Many new investors feel overwhelmed by the sheer number of choices in the stock market. You might see thousands of individual stocks, hundreds of specialized funds, and endless “hot tips” on social media. It feels like you need a finance degree just to get started. But what if you could own nearly every major company in the world and every reliable bond with just three simple choices?

The three-fund portfolio is a strategy designed for people who want to build serious wealth without spending their weekends staring at spreadsheets. By using three specific types of index funds, you can capture the growth of the entire global economy. This approach is famous for its “lazy” nature, but don’t let the name fool you. It is one of the most powerful and scientifically backed ways to invest for your future.

In this guide, we will break down exactly how the three-fund portfolio works, why it is the gold standard for long-term investors, and how you can set it up today to secure your retirement.

What is the Three-Fund Portfolio?

At its heart, the three-fund portfolio is a philosophy of simplicity. Instead of trying to find the next “winner” stock, you decide to own all of them. This strategy was popularized by the “Bogleheads” community, named after Jack Bogle, the founder of Vanguard. He believed that instead of looking for the needle in the haystack, you should just buy the whole haystack.

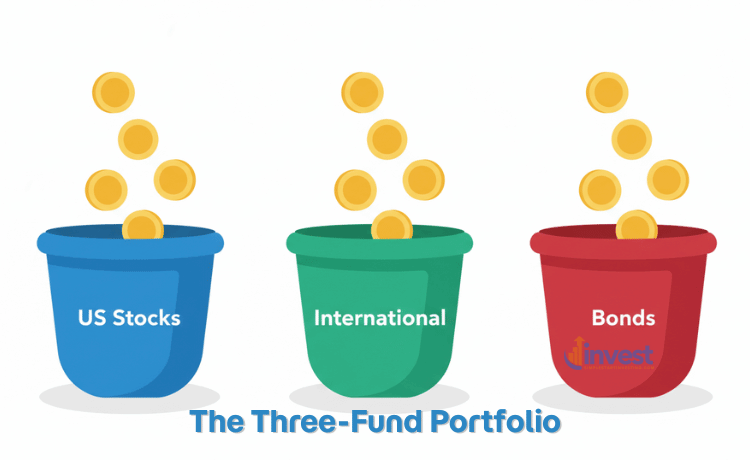

The portfolio consists of three broad categories:

- A Total US Stock Market Index Fund (covering thousands of American companies).

- A Total International Stock Market Index Fund (covering companies in Europe, Asia, and emerging markets).

- A Total Bond Market Index Fund (providing stability and regular interest payments).

1. The Total US Stock Market Fund: Your Growth Engine

The first pillar of the three-fund portfolio is the US stock market. This fund allows you to own a piece of almost every publicly traded company in the United States. From massive tech giants to small local banks, you own them all.

Simple Explanation: Think of this fund as a giant bucket that contains a small piece of every American business. When the US economy grows and companies make profits, the value of your bucket goes up. You aren’t betting on one horse; you are betting on the entire American race.

Real-World Example: When you buy a fund like the Vanguard Total Stock Market (VTI) or similar options from Fidelity or Schwab, you are instantly an owner of Apple (AAPL), Tesla (TSLA), Amazon (AMZN), and Walmart (WMT). If Apple has a record-breaking year, you benefit. If a small startup in Texas becomes the next big thing, you already own it because it is part of the total market.

Common Beginner Mistake: Many beginners think they need to pick the “best” sector, like artificial intelligence or green energy. They might put all their money into a few high-flying tech stocks, hoping to strike it rich quickly.

The Financial Logic: Sectors go in and out of fashion. By owning the Total US Stock Market, you don’t have to guess which sector will win next. If tech slows down but healthcare booms, your portfolio stays balanced because you own both. It’s about steady growth rather than gambling on a single trend.

2. The Total International Stock Market Fund: Global Diversification

The second pillar takes you beyond the borders of the US. While the American market is powerful, it only represents a portion of the global economy.

Simple Explanation: This fund works just like the US fund, but it buys companies in every other country. It gives you exposure to the growth of the entire world. If the US market has a slow decade while international markets thrive, this fund helps protect your total wealth.

Real-World Example: Through an international index fund, you own pieces of companies you likely use every day but aren’t based in the US. This includes Samsung (South Korea), Nestlé (Switzerland), Toyota (Japan), and ASML (Netherlands). Even if the US dollar weakens, your investments in these global companies can provide a helpful hedge.

Common Beginner Mistake: A frequent mistake is “Home Country Bias.” Many US investors believe they only need to invest in the US because “the US is the best.” They ignore the other 40 percent of the global stock market, thinking it is too risky or unnecessary.

The Financial Logic: History shows us that international stocks and US stocks take turns leading the market. There are long periods where international stocks outperform the US. By holding both, you reduce the risk of being stuck in a “lost decade” if one specific country’s economy struggles. You are truly a global investor.

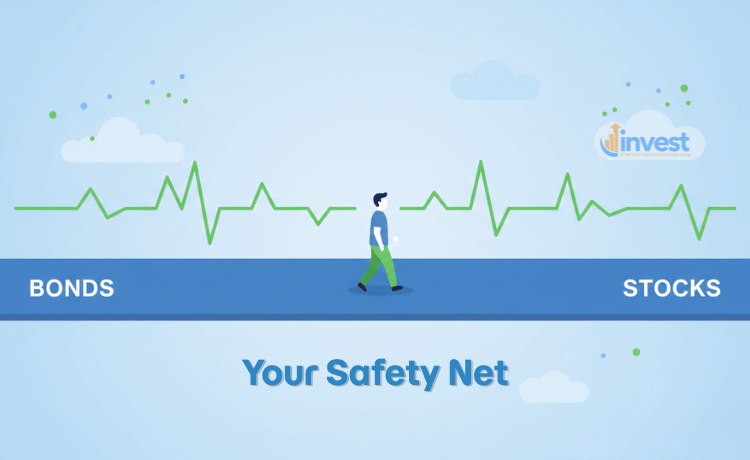

3. The Total Bond Market Fund: The Safety Net

The third pillar is where you find stability. While stocks provide growth, they can be a wild ride. Bonds act as the “shock absorbers” for your portfolio.

Simple Explanation: A bond is essentially a loan you give to a government or a large corporation. In exchange for your loan, they promise to pay you back with interest. Bonds are generally much less volatile than stocks. When the stock market goes down, bonds often hold their value or even go up.

Real-World Example: Imagine the stock market drops by 20 percent in a single month because of bad economic news. A portfolio made 100 percent of stocks like Amazon or JPMorgan would feel that full 20 percent drop. However, if you had a portion of your money in a Total Bond Fund, that part of your money might stay flat or only move 1 percent. If you had 100,000 dollars and the market dropped, having 20,000 dollars in bonds means 20 percent of your money stayed safe while the rest fluctuated.

Common Beginner Mistake: Many young investors think bonds are “boring” or for “old people.” They see the low interest rates and decide to skip bonds entirely, wanting 100 percent growth.

The Financial Logic: Bonds aren’t just for income; they are for psychological protection. Most people think they can handle a 40 percent market crash until it actually happens. Seeing your account balance drop significantly can lead to “panic selling,” which is the fastest way to lose money. Bonds keep the drops smaller so you can stay calm and keep investing for the long term.

Designing Your Asset Allocation

Now that you know the three ingredients, how much of each should you have? This is called asset allocation. The “perfect” mix depends on your age and how much risk you can stomach.

The “Age-Based” Starting Point

A classic rule of thumb is to subtract your age from 110 or 120 to find your stock percentage.

- If you are 30 years old: 110 minus 30 is 80. You might choose 80 percent stocks and 20 percent bonds.

- Of that 80 percent in stocks, many experts suggest a split like 70 percent US and 30 percent International.

Why Rebalancing Matters

As the market moves, your percentages will change. If the US stock market has a fantastic year, it might grow to become 90 percent of your portfolio. This means you are now taking more risk than you planned.

How to Fix It (The Simple Way): Once a year, you look at your accounts. If your stocks have grown too large, you sell a small portion of the “winners” and buy more of the “underperformers” (like bonds or international stocks) to get back to your original plan. This forces you to do the smartest thing in investing: Buy Low and Sell High.

Why the Three-Fund Portfolio Wins

The financial world is noisier than ever. High-frequency trading, crypto-currency volatility, and complex tax laws make many people feel like they are “missing out” if they aren’t doing something complicated. Here is why this simple strategy is actually the most sophisticated choice you can make this year.

Ultra-Low Fees

Every fund charges a fee called an “expense ratio.” Many “managed” funds (where a professional tries to pick stocks) charge 1 percent or more. The index funds used in a three-fund portfolio often charge less than 0.05 percent.

- If you invest 100,000 dollars and pay a 1 percent fee, you lose 1,000 dollars every year.

- If you pay 0.05 percent, you only pay 50 dollars. Over 30 years, that small difference can save you hundreds of thousands of dollars that stay in your pocket instead of the bank’s.

Tax Efficiency

In the US, the IRS has strict rules about capital gains taxes. Because the three-fund portfolio doesn’t buy and sell stocks constantly, it generates very few “taxable events.” This makes it perfect for taxable brokerage accounts, as well as retirement accounts like a 401(k) or IRA.

Maximizing Your Contributions

For this year, the IRS has increased the amount you can contribute to your retirement accounts.

- The 401(k) limit is now 24,500 dollars.

- The IRA limit is now 7,500 dollars. Using a three-fund portfolio within these accounts is a powerful way to shield your growth from taxes.

Common Misunderstandings About “Simplicity”

Misunderstanding: “I’m not diversified enough with only three funds.” Reality: You actually own more than 10,000 different stocks and thousands of bonds. You are more diversified than someone who owns 20 individual stocks they picked themselves.

Misunderstanding: “I’ll miss out on the next big thing.” Reality: When the next “big” company goes public, it is eventually added to the total market index. You will own it automatically. You won’t get the “lottery ticket” gain of buying it on day one, but you also won’t get the “total loss” if it fails.

Misunderstanding: “I should wait for the market to drop before I start.” Reality: Waiting for a “dip” is a form of market timing, which almost never works for beginners. The best day to start was yesterday; the second best day is today.

Summary for Your Journey

The three-fund portfolio is more than just a list of funds; it is a commitment to a better lifestyle. It allows you to ignore the daily news and the “talking heads” on television. You can rest easy knowing that as long as the global economy continues to function and grow over decades, you will grow with it.

You don’t need to be a genius to be a successful investor. You just need a plan that is so simple you can actually stick to it during both good times and bad.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Regulations regarding retirement accounts and taxes can change; please check current IRS guidelines or consult a qualified professional before making investment decisions.