Buying your first home in the United States often feels like trying to climb a mountain without any gear. You might have heard that you need a perfect credit score or a massive pile of cash just to get through the front door. If you have been looking at home listings on sites like Zillow or watching the housing market trends, you know that prices can be intimidating. This is where FHA loans enter the picture as a powerful tool for the everyday buyer.

An FHA loan is a mortgage that is insured by the Federal Housing Administration. This government backing acts like a safety net for lenders. Because the government promises to help the bank if a borrower cannot make payments, banks are much more willing to offer loans to people who might not have “perfect” financial backgrounds. Whether you are a retail worker at Walmart or a software engineer just starting out, understanding these loans can be the key to firing your landlord and becoming a homeowner.

What is an FHA Loan?

At its heart, an FHA loan is a collaboration between you, a private lender (like a local bank or a company like Quicken Loans), and the federal government. It is important to realize that the government does not actually give you the money. Instead, they provide “insurance” to the bank.

Think of it like a co-signer on a grand scale. If you were to default on your loan, the FHA pays the lender a portion of the loss. Because of this protection, lenders are willing to accept lower credit scores and smaller down payments than they would for a traditional (or “conventional”) loan.

Why Beginners Often Get It Wrong

Many people think that FHA loans are only for people who are struggling financially or have “bad” credit. This is a major misconception. In reality, many high-earning professionals use FHA loans because they would rather keep their cash in the stock market—investing in companies like Apple (AAPL) or Tesla (TSLA)—instead of tying it all up in the walls of a house.

The Right Way to Think

Don’t view an FHA loan as a “last resort” for people with low credit. Instead, see it as a strategic financial tool. It is a way to enter the real estate market sooner rather than later. By getting into a home with a low down payment, you start building equity while others are still sitting on the sidelines saving up for a 20 percent down payment that might take them a decade to reach.

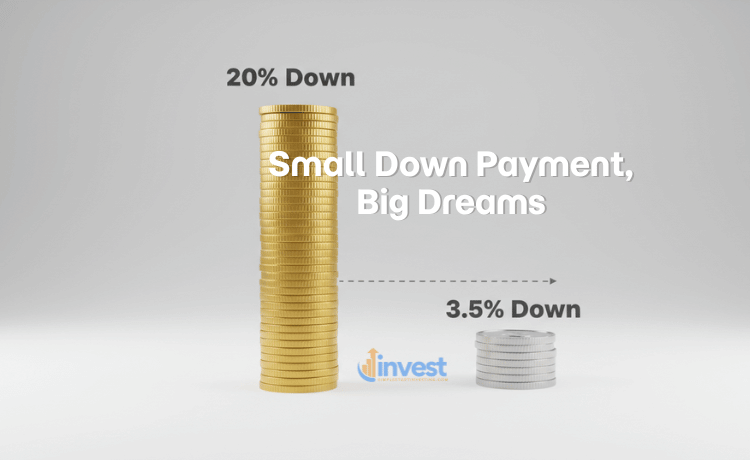

The Power of the 3.5 Percent Down Payment

The most famous feature of the FHA loan is the low down payment requirement. For most conventional loans, lenders often push for a 20 percent down payment to avoid extra fees. On a 400,000 dollar home, 20 percent is a staggering 80,000 dollars. For many first-time buyers, that is an impossible hurdle.

With an FHA loan, the minimum down payment is only 3.5 percent. On that same 400,000 dollar home, your required down payment drops to 14,000 dollars. That is a difference of 66,000 dollars that stays in your pocket or goes toward furniture and repairs.

A Real-World Example

Imagine you are looking at a charming condo priced at 300,000 dollars.

- Conventional Path: The bank might ask for 20 percent, which is 60,000 dollars.

- FHA Path: You only need 3.5 percent, which is 10,500 dollars.

The Mistake to Avoid

A common mistake is thinking that the 3.5 percent down payment is the only money you need at closing. Beginners often forget about “closing costs.” These are the fees for the lawyers, the title search, and the home appraisal. These costs usually add another 2 percent to 5 percent of the home’s price to your total bill.

The Correct Mindset

Always budget for “Cash to Close,” not just the down payment. If you are buying a 300,000 dollar home, don’t just save 10,500 dollars. Aim for at least 18,000 dollars to cover the down payment and the extra fees. However, here is a pro tip: FHA rules allow the seller to pay up to 6 percent of the purchase price toward your closing costs. This means you could potentially get into a home with only your 3.5 percent down payment if you negotiate well.

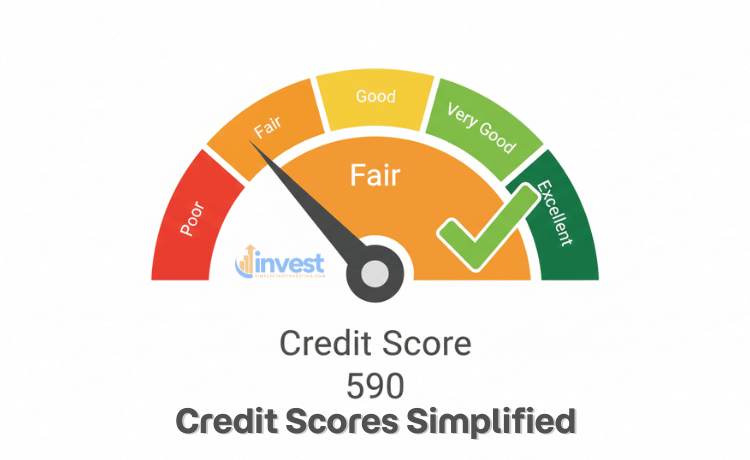

Credit Scores: You Don’t Need Perfection

Your credit score is essentially a grade for how well you handle borrowed money. In the world of conventional loans, having a score below 620 can make it very difficult to get a mortgage. FHA loans are much more forgiving.

The FHA allows for two main credit tiers:

- 580 or Higher: You qualify for the 3.5 percent down payment.

- 500 to 579: You can still get a loan, but you will need to put down 10 percent.

Why This Matters for Beginners

Many beginners assume that if they have a 550 credit score, they are “disqualified” from ever owning a home. This leads them to give up and continue renting for years. They might spend hundreds of dollars on “credit repair” scams when they could have simply applied for an FHA loan with a slightly higher down payment.

The Real Example

Let’s say a young couple has a credit score of 600. They have been told by a traditional bank that they need a 720 score to get a good rate. They feel defeated. But under FHA guidelines, their 600 score is more than enough to qualify for the 3.5 percent down payment option.

Adjusting Your Perspective

Your credit score is a snapshot, not a life sentence. While FHA loans are more lenient, a higher score will still get you a better interest rate. If your score is 585, you are “in,” but if you can push it to 620 by paying down a credit card balance, you might save thousands of dollars in interest over the life of the loan.

Understanding Debt-to-Income (DTI) Ratios

Lenders don’t just look at how much you make; they look at how much you owe compared to how much you make. This is called your Debt-to-Income ratio, or DTI.

FHA loans are generous here as well. While conventional loans often want your total debts (including the new house payment) to be below 43 percent of your monthly income, FHA lenders will sometimes allow you to go as high as 50 percent or even 57 percent in certain situations.

How to Calculate DTI (The Simple Way)

If you earn 5,000 dollars a month before taxes (your “gross” income), and your total monthly bills—including your car payment, student loans, credit cards, and your future mortgage payment—add up to 2,500 dollars, your DTI is 50 percent.

Common Beginner Error

New buyers often calculate their DTI based on their “take-home pay” (the money that actually hits the bank account after taxes). While this is a smarter way to budget for yourself, banks don’t do it that way. They use your gross income. If you use your net income to guess what the bank will allow, you might think you can afford much less than the bank is actually willing to lend you.

Better Decision Making

Even if the FHA allows a 50 percent DTI, ask yourself: “Do I want to spend half my paycheck on debt?” Just because a bank will lend you the money doesn’t mean you should take it all. Aiming for a total debt load of 30 to 35 percent of your income is a safer way to ensure you can still afford vacations and emergency repairs.

Mortgage Insurance: The Trade-Off

Since the FHA is taking a risk by backing your loan with a low down payment, they require you to pay for mortgage insurance. This is called MIP (Mortgage Insurance Premium).

There are two parts to this:

- Upfront MIP: This is usually 1.75 percent of the loan amount. Most people don’t pay this in cash; they add it to the total balance of the loan.

- Annual MIP: This is a monthly fee added to your mortgage payment. For most people, it is around 0.55 percent of the loan amount per year.

A Math Walkthrough

If your loan is 200,000 dollars:

- Your upfront fee would be 3,500 dollars (added to your loan).

- Your annual fee would be 1,100 dollars (about 92 dollars extra per month).

The Misunderstanding

Beginners often view MIP as “wasted money” and try to avoid FHA loans because of it. They compare it to conventional “Private Mortgage Insurance” (PMI), which can be cancelled once you own 20 percent of your home. With an FHA loan (if you put down 3.5 percent), that insurance usually stays for the entire life of the loan.

Correcting the Logic

While MIP is an extra cost, it is the “admission fee” to the party of homeownership. If waiting to save a 20 percent down payment takes you five years, and home prices in your city rise by 5 percent each year, you might end up paying 50,000 dollars more for the same house later. Paying 100 dollars a month in MIP is a small price to pay to stop paying 2,000 dollars a month in rent. You can always “refinance” into a conventional loan later once your home value has gone up.

Property Standards and the FHA Appraisal

When you buy a home with an FHA loan, the government wants to make sure the home is safe, sound, and worth the money. They will send an FHA-approved appraiser to check the property.

Unlike a standard appraisal that just looks at the value, an FHA appraisal looks at “health and safety.” They will check for things like:

- Peeling lead-based paint.

- Missing handrails on stairs.

- Functioning heating and electrical systems.

- Roof life (it usually needs at least two years of life left).

Why Sellers Sometimes Get Nervous

Some sellers at companies like Redfin or local real estate agencies are wary of FHA buyers because they fear the appraiser will demand expensive repairs before the deal can close.

The Beginner’s Mistake

New buyers often confuse an Appraisal with a Home Inspection.

- An Appraisal is for the bank (to protect their money).

- An Inspection is for you (to find out if the dishwasher is broken or the basement is damp). Never skip a private home inspection just because the FHA appraiser said the house was “fine.” The appraiser only cares about major safety issues; they won’t tell you if the HVAC system is likely to die next month.

Thinking Like a Pro

Use the FHA’s strict standards to your advantage. If a house fails an FHA appraisal, it means there is a significant safety issue. This gives you leverage to ask the seller to fix it. If they won’t, you are protected by an “amendatory clause” that lets you walk away with your deposit intact.

4 Big Myths About FHA Loans

To truly master the FHA loan process, we need to clear the air on some common urban legends in the real estate world.

Myth 1: They Are Only for First-Time Buyers

Reality: You can use an FHA loan even if you have owned five houses before. The only rule is that it must be for your primary residence (the home you actually live in). You cannot use an FHA loan to buy a vacation home in Florida or a pure investment property that you plan to rent out on Airbnb immediately.

Myth 2: The Interest Rates Are Higher

Reality: Because FHA loans are government-backed, the interest rates are often lower than conventional loan rates for people with average credit. Lenders feel safe, so they don’t have to charge a “risk premium.”

Myth 3: FHA Loans Take Too Long to Close

Reality: In the past, FHA loans had a reputation for being slow and full of “red tape.” In today’s digital world, an FHA loan usually closes in about the same time as any other loan—typically 30 to 45 days.

Myth 4: You Can’t Buy a Fixer-Upper

Reality: While the standard FHA loan requires the home to be in good shape, there is a special version called the FHA 203(k). This loan lets you buy a “distressed” property and includes the money for renovations in your mortgage. You can buy a “ugly” house and turn it into your dream home with one single loan.

Is an FHA Loan Right for You?

Choosing a mortgage is a personal decision that depends on your “financial health” and your long-term goals.

An FHA loan might be perfect if:

- Your credit score is between 580 and 660.

- You only have a small amount of savings (around 3 to 5 percent of a home’s price).

- You have a higher amount of monthly debt (like student loans or a car payment).

- You want a predictable, fixed-rate monthly payment.

You might want to look at other options if:

- You have a credit score above 720 (Conventional loans might be cheaper).

- You have 20 percent or more to put down (To avoid mortgage insurance entirely).

- You are a Veteran (VA loans offer 0 percent down and no monthly insurance).

Final Thoughts for the Simple Start

Navigating the American housing market is a marathon, not a sprint. The FHA loan program was created specifically to give people a “simple start.” It bridges the gap between the dream of owning a home and the reality of a modern budget.

By accepting a small monthly insurance fee (MIP) and a slightly more rigorous appraisal process, you gain access to the wealth-building power of real estate. Remember, the “best” time to buy a home is rarely when the market is perfect; it is when you are ready and have the right tools in hand.

Take the time to talk to an FHA-approved lender this week. Ask them to run the numbers based on your specific income. You might find that the door to your new home is much closer than you thought.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Mortgage regulations, interest rates, and loan limits are subject to change; please consult with a licensed mortgage professional or check current HUD guidelines before making a financial commitment.