Do you find yourself constantly checking the stock market, waiting for the “perfect” moment to buy? Perhaps you see the price of a stock like Apple (AAPL) or Amazon (AMZN) drop and wonder if it will go lower, only to watch it climb back up while you are still sitting on the sidelines. This feeling of hesitation and the fear of making a mistake is what keeps many beginners from ever starting their wealth-building journey.

The truth is that even professional investors on Wall Street struggle to “time the market.” Trying to guess the exact bottom or the exact top is a losing game for most. This is where Dollar-Cost Averaging (often called DCA) becomes your secret weapon. It is a simple, disciplined strategy designed to take the stress out of investing by focusing on consistency rather than timing.

By using Dollar-Cost Averaging, you stop trying to beat the market and start letting time work for you. In this guide, we will break down exactly how this strategy works, why it is the gold standard for beginners, and how you can use it to build a massive portfolio over time without losing sleep over daily price swings.

What Exactly is Dollar-Cost Averaging?

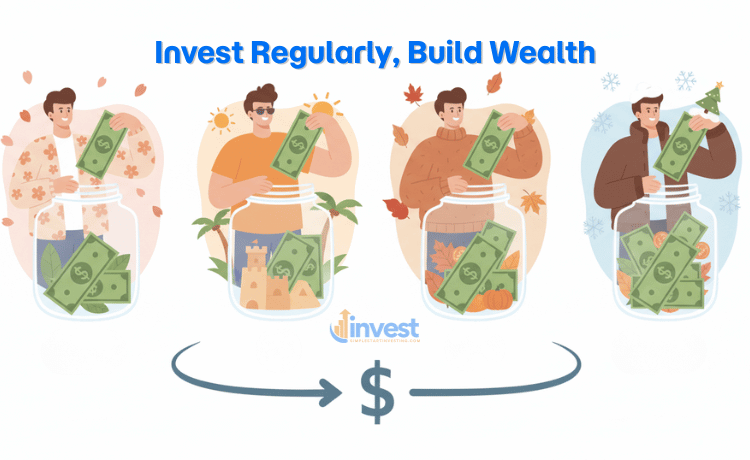

At its core, Dollar-Cost Averaging is the practice of investing a fixed amount of money into the market at regular intervals, regardless of whether the price is high or low. Instead of trying to guess when a stock is “cheap,” you commit to buying a certain dollar amount’s worth of shares every week, every month, or every paycheck.

Step 1: Explaining DCA in Plain English

Think of DCA like a subscription service for your future self. Just like you pay for a gym membership or a streaming service every month, you “pay” into your investment account. Because you are investing the same amount of money every time, you naturally buy more shares when prices are low and fewer shares when prices are high. Over time, this “averages out” the price you pay, often resulting in a lower cost per share than if you had tried to guess the best time to buy.

Step 2: A Real-World Example with Tesla (TSLA)

Imagine you decide to invest 400 dollars every month into Tesla (TSLA).

- In the first month, the price of one share is 200 dollars. Your 400 dollars buys you 2 shares.

- In the second month, the market is nervous and the price drops to 100 dollars. Your 400 dollars now buys you 4 shares.

- In the third month, the price recovers slightly to 160 dollars. Your 400 dollars buys you 2.5 shares.

In this scenario, you spent 1,200 dollars total over three months. You now own 8.5 shares. If you had spent all 1,200 dollars in the first month when the price was 200 dollars, you would only own 6 shares. By sticking to your plan when the price dropped, you ended up with more shares for the same amount of money.

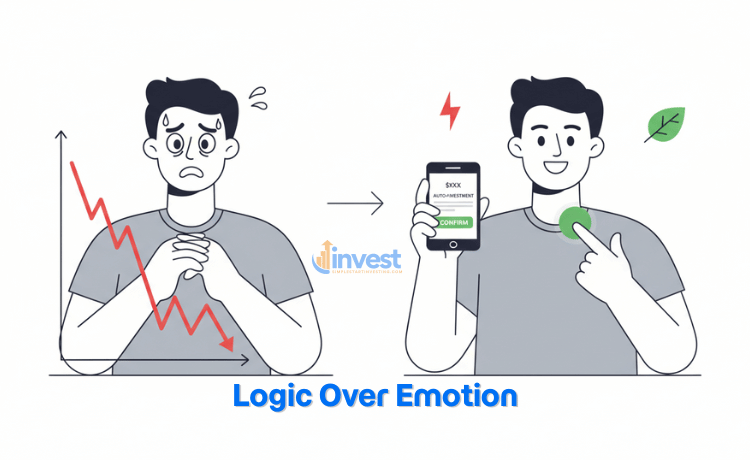

Step 3: The Common Beginner Mistake

Most beginners do the exact opposite of DCA. They wait for a stock to “look safe” before buying. This usually means they wait until the price has already gone up significantly. Then, when the market inevitably dips, they get scared and stop investing or, worse, sell their shares at a loss. They end up buying high and selling low because they are following their emotions instead of a plan.

Step 4: The Correct Financial Logic

The right mindset is to view a market drop as a “sale.” When you use Dollar-Cost Averaging, you should actually be happy when prices go down, because your fixed dollar amount is now working harder for you. It is picking up more “units” of wealth at a discount. Consistency is the engine of wealth, not the ability to predict the future.

Why “Timing the Market” is a Beginner’s Trap

You will often hear people talk about “buying the dip” or waiting for a “market crash” to start investing. While this sounds smart in theory, it is incredibly difficult to execute in reality. Market timing requires you to be right twice: you have to know when to get in, and you have to know when to get out.

The Problem with Waiting for the Bottom

Let’s say you have 5,000 dollars ready to invest in an S&P 500 Index Fund (like VOO or SPY). You decide to wait because the news says a recession might be coming. You wait six months, but the market actually goes up by 10 percent. Now, your 5,000 dollars buys 10 percent less than it would have half a year ago.

By waiting for a “better” price, you missed out on growth. This is known as “opportunity cost.” For beginners, the risk of being out of the market is often much higher than the risk of being in the market during a temporary dip.

Automation: The Cure for Emotional Investing

The reason Dollar-Cost Averaging works so well is that it can be automated. Most modern brokerage apps like Fidelity, Schwab, or Vanguard allow you to set up recurring investments.

When you automate your investing, you remove “analysis paralysis.” You don’t have to look at the charts or listen to the talking heads on the news. The money moves from your bank account to your investments automatically. This builds a powerful habit that continues even when you are busy, tired, or stressed.

DCA in Your Retirement Accounts: 401(k) and IRA

For many Americans, Dollar-Cost Averaging is already happening through their workplace retirement plans. If you have a 401(k), a portion of every paycheck is taken out and invested into funds. You are buying shares every two weeks, regardless of what is happening in the news.

Leveraging 2026 Contribution Limits

This year, the IRS has updated the limits for how much you can put into these tax-advantaged accounts.

- For a 401(k), the individual contribution limit has increased to 24,500 dollars.

- For an IRA (Individual Retirement Account), the limit has increased to 7,500 dollars.

If you want to maximize your IRA this year using DCA, you would take that 7,500 dollar limit and divide it by 12 months. This comes out to 625 dollars per month. By setting up an automatic transfer of 625 dollars into your IRA every month, you ensure that you hit the legal limit by the end of the year without having to find a huge lump sum of cash all at once.

Step 1: Explaining Retirement DCA

Retirement investing is a marathon, not a sprint. Using DCA within an IRA or 401(k) allows you to build a “nest egg” over 20 or 30 years. Because you are investing through different market cycles—recessions, bull markets, and everything in between—you are essentially buying into the long-term growth of the American economy.

Step 2: Real-World Example with Costco (COST)

Imagine an employee at Costco (COST) who contributes 10 percent of their salary to their 401(k). Every payday, that money buys shares of a diversified fund. Some weeks, the fund is “expensive,” and some weeks it is “on sale.” Over a 30-year career, that employee doesn’t need to know anything about technical analysis. The sheer force of consistent buying (DCA) combined with the growth of the company is what creates a millionaire.

Step 3: The Common Beginner Mistake

Many beginners think they should stop their 401(k) contributions when the market is doing poorly to “save money” or “wait for things to settle down.” This is a massive mistake. When you stop contributing during a downturn, you are missing out on the period where your money buys the most shares. You are essentially skipping the “buy low” part of the “buy low, sell high” equation.

Step 4: The Correct Financial Logic

The correct logic is to stay the course. In fact, if your budget allows, a market downturn is the best time to see if you can contribute more. Since regulations can change regarding tax limits and rules, it is always wise to check the current IRS guidance or speak with a tax professional to ensure your contributions stay within legal bounds.

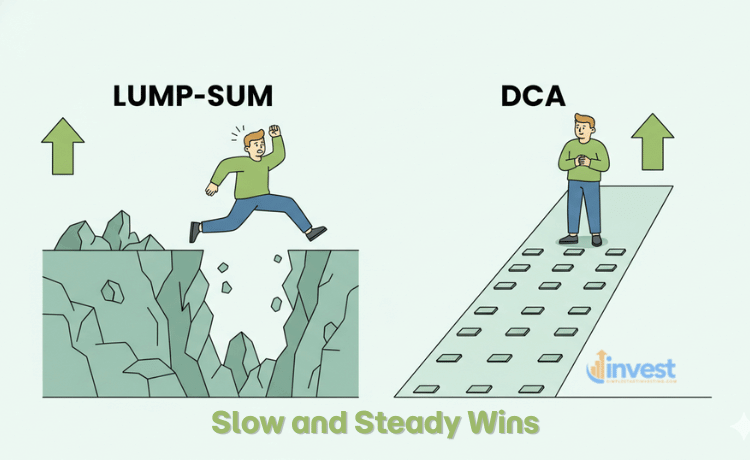

Comparing DCA to Lump-Sum Investing

A common question is: “If I have a large amount of money right now, should I invest it all at once or spread it out?” Investing all at once is called Lump-Sum Investing.

The Math of Lump-Sum vs. DCA

Historically, the stock market goes up about 70 percent of the time. Because of this, putting all your money in at once (Lump-Sum) often results in higher returns because the money has more time to grow. However, there is a catch: Regret Risk.

Imagine you have 50,000 dollars from an inheritance. You put it all into the market today. Tomorrow, a major global event happens and the market drops 20 percent. You have just lost 10,000 dollars in 24 hours (on paper). For a beginner, this is emotionally devastating. Many people in this situation would panic and sell everything, vowing never to invest again.

Why DCA is Better for Peace of Mind

If you took that same 50,000 dollars and invested 5,000 dollars a month for 10 months, a 20 percent drop in the first month would only affect your first 5,000 dollars. Meanwhile, your next 5,000 dollar investment would buy shares at a 20 percent discount!

DCA is an insurance policy against bad timing. It might result in slightly lower returns than a perfectly timed lump sum, but it drastically increases the chances that you will actually stay invested. And as we say in finance, “Time in the market beats timing the market.”

How to Start Your DCA Plan Today

Starting a Dollar-Cost Averaging strategy does not require a lot of money. You can start with as little as 10 dollars or 50 dollars a month.

Step 1: Choose Your Investment

For beginners, it is often best to start with a broad index fund or an ETF (Exchange-Traded Fund) that tracks the entire market, such as one that follows the S&P 500 or a Total Stock Market Fund. This way, you aren’t betting on just one company like Netflix (NFLX) or Walmart (WMT); you are betting on the success of hundreds of major companies at once.

Step 2: Pick Your Frequency

Decide how often you want to invest. Most people choose a monthly schedule to align with their rent or mortgage payments. Others prefer a bi-weekly schedule to align with their paychecks. The key is to pick a schedule you can realistically stick to even if your car breaks down or you have an unexpected medical bill.

Step 3: Automate It

Log into your brokerage account and look for “Recurring Investments” or “Automatic Transfers.” Link your bank account and set the amount and the date. Once this is done, your job is to do… nothing.

Step 4: The Mindset Shift

Once your DCA plan is running, stop checking your account balance every day. In fact, don’t even check it every month. Check it once or twice a year to ensure your goals are still on track. Remember, the goal of DCA is to reduce stress. If you are still obsessing over the daily price of Microsoft (MSFT), you aren’t fully embracing the power of the strategy.

Summary: The Power of the Boring Path

Dollar-Cost Averaging is not “sexy.” It won’t make you a millionaire overnight, and it doesn’t give you exciting stories to tell at dinner parties about how you “called the bottom” of the market.

What it does do, however, is work. It builds wealth through the power of habit and mathematics. It protects you from your own emotions and ensures that you are always buying when things are on sale. In a world of volatile markets and constant news alerts, the “boring” path of consistent, regular investing is usually the one that leads to the most financial freedom.

Start small, stay consistent, and let time do the heavy lifting. Your future self will thank you for the stress-free foundation you built today.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. The regulations and limits mentioned can change; please check current IRS or SEC guidelines or consult with a qualified professional.