leader like Johnson & Johnson (JNJ), and 2,500 dollars into a utility company like Duke Energy (DUK).

Step 3: Common Beginner Mistake Many beginners think diversification means they won’t lose any money. They believe that if they buy five different stocks, their portfolio value will never go down. This is a misunderstanding. Even a diversified portfolio can lose value when the whole market is having a bad day.

Step 4: The Correct Mindset The real purpose of diversification is to prevent a “total wipeout.” If Tesla has a bad year and its stock price drops, Sarah loses a huge portion of her savings. But for Mark, the steady performance of Walmart or Johnson & Johnson can help offset Tesla’s drop. Diversification is about managing the “swing” of your account so you don’t panic and sell everything at the wrong time.

Why You Can’t Just Pick One “Winner”

It is tempting to look at a company like Apple (AAPL) or Amazon (AMZN) and think, “These companies are huge, they will never fail.” While these are successful businesses, no company is immune to problems. Regulations can change, new competitors can emerge, or the entire economy can shift.

When you focus on investment diversification, you are admitting that you cannot predict the future. You are choosing to be “mostly right” most of the time, rather than “exactly right” once and “completely wrong” later.

Understanding Sectors: The Different “Neighborhoods” of the Market

In the US stock market, companies are grouped into “sectors.” These are like different neighborhoods in a city. One neighborhood might be for tech, another for banks, and another for energy.

- Technology: Companies like Microsoft (MSFT) or Nvidia (NVDA). They grow fast but can be very volatile.

- Consumer Staples: Companies that sell things people need every day, like Costco (COST) or Procter & Gamble (PG). People still buy soap and cereal even during a recession.

- Healthcare: Companies like UnitedHealth (UNH). Healthcare is often steady because people need medical care regardless of the stock market.

- Energy: Companies like ExxonMobil (XOM). These are often tied to the price of oil and gas.

By owning a little bit of each neighborhood, you ensure that if the tech neighborhood is having a “stormy” year, the consumer staples neighborhood might be “sunny,” keeping your overall portfolio stable.

The Two Main Layers of Diversification

For a complete beginner, it helps to think of diversification in two simple layers: Asset Allocation and Security Diversification.

Layer 1: Asset Allocation (The Big Categories)

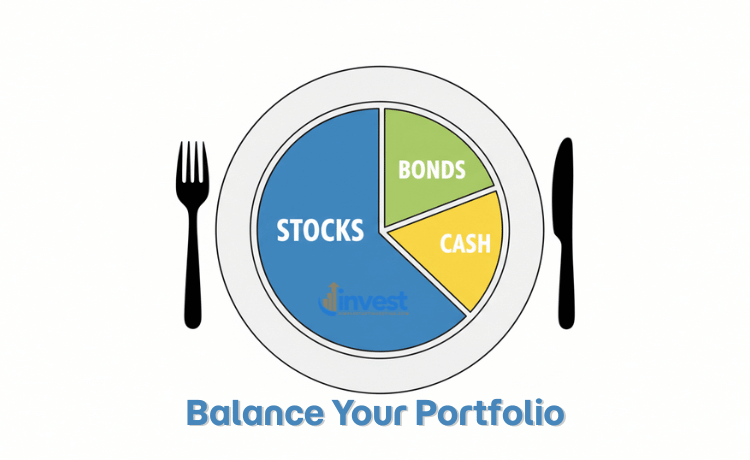

This is the balance between different types of investments, such as stocks, bonds, and cash.

Step 1: Simple English Explanation Asset allocation is like deciding how much of your meal should be protein, how much should be vegetables, and how much should be grains. Stocks are like the protein (for growth), and bonds are like the vegetables (for health and stability).

Step 2: Real-World Example A young worker in their 20s might choose to have 90 percent of their money in stocks for long-term growth and 10 percent in bonds for a little bit of safety. If they have 1,000 dollars, they put 900 dollars into the stock market and 100 dollars into a bond fund. An older person near retirement might choose 50 percent stocks and 50 percent bonds to protect what they have already built.

Step 3: Common Beginner Mistake Many new investors think “diversification” only means buying different stocks. They ignore bonds or cash entirely, thinking they are “boring.”

Step 4: The Correct Mindset Bonds and cash act as the “shock absorbers” for your car. When the stock market road gets bumpy, those “boring” assets are what keep you from crashing. True investment diversification requires looking at all types of assets, not just stocks.

Layer 2: Security Diversification (The Specific Companies)

Once you decide how much to put in stocks, you need to decide which ones.

Step 1: Simple English Explanation This is making sure you don’t just buy one brand of stock. Instead of only buying Amazon, you buy a mix of many companies.

Step 2: Real-World Example Instead of picking 20 individual stocks, many Americans use an “Index Fund” or an “ETF” (Exchange-Traded Fund). For example, an S&P 500 fund allows you to own a tiny piece of the 500 largest companies in the US, from JPMorgan Chase (JPM) to Disney (DIS), all with one single purchase.

Step 3: Common Beginner Mistake A common error is buying five different “Tech” ETFs and thinking you are diversified. If all five funds own the same companies, like Apple and Google, you aren’t actually diversified. You are just repeating the same bet.

Step 4: The Correct Mindset You want “uncorrelated” assets. This is a fancy way of saying you want investments that don’t always move in the same direction at the same time. When the price of gas goes up, an airline stock might go down, but an energy stock might go up. That balance is the key.

Important Rules for This Year (2026)

If you are planning your strategy for this year, there are some specific rules and limits in the US that you should keep in mind. The IRS often updates how much you can contribute to tax-advantaged accounts, which are great tools for building a diversified portfolio.

Retirement Account Limits

For the current year, the contribution limit for a 401(k) plan has increased to 24,500 dollars. If you are using an IRA (Individual Retirement Account), the limit is now 7,500 dollars. If you are aged 50 or older, you can add even more through “catch-up” contributions.

These accounts allow you to hold a diversified mix of funds while saving on taxes. The SEC (Securities and Exchange Commission) has also been focusing heavily on making sure beginners understand the risks of “complex” products. They recommend that most retail investors stick to transparent, well-diversified funds rather than trying to use “leveraged” or “inverse” products that can be very dangerous for a beginner.

Note: Regulations can change; please check current guidelines or consult a professional.

The “Diworsification” Trap: Can You Have Too Much?

Wait—can you actually have too much diversification? Surprisingly, yes. There is a point where adding more stocks doesn’t actually help you reduce risk; it just makes your returns average and your paperwork a nightmare. This is sometimes called “diworsification.”

How to Avoid the Quantity Trap

Step 1: Simple English Explanation If you own 500 different stocks individually, you are essentially trying to track the entire market yourself. It becomes very hard to know what you own, and you might end up paying way too much in fees or spending all your free time reading financial reports.

Step 2: Real-World Example Imagine a beginner who opens five different brokerage accounts and buys 50 different “hot” stocks they saw on social media. They have stocks in tech, mining, retail, and biotech. They feel diversified, but they have no idea if those companies are actually good businesses. They are just “collecting” stocks like trading cards.

Step 3: Common Beginner Mistake New investors often think that owning 50 stocks is “safer” than owning 20. In reality, once you get past about 20 to 30 well-chosen companies in different industries, the extra safety you get from adding more is very small.

Step 4: The Correct Mindset Focus on quality diversification. It is better to own one broad “Total Market Fund” that holds 3,000 companies automatically than to try and pick 50 individual stocks yourself. The goal is simplicity and coverage, not just a high number of different names in your account.

Simple Steps to Start Diversifying Today

You don’t need a math degree to build a solid portfolio. Here is a logical way to think about it as you set up your accounts this year.

1. Start with the “Foundation”

Most experts suggest a “Core” investment. This is usually a broad index fund that covers the entire US stock market. If you put 70 percent of your money here, you are already more diversified than most people because you own a piece of everything from Walmart to Microsoft.

2. Add “International Flavor”

Don’t forget that there are great companies outside the United States. Adding an International Fund gives you exposure to companies like Toyota or Samsung. This protects you if the US economy slows down while other parts of the world are growing.

3. Balance with “Stability”

Depending on your age, put a portion of your money into a Bond Fund. If you have 100 dollars and decide on a “balanced” approach, you might put 70 dollars in stocks and 30 dollars in bonds. If the stock market drops and your 70 dollars becomes 60 dollars, your 30 dollars in bonds will likely stay around 30 dollars, meaning your total account only dropped a small amount.

4. Review and “Rebalance”

Over time, some of your investments will grow faster than others. If your stocks do really well, they might grow to become 90 percent of your portfolio. This means you are now “over-exposed” to stock market risk. Once a year, you should look at your account and move some money back to your original plan (for example, selling a bit of stock to buy more bonds).

The Logic of Staying Power

The biggest enemy of a beginner investor isn’t the market—it’s emotions. When the news says the market is crashing, people who are not diversified often panic. They see their one or two stocks dropping by 50 percent and they sell everything because they are scared of losing it all.

Investment diversification gives you the confidence to stay calm. When you know that you own hundreds of different businesses across the globe, you realize that it is almost impossible for all of them to go to zero at the same time.

If you start with 1,000 dollars and diversify it properly, you might see it dip to 950 dollars during a bad month. That is much easier to handle than seeing it dip to 500 dollars because you put everything into one risky company. Staying in the market is how you win in the long run.

Summary of the Diversified Mindset

Building wealth is a marathon, not a sprint. By using investment diversification, you are making sure you have the right shoes, plenty of water, and a steady pace to reach the finish line.

- Spread your risk: Don’t rely on one company or one sector.

- Use the tools available: Look into Index Funds and ETFs for “instant” diversification.

- Keep it simple: You don’t need 100 different accounts; you just need a few funds that cover different areas.

- Watch the limits: Make sure you are taking advantage of the updated IRS limits for your 401(k) and IRA this year.

By following these simple rules, you are moving away from “gambling” and toward “investing.” You are protecting your future self from the mistakes of today.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Always conduct your own research or consult with a qualified financial advisor before making investment decisions.