Imagine you are standing at the edge of a swimming pool. If you stay in the shallow end, you feel safe, but you cannot dive. If you go to the deep end, you can do a spectacular dive, but you must be a better swimmer because the water is over your head.

Investing is exactly like that pool. Every time you put your money into the market, you are balancing the “splash” you want to make (your return) with the depth of the water (your risk). Most people start investing because they want the big splash, but they panic the moment they feel the water rising above their chin.

In this guide, we will break down the fundamental relationship between investment risk and return so you can build a portfolio that lets you sleep soundly, even when the market gets choppy.

What Exactly is Investment Risk and Return?

At its simplest, return is the money you make on your investment. If you buy a share of a company like Apple (AAPL) for 200 dollars and sell it later for 220 dollars, that 20 dollar increase is your return.

Risk, on the other hand, is the possibility that things won’t go as planned. It is the chance that instead of Apple going up to 220 dollars, it drops to 150 dollars, or stays at 200 dollars for years while other things get more expensive.

1. Plain English Explanation

Think of risk as the “price of admission” for the potential to grow your wealth. If there were no risk, everyone would put their money there, and the potential for profit would disappear. Return is your “reward” for being willing to let your money sit in an uncertain environment.

2. Real-World US Example

Let’s look at two different companies.

- Costco (COST): This is often seen as a more stable company. People always need groceries. Its stock price might move up and down, but it usually doesn’t swing wildly in a single day.

- Tesla (TSLA): This is a high-growth tech and car company. It has the potential for massive gains, but it can also drop 10 percent in a single week based on a piece of news.

If you want the stability of Costco, you accept that you might not see your money triple overnight. If you want the “moonshot” potential of Tesla, you have to accept that your account balance might look scary some mornings.

3. The Common Beginner Mistake

Many beginners believe that “high risk” is a guarantee of “high return.” They see a volatile stock or a new trend and think, “Since it’s risky, I’m going to make a lot of money!”

4. The Mindset Shift

Risk does not guarantee a return; it only allows for the possibility of one. You should think of risk as a “volatility tax.” You are paying for the chance of a higher reward by accepting that the journey will be a bumpy ride. High risk only means the range of possible outcomes is wider—including the outcome where you lose money.

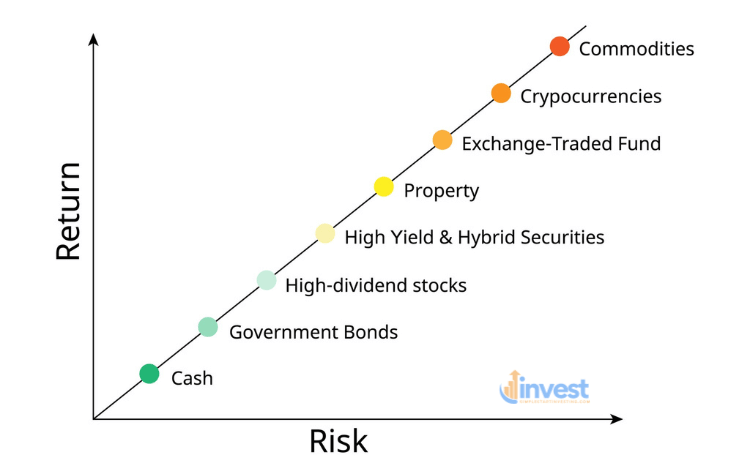

The Seesaw: Why You Can’t Have One Without the Other

In the world of finance, risk and return sit on opposite ends of a seesaw. When one goes up, the other usually follows. This is called the Risk-Return Tradeoff.

1. Plain English Explanation

If an investment sounds too good to be true—like “guaranteed 20 percent returns with zero risk”—it is almost certainly a scam or a misunderstanding. In a fair market, if you want a higher “ceiling” (the most you could make), you must be willing to accept a lower “floor” (the most you could lose).

2. Real-World US Example

Consider a US Treasury Bond vs. a Start-up Stock.

- US Treasury Bonds: These are backed by the US government. They are considered very safe. Because the risk of the government failing is extremely low, they pay a relatively low “interest” or return.

- A New Tech AI Stock: This company could become the next Nvidia (NVDA), or it could go bankrupt. Because the risk of losing everything is high, investors demand the potential for a 500 percent return to make it worth their while.

3. The Common Beginner Mistake

Beginners often try to “game the system” by looking for the highest possible returns without checking the “risk rating” of what they are buying. They look at the “Top Gainers” list on their brokerage app and buy whatever is at the top, not realizing those stocks are at the top because they are incredibly volatile.

4. The Mindset Shift

Instead of asking “How much can I make?”, start by asking “How much am I willing to see this drop before I panic?” Your return is the result of your strategy, but your risk is the foundation of it. You must build the foundation before you can reach for the roof.

Understanding Your “Sleep Factor”: Risk Tolerance vs. Capacity

There are two ways to look at how much risk you should take. One is emotional (Risk Tolerance) and the other is financial (Risk Capacity).

1. Plain English Explanation

Risk Tolerance is how you feel. If the market drops 20 percent and you can’t eat or sleep because you are checking your phone every five minutes, your risk tolerance is low. Risk Capacity is what you can actually afford. If you are 22 years old and have 40 years before you retire, you have a high capacity because you have time to recover. If you are 64 and retiring next year, your capacity is low because you need that money now.

2. Real-World US Example

Imagine two neighbors, Sarah and Bob, both investing in the S&P 500 (an index of the 500 largest US companies).

- Sarah is 25, working at Amazon (AMZN), and has a steady paycheck. Even if the market crashes, she doesn’t need her investment money for 30 years. She has a high risk capacity.

- Bob is 65 and plans to retire in 6 months. If the market crashes 30 percent, his retirement plans are ruined. He has a low risk capacity, even if he personally feels “brave” about the market.

3. The Common Beginner Mistake

New investors often confuse “being a gambler” with “having high risk tolerance.” They take big risks with money they actually need for rent or a house down payment in two years. This is a failure of Risk Capacity.

4. The Mindset Shift

Your “Risk Capacity” (your math) should always override your “Risk Tolerance” (your feelings). You might feel like you can handle a big drop, but if you actually need that money for a down payment on a house in Florida next year, you shouldn’t be taking high risks with it.

The Three Pillars of Risk Management

You cannot eliminate risk entirely, but you can manage it. Think of this as wearing a seatbelt and having an airbag while driving. It doesn’t mean you won’t ever have an accident, but it makes the accident much less likely to be fatal to your finances.

1. Diversification: Don’t Put Your Life Savings in One Stock

This is the most famous rule in investing. If you put all your money into Boeing (BA) and the company has a major technical crisis, your entire net worth drops. If you put your money into 500 different companies, and one has a crisis, the other 499 help carry the load.

2. Time Horizon: The Great Healer

In the short term (days or months), the stock market is a voting machine based on emotions. In the long term (years or decades), it is a weighing machine based on actual company profits. If you hold a broad basket of US stocks for 20 years, your risk of losing money historically drops significantly.

3. Asset Allocation: The Mix

This is the balance between different types of investments. For example, a “Balanced Portfolio” might have some stocks (for growth) and some bonds or cash (for safety). When stocks go down, bonds often stay stable or go up, acting as a cushion.

Why “No Risk” is Actually a Risk

Some people are so afraid of the stock market that they keep all their money in a basic physical safe or a standard checking account that pays zero interest. While this feels “safe” because the number of dollars doesn’t go down, you are actually facing a silent enemy: Inflation.

1. Plain English Explanation

If you have 1,000 dollars today, and the price of milk and gas goes up by 3 percent this year, your 1,000 dollars will buy less “stuff” next year. By avoiding the risk of the stock market, you are accepting the guarantee that your money will lose purchasing power over time.

2. Real-World US Example

In the US, the cost of living generally rises every year. If you kept 10,000 dollars under your mattress for the last 20 years, it would still be 10,000 dollars today—but it would only buy about half as much as it did back then. Meanwhile, if that money had been in a simple S&P 500 index fund, it likely would have grown significantly, far outpacing the cost of living.

3. The Common Beginner Mistake

Thinking that “cash is safe.” Cash is only safe for the short term (emergencies). For the long term, cash is a losing investment because of inflation.

4. The Mindset Shift

You have to choose your risk. You can choose the market risk (prices go up and down) or the inflation risk (your money slowly loses value). For long-term goals like retirement, the risk of inflation is often much more dangerous than the risk of market volatility.

Current Market Context: Investing in the Mid-2020s

As we navigate the current economic landscape, things look a bit different than they did a decade ago. Interest rates have settled at a higher “normal” level compared to the “zero-rate” era of the 2010s.

What this means for you:

- Savings accounts actually pay money now: You can get a decent return just by having your money in a High-Yield Savings Account (HYSA) or a Certificate of Deposit (CD). This is a “lower risk” way to get some “return.”

- Concentration Risk: A few giant tech companies like Microsoft (MSFT) and Alphabet (GOOGL) make up a huge part of the US stock market. This means if you buy a “total market fund,” you are actually very exposed to how tech performs.

- Changing Rules: The IRS updates its rules frequently. For example, for the current tax year, the limits for how much you can put into your 401(k) or IRA have increased to keep up with inflation. Using these accounts is a “smart” way to increase your total return by paying less in taxes.

Note: Regulations and tax laws change; please check the current IRS guidelines or consult a professional.

Summary for Your Journey

The goal of understanding investment risk and return isn’t to become a math genius. It’s to become an emotional genius.

- Accept that risk is necessary to beat inflation and grow wealth.

- Know your “why” and your “when.” If you need the money soon, take less risk.

- Diversify. Never let one company’s bad news ruin your life.

- Stay the course. The market will drop—that is a certainty. Your job is to stay in the pool until you’ve reached the other side.

Building wealth is a marathon, not a sprint. By respecting the relationship between risk and reward, you can stop worrying about the “weather” of the market and start focusing on your long-term destination.

Disclaimer: This content is for educational purposes only and does not constitute financial, legal, or tax advice. Investing involves risk, including the possible loss of principal. Always conduct your own research or consult with a qualified financial advisor before making investment decisions.