Imagine you just received your paycheck. It feels great, right? But then, the “vultures” arrive. The landlord wants their cut. The electric company sends a bill. You need groceries, gas, and maybe a little weekend fun. By the time you reach the end of the month, you look at your bank account and realize there is nothing left to save.

This is the cycle most people live in, and it is the fastest way to stay stuck. But what if you flipped the script? What if you were the very first person who got paid every single month?

This simple shift is called the pay yourself first strategy. It is not just a catchy phrase; it is the single most powerful habit used by wealthy individuals to build a future without constantly stressing over every penny. In this guide, we are going to break down exactly what this means and how you can start doing it today, even if you feel like you do not have a dollar to spare.

What Does “Pay Yourself First” Actually Mean?

At its heart, to pay yourself first means that you treat your savings and investments as your most important monthly bill. Most people follow a “leftover” strategy. They receive their pay, spend on their needs and wants, and then hope there is something left at the bottom of the bucket to put into a savings account.

The problem? There is almost never anything left. Our brains are wired to find ways to spend the money we see in our accounts. If you have 500 dollars sitting there, you are much more likely to justify a nice dinner or a new pair of shoes.

When you pay yourself first, you take a set amount of money out of your paycheck the moment it hits your account. You move it to a separate place—like a high-yield savings account or a retirement fund—before you pay for rent, before you buy coffee, and before you pay your internet bill. You are essentially telling the world that your future self is more important than your current impulses.

Why the “Leftover” Strategy Fails Every Time

We have all been there. We tell ourselves, “I’ll save 200 dollars at the end of this month if I’m careful.” Then, an unexpected birthday party comes up. Or you see a sale at a store like Walmart or Target that is too good to pass up. By day 28 of the month, that 200 dollars has vanished into thin air.

This happens because of a concept called Parkinson’s Law. This law suggests that our “work” (or in this case, our spending) expands to fill the time or money available. If your bank balance shows 3,000 dollars, you will subconsciously find 3,000 dollars’ worth of “needs.”

By removing your savings immediately, you artificially lower your “available” balance. If you move 300 dollars to a separate account right away, your brain now thinks you only have 2,700 dollars to live on. You will naturally adjust your spending to fit that new, smaller number. It is a psychological trick that works every single time.

The Core Strategy: A Deeper Look

To truly master this, we need to look at how it applies to real life. Let’s break down a few key areas where you can apply this logic.

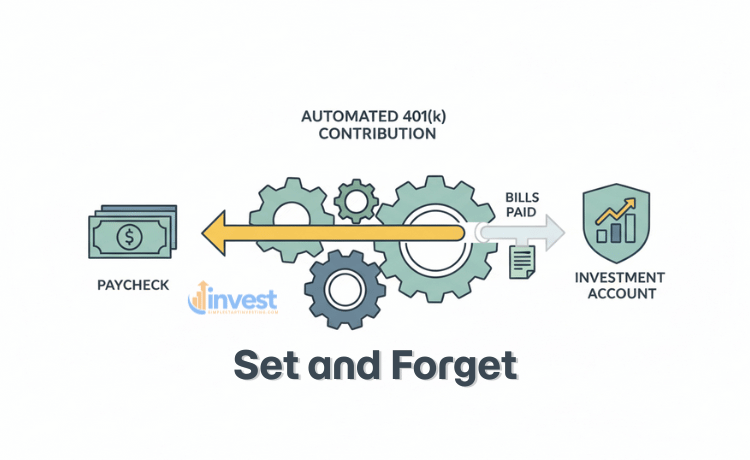

1. Using Your Employer’s 401(k) Plan

If you work for a company like Amazon, Microsoft, or even a local hospital, you likely have access to a 401(k) plan. This is the ultimate way to pay yourself first because the money never even touches your bank account.

The Explanation: A 401(k) is a retirement savings plan sponsored by an employer. You decide what percentage of your salary you want to save, and the company takes it directly from your paycheck before the government even takes taxes.

The Example: Let’s say you earn 5,000 dollars per month. You decide to contribute 10 percent to your 401(k). This means 500 dollars is automatically moved into your investment account. When you look at your paycheck, it shows that your “gross” pay was 5,000 dollars, but your take-home pay is based on 4,500 dollars. You never “saw” that 500 dollars, so you never had the chance to spend it on a new gadget or a fancy meal.

The Common Mistake: Many beginners wait until they “feel” they are making enough money to start. They think, “I’ll start my 401(k) when I get my next raise.”

The Correct Mindset: The best time to start is now, regardless of your salary. If you wait for a raise, you will likely just experience “lifestyle creep,” where your spending grows as fast as your income. If you start with even 1 percent today, you are building the muscle of paying yourself first.

2. The Direct Deposit Trick

Not everyone has a 401(k), especially if you are a freelancer or work for a small business. But you can still automate the process.

The Explanation: Most employers allow you to split your direct deposit into two or more bank accounts. You can tell your payroll department to send 90 percent of your pay to your checking account and 10 percent to a separate savings account at a different bank.

The Example: Imagine you work at Costco. On payday, your 1,800 dollar paycheck is split. 1,600 dollars goes into your main account for bills. The other 200 dollars goes into a high-yield savings account that you don’t even have a debit card for. Because you don’t see that 200 dollars in your “daily” account, you don’t count it as money you can spend.

The Common Mistake: Beginners often keep their “spending” and “savings” in the same bank. When they see a large total balance, they feel “rich” and spend more than they should, promising to “transfer it back later.”

The Correct Mindset: “Out of sight, out of mind” is your best friend. Savings should be held in a place that is slightly inconvenient to reach. This creates a “speed bump” that stops impulsive spending.

Navigating the Rules: 401(k) and IRA Limits

When you decide to pay yourself first, you need to know where to put that money. In the United States, the IRS sets limits on how much you can put into these special tax-advantaged accounts.

For the current year, the contribution limit for a 401(k) has increased to 24,500 dollars. If you are lucky enough to be over the age of 50, you can actually add even more as a “catch-up” contribution.

If you don’t have a 401(k), you might use an Individual Retirement Account (IRA). The limit for that this year is 7,500 dollars.

You don’t need to hit these maximums to be successful. If you can only afford to put away 50 dollars a month right now, that is perfectly fine. The goal is to establish the habit of the money moving before you touch it.

How to Handle Debt While Paying Yourself First

A very common question for beginners is: “Should I pay myself first if I still have credit card debt?” It feels wrong to save money when you owe money to a bank like JPMorgan Chase or American Express.

The Logic: If you put every single extra penny toward your debt and save nothing, what happens when your car breaks down? You will have no choice but to use your credit card again. This creates a vicious cycle of debt.

The Strategy: You should do both. Set a small, non-negotiable amount to pay yourself first to build a “starter” emergency fund (perhaps 1,000 dollars). Once you have that tiny safety net, you can put the rest of your extra cash toward your debt.

The Example: Suppose you have 500 dollars extra each month. Instead of putting all 500 dollars on your credit card, put 100 dollars into a savings account and 400 dollars toward the debt. In ten months, you will have 1,000 dollars in the bank AND you will have lowered your debt by 4,000 dollars. If a tire blows out, you use your 1,000 dollars instead of the credit card.

The Common Mistake: Thinking you must be “debt-free” before you are allowed to save. This often leads to people never starting a savings habit because they feel overwhelmed by their debt.

The Correct Mindset: Saving is a form of defense. Debt repayment is a form of offense. You need both to win the game. Paying yourself first ensures you never have to go deeper into debt when life gets messy.

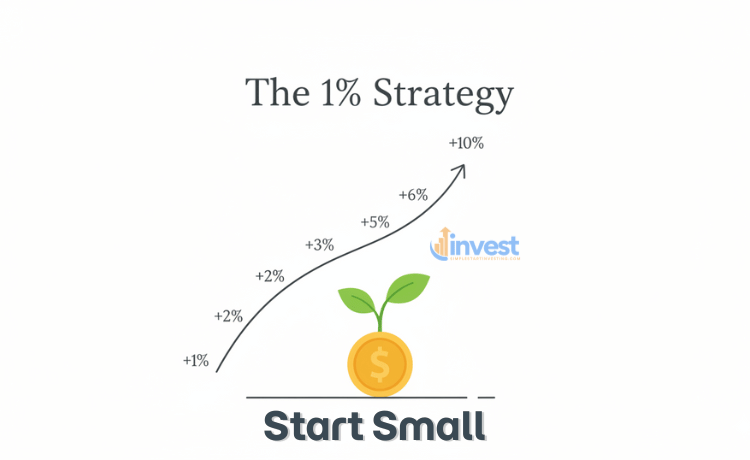

The 1% Incremental Growth Strategy

If the idea of taking 10 percent or 20 percent out of your check feels impossible, don’t panic. You can use the “1% Trick.”

The Explanation: Start by paying yourself just 1 percent of your income. It is such a small amount that you likely won’t even notice it is gone. Then, every three months, increase that amount by just 1 percent.

The Example: If you earn 4,000 dollars a month, 1 percent is only 40 dollars. You can surely find a way to live on 3,960 dollars. Three months later, you move to 2 percent, which is 80 dollars. By the end of a couple of years, you could be saving 10 percent or 15 percent of your income without ever feeling the “pain” of a big budget cut.

The Common Mistake: Trying to go from 0 percent to 20 percent savings overnight. This is like trying to run a marathon when you haven’t walked a mile in years. You will get “burnout,” feel restricted, and eventually quit.

The Correct Mindset: Financial success is a marathon, not a sprint. Small, consistent actions are more powerful than one-time giant leaps. Slow and steady wins because it is sustainable.

What Happens to the Money You “Pay Yourself”?

Once you have automated your savings, you have to decide where it goes. For beginners, there are three main buckets:

- The Emergency Fund: This is your “peace of mind” money. It sits in a safe bank account and is only for things like medical emergencies or job loss.

- Short-Term Goals: This is for things you want in the next 1 to 5 years, like a down payment on a house or a new car (maybe a Tesla or a Ford).

- Long-Term Wealth: This is for your retirement. This money goes into the stock market through index funds or shares of companies like Apple (AAPL) or Microsoft (MSFT).

By paying yourself first, you are funding these three buckets automatically. You are no longer “hoping” to become wealthy; you are building a system that makes wealth inevitable.

Important Considerations for the Current Market

In the current year, interest rates have shifted, and inflation is something every American is feeling at the grocery store. This makes the pay yourself first habit even more critical. When prices go up, your “leftovers” at the end of the month will naturally get smaller. If you wait to save what is left, you will likely save zero.

By taking your cut first, you force yourself to be more creative and disciplined with what remains. You might find yourself cooking at home more or canceling a subscription you don’t use. These small lifestyle adjustments are much easier to make when the money is already safely tucked away in your savings.

Summary of the “Pay Yourself First” Routine

- Calculate your target: Start with a percentage you can handle (even if it’s just 1% to 3%).

- Automate it: Use your employer’s 401(k) or set up a recurring transfer at your bank.

- Adjust your lifestyle: Live on whatever is left over.

- Increase slowly: Every few months, bump your savings up by 1%.

- Stay consistent: Don’t skip a month, even if things get tight. Even 5 dollars is better than 0 dollars.

Final Thoughts

Paying yourself first is the ultimate act of self-care. It is a promise to your future self that you won’t have to work forever and that you will have a safety net when things get tough. It removes the “guilt” of spending because once your savings are gone, the money left in your account is yours to enjoy, completely stress-free.

Remember, the goal isn’t to be restricted; it’s to be free. And freedom starts with the very first dollar you set aside for yourself.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Regulations regarding tax limits and investment accounts can change; please check current IRS guidelines or consult with a certified financial professional.