If you have ever listened to legendary investors like Warren Buffett, you have likely heard them praise a specific way of building wealth that does not involve picking the next “hot” stock or watching charts all day. They are talking about index funds for beginners. While many people think you need to be a math genius or a Wall Street insider to make money in the market, the truth is that one of the most powerful tools for building long-term wealth is actually one of the simplest.

Index funds for beginners provide a way to own a piece of hundreds of the most successful companies in the world all at once. Instead of trying to find a needle in a haystack, you are simply buying the entire haystack. This strategy has turned regular workers into millionaires because it focuses on steady growth, low costs, and the power of time. In this guide, we will break down exactly how these funds work and why they should be the foundation of your investing journey.

What Exactly Is an Index Fund?

To understand an index fund, first think about a “market index.” An index is basically a list or a “scoreboard” of stocks that represent a part of the economy. For example, the S&P 500 is an index that tracks the performance of 500 of the largest companies in the United States, such as Apple, Microsoft, and Amazon.

An index fund is a type of investment that buys all the stocks listed on that specific index. When you put your money into an index fund, the fund manager uses that money to buy shares in all those companies in the exact same proportions as they appear in the index. You are not betting on just one company; you are betting on the overall growth of the American economy.

A Real-World Example Imagine you go to a grocery store. Instead of spending hours trying to pick the perfect individual apples, oranges, and bananas, you buy a pre-packaged fruit basket that contains the top 10 most popular fruits in the store. If the price of apples goes down but the price of oranges goes up, your basket still holds its value because it is diversified. An index fund tracking the S&P 500 works the same way with companies like Tesla, Walmart, and JPMorgan Chase.

The Common Beginner Mistake Many beginners think that because index funds are “average,” they will only get “average” results. They believe they need to find the next “Amazon” early on to get rich. They spend hours researching tiny companies they don’t understand, hoping for a 1,000 percent return in a week.

The Financial Logic Shift

Why Do Millionaires Love This Strategy?

You might wonder why someone with millions of dollars would choose a “simple” index fund instead of something more complex. The answer lies in efficiency. Millionaires know that keeping more of what they earn is just as important as the growth itself.

Index funds are “passively managed.” This means there isn’t a team of expensive analysts sitting in an office in New York trying to decide which stock to buy or sell every hour. The fund simply follows the index. Because there is less work involved for the fund company, they charge you much lower fees. In the world of investing, these fees are called “expense ratios.”

The Power of Low Fees Let’s look at how this works with simple numbers. Imagine you invest 10,000 dollars. One fund charges you a fee of 1 percent every year, while a low-cost index fund charges you only 0.05 percent. While a 1 percent fee sounds small, over thirty years, that fee can eat up tens of thousands of dollars of your potential wealth. By choosing the low-cost index fund, that extra money stays in your account and continues to grow.

The Common Beginner Mistake New investors often ignore the “small” fees, thinking that a 1 or 2 percent management fee is a fair price for “expert” advice. They don’t realize that these fees are taken out regardless of whether the fund makes money or loses money.

The Financial Logic Shift In investing, you don’t get what you pay for; you get what you keep. Every dollar you pay in fees is a dollar that isn’t compounding for your future. Millionaires use index funds because they are the most efficient way to keep their costs near zero while participating in the growth of the world’s biggest companies.

The Magic of Diversification: Your Financial Safety Net

One of the scariest parts of investing for a beginner is the fear of losing everything. We have all heard stories of a company going bankrupt and its stock price hitting zero. This is a real risk when you own just one or two stocks.

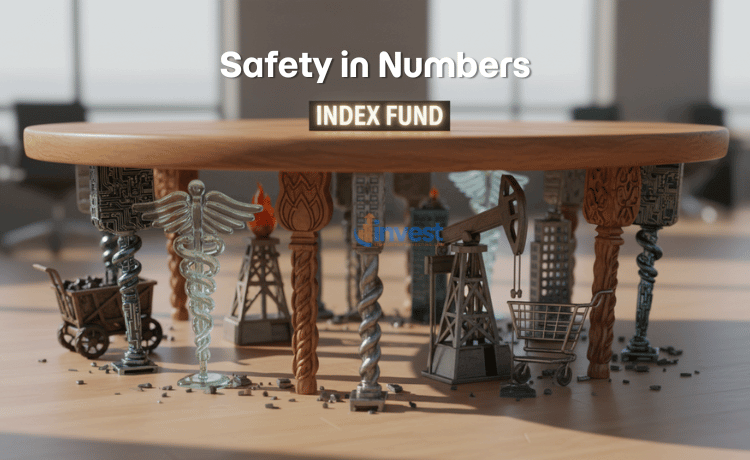

Index funds solve this through “diversification.” When you own an index fund, you are spread out across many different sectors of the economy. Your money is in technology (like Nvidia), retail (like Costco), healthcare (like UnitedHealth), and energy (like Chevron).

A Simple Illustration Think of your investment like a table. If the table only has one leg (one stock) and that leg breaks, the whole table falls over. If your table has 500 legs (an S&P 500 index fund) and a few of those legs break, the table remains perfectly stable. The other hundreds of legs hold it up.

The Common Beginner Mistake Beginners often think they are diversified because they own three different tech stocks. But if the tech industry has a bad year, all three of those stocks will likely go down at the same time. This is called “concentration risk,” and it is a common trap.

The Financial Logic Shift True diversification means owning different types of companies that react differently to the economy. When you buy a total market index fund, you own a piece of almost every public company in the US. This doesn’t mean you won’t see ups and downs, but it means the risk of your total investment going to zero is virtually non-existent as long as the US economy exists.

How to Start Your Index Fund Journey

Starting is much easier than it was twenty years ago. You no longer need a fancy broker or a large sum of money. Most major investment firms in the US now offer index funds with no minimum investment required.

First, you need to open a brokerage account. Popular choices in the US include Vanguard, Fidelity, and Charles Schwab. Once your account is open and linked to your bank, you can search for the “ticker symbol” of the index fund you want to buy. For example, VOO is a popular Vanguard fund that tracks the S&P 500.

The Step-by-Step Logic

- Open an account: Choose a reputable US brokerage.

- Transfer funds: Move money from your savings to your investment account.

- Select your fund: Look for a “Total Stock Market” or “S&P 500” index fund.

- Automate: Set up a plan to buy a small amount every month, regardless of whether the market is up or down.

The Common Beginner Mistake Many people wait for the “perfect time” to buy. They watch the news and wait for the market to drop before they start. This is called “timing the market,” and even experts find it nearly impossible to do consistently.

The Financial Logic Shift “Time in the market” is more important than “timing the market.” If you wait for the perfect moment, you might miss out on months of growth. The most successful investors are those who start as early as possible and keep adding money consistently, a strategy known as Dollar Cost Averaging.

Understanding the Risks (Because Nothing Is Guaranteed)

While index funds are considered one of the safest ways to invest in stocks, “safe” does not mean “no risk.” The stock market moves in cycles. There will be years when the value of your index fund goes down by 10 percent, 20 percent, or even more.

The key is understanding that these drops are a normal part of the process. Since 1926, the S&P 500 has provided an average annual return of around 10 percent, but it rarely returns exactly 10 percent in a single year. Some years it is up 30 percent, and some years it is down 15 percent.

The Common Beginner Mistake When the market drops, many beginners panic and sell their index funds to “save” what money they have left. They treat a temporary drop in price as a permanent loss.

The Financial Logic Shift A loss only becomes “real” when you sell. If the market goes down, the number of shares you own in your index fund stays exactly the same. You still own the same piece of Apple and Microsoft. History shows that the US market has recovered from every single crash it has ever faced. For a long-term investor, a market drop is actually an opportunity to buy more shares at a “discounted” price.

The Different Types of Index Funds

Not all index funds are the same. While the S&P 500 is the most famous, there are others you should know about to build a complete portfolio.

- Total Stock Market Funds: These include the 500 large companies from the S&P 500 plus thousands of smaller companies. This gives you even more diversification.

- International Index Funds: These track companies outside of the US, like Toyota in Japan or Nestle in Switzerland. This protects you if the US economy slows down while other countries grow.

- Bond Index Funds: These track government and corporate bonds. Bonds are generally “stabler” than stocks and can act as a cushion during market crashes.

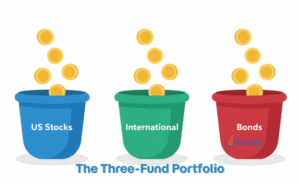

The “Simple Start” Strategy For a total beginner, you don’t need a complicated mix. Many experts suggest a simple “Three-Fund Portfolio” consisting of a US Total Stock Market fund, an International Stock Market fund, and a Total Bond Market fund. This covers almost every corner of the financial world with just three simple investments.

Regulations and Your Protection

In the United States, investing is highly regulated to protect you. The Securities and Exchange Commission (SEC) oversees the fund companies to ensure they are being honest about what they own and what they charge. Additionally, most brokerage accounts are protected by the Securities Investor Protection Corporation (SIPC).

It is important to remember that tax laws can change. For example, the IRS has specific rules about how much you can contribute to retirement accounts like a 401(k) or an IRA, which are great places to hold your index funds. Regulations may change; please check current guidelines or consult a professional to ensure you are maximizing your tax advantages.

Conclusion: Simplicity Is Your Superpower

Investing in index funds is not about getting rich overnight. It is about participating in the long-term success of the greatest companies in the world. It is about keeping your costs low, staying diversified, and having the discipline to stay invested when things get bumpy.

You don’t need to read complex balance sheets or follow every tweet from a CEO. You just need to start, stay consistent, and let the power of the market work for you. That is the simple strategy that has built fortunes for millions, and it is available to you today.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investing involves risk, including the loss of principal. Past performance is not indicative of future results.