If you have recently started a new job in the United States, you have likely heard the term 401(k) mentioned during your orientation. It often comes up alongside talk of “benefits” and “retirement,” but for many beginners, it sounds like a confusing string of numbers and letters. You might find yourself wondering if it is just another deduction taking money away from your paycheck.

In simple terms, a 401(k) is a special type of savings account offered by your employer that helps you save money for your future self. Think of it as a personal “future-you” fund that travels with you through your career. Because the United States government wants to encourage people to save for retirement, they provide significant tax advantages to anyone who uses these accounts. This makes a 401(k) one of the most powerful tools available for building long-term wealth.

The most exciting part about a 401(k) is that it is often the only place where you can find “free money” in the financial world. Many companies will actually give you extra money just for contributing to your own account. Whether you are working at a giant like Walmart, a tech leader like Amazon, or a local business, understanding how to use this account is the first major step toward financial independence.

What is a 401(k)?

At its core, a 401(k) is a “defined contribution plan.” This is a fancy way of saying that you decide how much money you want to put in, and that money is taken directly out of your paycheck before you even see it.

The Simple Explanation Imagine you have a digital piggy bank. Every time you get paid, a small portion of your salary—perhaps 5 percent—is automatically moved into this piggy bank. Because this happens automatically, you never “miss” the money because it was never in your checking account to begin with. Over time, this piggy bank grows not just from your contributions, but also from investments.

A Real-World Example Let’s say you work at Costco and earn 50,000 dollars a year. You decide to contribute 6 percent of your salary to your 401(k). Every year, 3,000 dollars will move from your pay into your retirement account. If you get paid twice a month, that is 125 dollars per paycheck. This money is then typically invested in things like the S&P 500 index or stocks of companies like Apple (AAPL) or Microsoft (MSFT) so it can grow over the decades.

The Common Beginner Mistake Many beginners think a 401(k) is just a “savings account” like the one at their bank. They assume the money just sits there in cash, waiting for them to grow old.

The Right Mindset A 401(k) is an investment vehicle, not just a storage box. The money inside is meant to be put to work. By investing your contributions in the stock market, your money earns more money. If your account grows by 7 percent in a year, you didn’t just save money—you created new wealth without lifting a finger.

The “Free Money” Magic: Understanding the Employer Match

One of the greatest benefits of a 401(k) is the employer match. This is a massive incentive that many people leave on the table simply because they don’t understand it.

The Simple Explanation An employer match is when your company promises to put money into your 401(k) as long as you put money in too. It is essentially a 100 percent return on your investment the moment you make it. If your employer offers a match and you don’t contribute, you are literally turning down a portion of your salary.

A Real-World Example Imagine your company offers a 100 percent match on the first 3 percent of your salary. If you earn 60,000 dollars and contribute 3 percent, you are putting 1,800 dollars into the account. Because of the match, your employer also puts 1,800 dollars into the account. Now you have 3,600 dollars in total, but it only cost you 1,800 dollars from your take-home pay.

The Common Beginner Mistake New employees often think, “I can’t afford to save 3 percent right now, I’ll wait until I have a higher salary.” They believe they are saving money by keeping that 3 percent in their paycheck.

The Right Mindset By not contributing enough to get the full match, you are accepting a pay cut. If your employer offers a match, your “true” salary includes that extra money. Missing the match is like working for 97 percent of your salary when you could be getting 100 percent plus a bonus. Always aim to contribute at least enough to get the full employer match.

Traditional vs. Roth: When Do You Want to Pay Taxes?

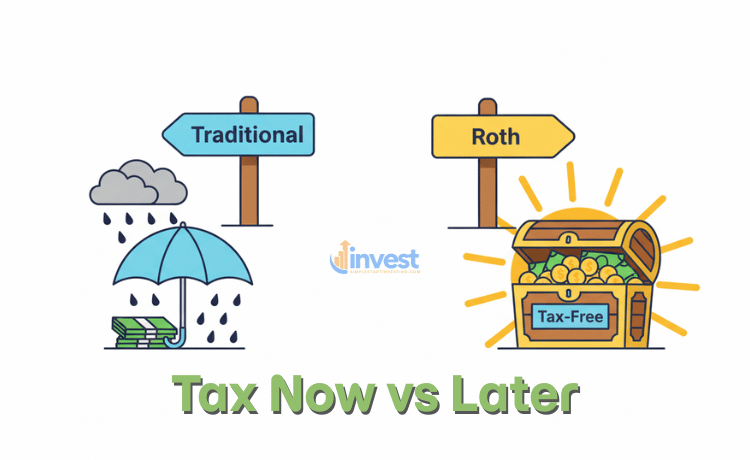

When you sign up for a 401(k), you will likely be asked to choose between two flavors: Traditional and Roth. The difference is all about when Uncle Sam (the IRS) gets his cut.

The Traditional 401(k) (Tax-Deferred)

The Simple Explanation With a Traditional 401(k), you put money in before taxes are taken out. This lowers your taxable income today, meaning you pay less in income tax this year. However, when you retire and take the money out, you will pay taxes on it then.

A Real-World Example Suppose you earn 70,000 dollars this year. If you put 5,000 dollars into a Traditional 401(k), the IRS only taxes you as if you earned 65,000 dollars. You get a “discount” on your taxes today, which leaves more money in your pocket for bills or other needs.

The Roth 401(k) (Tax-Free Growth)

The Simple Explanation With a Roth 401(k), you put money in after you have already paid taxes on it. You don’t get a tax break today, but the massive benefit is that when you retire, every single dollar you take out—including all the growth—is 100 percent tax-free.

A Real-World Example Imagine you put 5,000 dollars into a Roth 401(k) today. Over thirty years, that money grows to 40,000 dollars because you invested it in successful companies like Tesla (TSLA) or Alphabet (GOOGL). When you retire, you can take out all 40,000 dollars and pay zero dollars in taxes to the government.

The Common Beginner Mistake Many beginners choose Traditional because they like seeing a slightly bigger paycheck today. They don’t realize that in 30 years, they might be in a higher tax bracket or that tax rates in the US might be higher overall.

The Right Mindset Think about your future tax rate. If you are young and in a lower-paying entry-level job, a Roth 401(k) is often a “gift” to your future self. You pay a little tax now while your rate is low, so you can enjoy a massive pile of tax-free cash later.

401(k) Rules and Limits for This Year

The IRS sets very specific rules on how much you can contribute to these accounts. These rules are updated frequently to account for inflation. For this year, the limits have increased to give savers more room to grow their nest eggs.

Contribution Limits

The Simple Explanation There is a “cap” on how much of your own salary you can put into a 401(k) each year. This prevents high earners from hiding all their money from taxes.

The Current Numbers For this year, the individual contribution limit is 24,500 dollars. This applies to your own contributions, whether they are Traditional or Roth. If you are age 50 or older, you are allowed an extra “catch-up” contribution of 8,000 dollars, bringing your total possible contribution to 32,500 dollars. If you are between the ages of 60 and 63, a special “super catch-up” rule allows you to contribute up to 11,250 dollars extra.

The Common Beginner Mistake Beginners often see these large numbers and think, “I’ll never reach 24,500 dollars, so this rule doesn’t matter to me.”

The Right Mindset While you might not hit the maximum today, the goal is to increase your contribution percentage every time you get a raise. By understanding the ceiling, you can plan your long-term wealth strategy. Also, remember that your employer’s matching funds do not count toward your 24,500 dollar limit. The total limit for both you and your employer combined is much higher, sitting at 72,000 dollars this year.

Common 401(k) Pitfalls to Avoid

Even though a 401(k) is designed to be “set it and forget it,” there are a few mistakes that can ruin your progress.

1. Cashing Out When Changing Jobs

The Problem When people leave a job, they often see a “check” waiting for them in their 401(k). It is tempting to take that 10,000 dollars and buy a new car or pay for a vacation.

The Reality If you cash out a 401(k) before age 59 and a half, you will usually pay a 10 percent early withdrawal penalty PLUS regular income taxes. On a 10,000 dollar balance, you might only walk away with 6,000 dollars or 7,000 dollars after the government takes its share. More importantly, you lose all the future growth that 10,000 dollars would have generated over the next few decades.

2. Ignoring “Vesting” Schedules

The Problem Some people assume that the “match” money from their employer is theirs the moment it hits the account.

The Reality Most companies use a vesting schedule. This means you have to work for the company for a certain number of years (usually three to five) before you “own” the employer’s contributions. If you leave too early, the company can take back their matching funds. Always check your company’s policy before planning a job move.

How to Get Started Today

Starting your 401(k) journey is much easier than it used to be. Thanks to recent laws like the SECURE Act 2.0, many companies are now required to automatically enroll new employees.

- Check with Human Resources: Ask for your 401(k) login details. Most plans are managed by companies like Fidelity, Vanguard, or Charles Schwab.

- Pick Your Percentage: Even if you can only start with 1 percent or 2 percent, start now. Most experts recommend aiming for 10 percent to 15 percent eventually, but getting the match is the first priority.

- Choose Your Investments: For most beginners, a Target Date Fund is a great choice. You just pick the year you plan to retire (like 2060), and the fund automatically manages the risk for you.

- Set It to Increase: Many plans allow you to “auto-escalate.” This means your contribution will automatically go up by 1 percent every year. You won’t even notice the difference in your paycheck, but your future self will be incredibly grateful.

A Final Thought on Your Future

A 401(k) isn’t about the stock market or tax codes; it’s about freedom. Every dollar you put in today is a purchase of your future time. By starting early and understanding these simple rules, you are ensuring that your older self has the financial security to live life on your own terms.