Have you ever looked at your bank account and felt a sudden pit in your stomach because a “surprise” bill just arrived? Maybe it was the annual car registration, a semi-annual insurance premium, or the realization that the holiday season is only four weeks away and your “gift budget” is exactly zero dollars.

Most people treat these moments like financial emergencies. They scramble, put the balance on a credit card, and spend the next three months paying it off with interest. But here is the secret: these aren’t emergencies. They are predictable expenses.

If you are tired of living in a cycle of “financial surprises,” it is time to master a simple yet life-changing tool. In the world of personal finance, we call this a sinking fund. It is the bridge between the stress of today and the financial freedom of tomorrow.

What Exactly Is a Sinking Fund?

At its most basic level, a sinking fund is a way to set aside a specific amount of money every month for a specific future expense. Think of it as a “pre-payment” plan that you control. Instead of waiting for a big bill to hit and hoping you have the money, you build the money gradually over time so that when the bill arrives, you already have the cash sitting there, waiting to be used.

The term sounds a bit strange—why would you want your fund to “sink”? Historically, the term comes from businesses “sinking” or paying off a debt gradually. For you, it means you are gradually “sinking” the cost of a future purchase so it doesn’t sink your budget later.

A Real-Life Example Imagine you know that your annual Amazon Prime membership and your car’s smog check happen every October. Together, they cost about 240 dollars. Instead of panicking in October, you decide to set up a sinking fund in January.

If you save 20 dollars every month for 12 months, by the time October rolls around, you have exactly 240 dollars. When the bill hits your inbox, you don’t feel a thing. You simply move that money from your savings to your checking account and pay it off. You didn’t “lose” money in October; you just spent what you had already saved.

The Common Beginner Mistake Many beginners think that having one big “Savings Account” is enough. They put all their extra money into one pile and assume it covers everything. The problem? When they see 5,000 dollars in that account, they might feel rich and decide to buy a new couch from Wayfair. Two weeks later, the car breaks down, and they realize that 5,000 dollars was actually supposed to cover their taxes and repairs.

The Correct Mindset Shift You must stop viewing your savings as one big “bucket” of money. Instead, view it as a collection of smaller “envelopes” with specific names on them. When you give your money a job before you spend it, you gain clarity. You realize that “having money in the bank” is not the same as “having money available to spend.”

Sinking Funds vs. Emergency Funds: Know the Difference

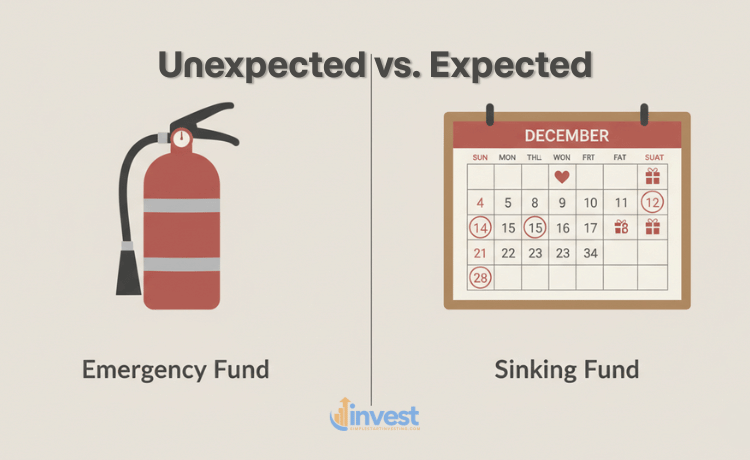

One of the biggest hurdles for new investors and savers is confusing a sinking fund with an emergency fund. While they both live in your savings account, they serve completely different purposes.

An emergency fund is for the “unknown unknowns.” This is money for things you cannot predict: a sudden job loss, an unexpected medical crisis, or a major plumbing leak in your house. It is your financial safety net.

A sinking fund is for the “known unknowns” or “known knowns.” You know Christmas happens every December 25th. You know your car will eventually need new tires. You know your best friend is getting married next summer. These are not emergencies; they are upcoming events.

A Real-Life Example Let’s say you are driving a Tesla Model 3. If you get into a sudden accident that isn’t covered by insurance, that is an emergency. You pull from your Emergency Fund. However, if you know that in about two years you will need to replace the tires (which are notoriously expensive for EVs), that is a sinking fund. You start saving 50 dollars a month now so the 1,200-dollar tire bill doesn’t ruin your month later.

The Common Beginner Mistake Newbies often use their emergency fund to pay for things like holiday gifts or a planned vacation to Hawaii. They tell themselves, “I’ll pay it back later.” But then a real emergency happens—like a layoff—and the money is gone because it was spent on plane tickets.

The Correct Mindset Shift An emergency fund is like a fire extinguisher; you hope you never have to use it. A sinking fund is like a gift card to your future self; you know exactly when and how you are going to use it. By separating these two, you protect your safety net while still enjoying your life.

The Most Common Sinking Fund Categories

If you are just starting, you might wonder what you should actually save for. While everyone’s life is different, most Americans benefit from these five core sinking fund categories.

1. Home and Car Maintenance

If you own a home or a car, things will break. It isn’t a matter of “if,” but “when.” Instead of being shocked when the HVAC system at your house needs a 500-dollar repair or your Ford F-150 needs a new battery, you should have a fund ready.

2. Holidays and Special Occasions

The “Holiday Hangover” is real. Many people spend January and February stressed because they overspent in December. A sinking fund for Christmas, Hanukkah, or birthdays allows you to be generous without the debt.

3. Annual Subscriptions and Taxes

Do you pay for Disney+, Netflix, or a gym membership annually to save money? What about property taxes or professional licensing fees? These “once-a-year” hits are the primary reason budgets fail.

4. Travel and Fun

Saving for a big trip to a National Park or a flight to see family shouldn’t happen the month before you leave. By spreading the cost over a year, a 2,400-dollar vacation becomes a manageable 200-dollar-a-month “bill” you pay to yourself.

5. “The Next Phone” or Tech

We know that smartphones don’t last forever. If you know you want the newest iPhone or Samsung Galaxy in two years, start a sinking fund today. Saving 40 dollars a month for 24 months gives you nearly 1,000 dollars for a brand-new device without using a payment plan.

How to Calculate Your Sinking Fund (The Easy Way)

You don’t need to be a math genius or a Wall Street analyst to figure this out. All you need to know is two things: How much do I need? and When do I need it?

Let’s walk through the logic without any complex math.

Step 1: Identify the total cost of the item or event. Step 2: Identify how many months you have until that date arrives. Step 3: Divide the total cost by the number of months.

A Real-Life Example Let’s say you want to save for a wedding anniversary trip to New York City. You estimate the flights, a hotel near Times Square, and dinner at a nice steakhouse will cost 1,800 dollars. Your anniversary is in 6 months.

To find your monthly savings goal, you take that 1,800 dollars and split it into 6 equal parts. This means you need to set aside 300 dollars every single month.

The Common Beginner Mistake Beginners often forget to include “hidden costs.” For a trip, they might only save for the flight and hotel, forgetting about Ubers, tips, and airport snacks. This leads to them “borrowing” from their rent money once they actually get on the trip.

The Correct Mindset Shift Always over-estimate slightly. If you think the trip will cost 1,800 dollars, try to save 2,000 dollars. It is much better to come home with 200 dollars extra than to come home with 200 dollars in credit card debt.

Where Should You Keep Your Sinking Funds?

This is a critical question for a “Simple Start.” You shouldn’t just leave this money in your everyday checking account. If you see it there when you are at the Costco checkout line, you will be tempted to spend it on a giant television or a year’s supply of snacks.

The best place for sinking fund money is a High-Yield Savings Account (HYSA).

An HYSA is a type of savings account, usually at an online bank like Ally, Marcus by Goldman Sachs, or SoFi, that pays you a higher interest rate than a traditional “big bank.” It is still FDIC-insured, meaning your money is safe up to 250,000 dollars.

Why use an HYSA for Sinking Funds?

- Out of sight, out of mind: It’s harder to spend money you don’t see every time you open your banking app.

- Buckets or Vaults: Many modern online banks allow you to create “buckets” or “sub-accounts.” You can have one main account, but inside, you can label 500 dollars for “Car Repairs” and 300 dollars for “Christmas.”

- Interest: While you are waiting to spend the money, the bank pays you interest. It might only be a few dollars a month, but that is better than nothing!

The Common Beginner Mistake Some people try to invest their sinking fund money in the stock market (like buying shares of AAPL or AMZN) because they want it to grow faster. This is dangerous! If the stock market drops 10 percent the week before your car insurance is due, you won’t have enough money to pay the bill.

The Correct Mindset Shift Sinking funds are for spending, not for investing. The goal isn’t to make a 10 percent return; the goal is for the money to be there exactly when you need it. Keep this money in a safe, liquid savings account, not in the stock market.

The Psychological Benefit: Ending Financial Guilt

Perhaps the biggest reason to use sinking funds has nothing to do with math and everything to do with your mental health.

In the US, we are constantly bombarded with advertisements telling us to “Buy Now, Pay Later.” This creates a culture of guilt. When you buy something expensive, even if you need it, you feel bad because you know you are hurting your future self.

When you have a sinking fund, that guilt disappears.

A Real-Life Example Imagine it’s Black Friday. You see a great deal on a new MacBook. If you haven’t saved for it, buying it feels like a “guilty pleasure” that will haunt your bank statement for months.

But, if you have a “New Laptop” sinking fund with 1,200 dollars in it, buying that MacBook feels like a victory. You aren’t “spending” money in a way that hurts; you are simply executing a plan you’ve had for months. You can walk out of the store with a smile, knowing your rent, groceries, and retirement savings are all still perfectly safe.

Step-by-Step: How to Start Your First Sinking Fund Today

If you are ready to stop the “surprise bill” cycle, here is your action plan:

1. Look at your bank statements from the last year. Identify those big, one-time expenses. Look for the Amazon Prime renewal, the car registration, the vet visit, and the holiday spending.

2. Pick just TWO categories to start. Don’t try to save for 20 things at once. Pick the two that stress you out the most. For many, this is “Car Maintenance” and “Christmas/Holidays.”

3. Open a dedicated savings account. If your current bank doesn’t allow “buckets,” consider opening an account at a reputable online bank. It takes about 10 minutes.

4. Set up an automatic transfer. This is the most important step. Don’t rely on your willpower. Set it so that every time you get a paycheck, 25 dollars or 50 dollars automatically moves into your sinking fund. If you don’t see the money, you won’t miss it.

5. Spend it when the time comes! This is the fun part. When that “surprise” bill arrives, don’t panic. Gently transfer the money from your sinking fund to your checking account and pay the bill. Give yourself a pat on the back. You just beat the system.

Summary: Your Financial Shield

Sinking funds turn “crises” into “inconveniences” and “stress” into “strategy.” By looking ahead and planning for the inevitable costs of life, you take control of your narrative. You are no longer a victim of your mailbox; you are the manager of your money.

As you become more comfortable with sinking funds, you can add more categories. Eventually, you might have funds for “Self-Care,” “Home Decor,” or even a “New Car Fund.” Each one is a brick in the wall of your financial security.

Remember, the goal of investing and personal finance isn’t just to have a high net worth—it’s to have a high quality of life. And nothing improves quality of life like knowing that no matter what bill arrives in the mail tomorrow, you’ve already got it covered.

Regulations and banking features can change; please check current guidelines or consult with a financial professional.