When tax season rolls around in the United States, most people focus on one thing: how to pay less to the IRS. One of the most powerful ways to do this is by using deductions. However, many beginners get stuck on a big fork in the road. Should you take the standard deduction vs. itemized?

Understanding the difference between these two paths can be the difference between a massive tax bill and a healthy refund. In this guide, we will break down exactly how these work, why they matter, and how to pick the best one for your wallet.

What Exactly Is a Tax Deduction?

Before we dive into the battle of standard deduction vs. itemized, we need to understand the goal. A tax deduction is like an invisible discount on your income. It is a specific amount of money you are allowed to subtract from your total earnings before the government calculates how much you owe in taxes.

Imagine you are at a grocery store like Walmart or Costco. If you have a coupon for 5 dollars off, that discount is applied before you pay at the register. A tax deduction works the same way for your yearly salary. If you earned 60,000 dollars this year but have 15,000 dollars in deductions, the IRS acts as if you only earned 45,000 dollars.

The 4-Step Breakdown of Deductions

Easy Explanation: A deduction lowers your “taxable income.” The lower your taxable income, the lower your final tax bill. It is not a direct credit (money back), but rather a reduction in the “pie” that the IRS can take a slice of.

Real-World Example: Consider a young professional working at Amazon in Seattle. If they earn 100,000 dollars and qualify for 20,000 dollars in total deductions, they only pay taxes on 80,000 dollars. This can save them thousands of dollars in actual cash.

Common Misconception: Many beginners think a 1,000 dollar deduction means their tax bill drops by exactly 1,000 dollars. This is incorrect.

The Financial Logic: A deduction reduces the income that is taxed. If you are in the 22 percent tax bracket, a 1,000 dollar deduction saves you 220 dollars in actual taxes, not the full 1,000 dollars. It is a reduction of the base, not a direct refund of the total.

What is the Standard Deduction?

The standard deduction is the “no-hassle” option. It is a flat, fixed dollar amount that the IRS allows you to subtract from your income, no questions asked. You do not need to prove how you spent your money or provide receipts for your groceries or rent.

Every year, the IRS adjusts this amount for inflation. For the current year, the amount you get depends entirely on your “filing status,” which is a fancy way of saying whether you are single, married, or a head of household.

Why Beginners Love the Standard Deduction

For most people—about 9 out of 10 taxpayers in the U.S.—the standard deduction is the winner. It is incredibly simple. You check a box on your tax return, and boom, a large chunk of your income becomes tax-free.

Example of Current Amounts: If you are a single person filing your taxes this year, the IRS might give you a standard deduction of around 15,000 dollars. If you are a married couple filing together, that amount doubles to 30,000 dollars. (Note: These numbers change slightly every year based on new laws, so always check the current IRS guidelines).

What Are Itemized Deductions?

If the standard deduction is the “fixed price menu,” then itemizing is ordering “à la carte.” When you itemize, you are telling the IRS: “I have specific expenses that add up to more than the flat standard amount you offered me. I want to list them all out individually.”

To do this, you use a specific form called Schedule A. You list things like mortgage interest, state and local taxes, and large medical bills.

The 4-Step Breakdown of Itemizing

Easy Explanation: Itemizing is the process of listing out every single tax-deductible expense you had during the year. You only do this if the total of these expenses is higher than the standard deduction amount.

Real-World Example: Imagine Sarah owns a home in a high-tax state like California and works for Tesla. She pays 15,000 dollars in mortgage interest, 10,000 dollars in property taxes, and gives 5,000 dollars to her local church. Her total listed expenses are 30,000 dollars. Since 30,000 dollars is much higher than the 15,000 dollar standard deduction for a single person, Sarah chooses to itemize to save more money.

Common Misconception: Beginners often think they can take the standard deduction AND then add some of their favorite itemized deductions on top.

The Financial Logic: You must choose one or the other. It is an “either/or” situation. You cannot take the 15,000 dollar flat deduction and then try to add 2,000 dollars of charitable donations on top. You have to decide which single “bucket” is bigger and go with that one.

Comparing the Two: Which One Wins?

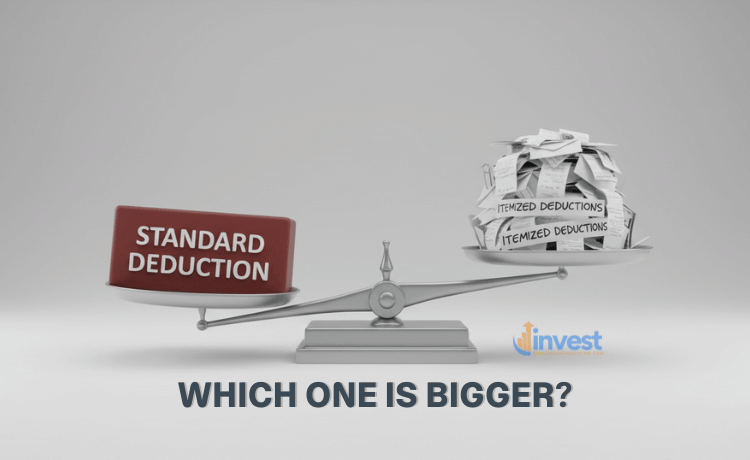

The logic here is very simple: The bigger number always wins. Your goal is to choose the method that gives you the largest total deduction, because that results in the lowest taxable income.

How to Decide This Year

Think of it as a scale. On one side, you have the standard deduction vs. itemized list on the other.

- Check your standard deduction amount: Look up what the IRS is offering for your status (Single, Married, etc.) this year.

- Estimate your itemized expenses: Add up your mortgage interest, state/local taxes, and charity.

- Compare: If your estimated list is higher than the standard amount, it’s time to find your receipts and itemize. If not, take the easy path and use the standard deduction.

Deep Dive: Common Itemized Deductions

If you are considering itemizing, you need to know what counts. The IRS has very strict rules about what can be “put on the list.” Here are the heavy hitters:

1. State and Local Taxes (SALT)

This includes the income tax or sales tax you paid to your state, plus your local property taxes.

- The Rule: There is a limit on how much you can deduct here. For many years, it was capped at 10,000 dollars. However, under newer rules like the “One Big Beautiful Bill Act,” this cap has been significantly increased to around 40,000 dollars for most families.

- Beginner Tip: If you live in a state with high property taxes like New Jersey or New York, this new higher limit makes itemizing much more attractive than it used to be.

2. Mortgage Interest

If you bought a home with a loan, the interest you pay to the bank (like JPMorgan Chase or Bank of America) is often deductible.

- The Rule: Generally, you can deduct interest on the first 750,000 dollars of your mortgage debt. If you bought your house many years ago (before 2017), you might even be able to deduct interest on up to 1 million dollars of debt.

3. Charitable Contributions

Money or goods given to a qualified non-profit (501c3) organization can be deducted.

- Example: If you donate 500 dollars to the Red Cross or drop off a bag of clothes at Goodwill (get a receipt!), those count toward your itemized total.

4. Medical and Dental Expenses

This is a tricky one for beginners. You can only deduct the part of your medical expenses that is “unusually high.”

- The Logic: You can only deduct medical costs that are more than 7.5 percent of your total income.

- Example: If you earn 100,000 dollars, the first 7,500 dollars of medical bills don’t count for the deduction. Only the 7,501st dollar and beyond can be added to your itemized list.

Why Timing and Records Matter

If you decide to go the itemized route, your biggest enemy is a lack of organization. While the standard deduction requires zero paperwork, itemizing requires “proof.”

The “Shoebox” Mistake

Many beginners realize in April that they should have itemized, but they didn’t save their receipts from January.

- The Error: Assuming you can just “estimate” your donations or home repairs.

- The Correction: The IRS requires documentation. If you donate a used car to a charity or pay a large medical bill, you need a written record. Use apps or a simple folder to keep track of these throughout the year.

Common Mistakes Beginners Make

1. Fearing the Audit

Some people take the standard deduction even though itemizing would save them 5,000 dollars because they are afraid of an IRS audit.

- The Reality: As long as your deductions are legitimate and you have receipts, you have nothing to fear. Don’t leave money on the table out of fear.

2. Missing the “Standard” Increase

The standard deduction has become so large in recent years that many people who used to itemize are actually better off taking the standard deduction now.

- The Correction: Every two or three years, re-run the numbers. Just because your parents always itemized doesn’t mean it’s the right choice for you today.

3. Forgetting “Above-the-Line” Deductions

There are some deductions you can take regardless of whether you choose the standard or itemized path. These are called “adjustments to income.”

- Examples: Student loan interest (up to 2,500 dollars), contributions to a Traditional IRA, or Health Savings Account (HSA) contributions. You get these even if you take the “easy” standard deduction!

Summary: Standard Deduction vs. Itemized

Deciding between the standard deduction vs. itemized is one of the most important financial choices you make each year.

- Take the Standard Deduction if: You want simplicity, don’t own a home, or your total specific expenses (taxes, interest, charity) are less than 15,000 dollars (Single) or 31,500 dollars (Married).

- Itemize if: You have a large mortgage, live in a high-tax state, had massive medical bills, or gave a lot to charity, and those totals beat the standard amount.

Remember, tax laws are dynamic. The numbers we use today—like the 40,000 dollar SALT cap or the 15,750 dollar standard deduction—are based on current legislation. Always verify the specific limits for the year you are filing, as rules can change.

Tax planning isn’t just for the wealthy. It is a skill for anyone who wants to build wealth. By choosing the right deduction path, you keep more of your hard-earned money to invest in your future, whether that’s through stocks, real estate, or retirement accounts.

Disclaimer: This content is for educational purposes only and does not constitute financial, legal, or tax advice. Tax regulations are subject to change; please check current IRS guidelines or consult with a qualified tax professional regarding your specific situation.