If you have ever walked down a busy street in any American city, you have likely seen the massive, glass-walled buildings belonging to giants like JPMorgan Chase or Bank of America. Right next to them, you might find a smaller, more modest office with “Credit Union” in the name. At first glance, they both seem to do the same thing: they hold your money, give you a plastic card to spend it, and offer loans when you need a car or a house.

But underneath the surface, these two types of institutions are as different as a massive global supermarket and a local farmer’s market. Choosing between Banks vs. Credit Unions isn’t just about which logo you like better. It is a decision that affects how much you pay in fees every month, how much interest you earn on your savings, and how you are treated when you walk through the door.

For a complete beginner, the world of finance can feel like a maze of jargon. This guide is designed to strip away the confusion and help you decide which “vault” is the right fit for your financial future this year.

What is a Bank? (The For-Profit Business)

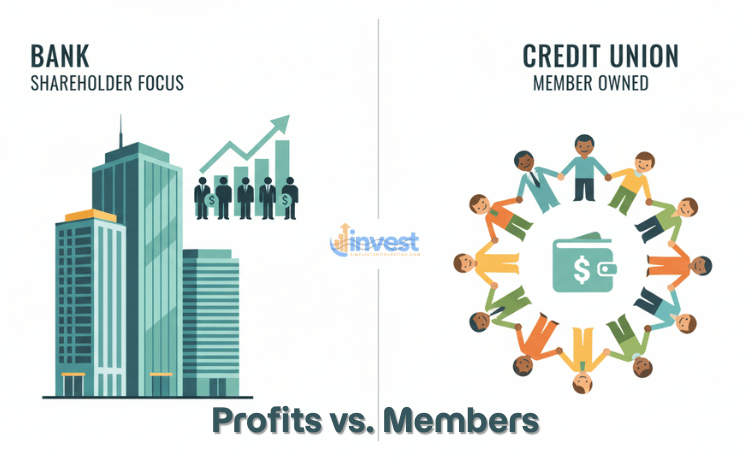

A bank is a financial institution licensed to receive deposits and make loans. However, the most important thing to understand about a bank is its business model. Most large banks in the United States, such as Wells Fargo or Citigroup, are for-profit corporations.

This means the bank has a primary goal: to make money for its owners. These owners are called stockholders. If you look at the stock market today, you will see companies like JPMorgan (JPM) traded publicly. People buy these stocks because they want the bank to be as profitable as possible so the stock price goes up.

Because banks are businesses, they view you as a “customer.” They provide services to you, but they also need to generate a profit from your activity. This profit often comes from the difference between the interest they pay you on your savings and the interest they charge others for loans, as well as various service fees.

A Real-World Example

Imagine you use a large national bank like Bank of America. You might choose them because they have an ATM on every corner, which is very convenient. However, because they are a for-profit giant, they might charge a monthly maintenance fee of 12 dollars unless you keep a certain amount of money in your account. That fee goes toward the bank’s operating costs and helps generate profit for the people who own the bank’s stock.

Common Beginner Misconception

Many people think that because a bank is “big” and “famous,” it must be the best place for their money. They assume that a famous name equals better financial benefits for the individual user.

The Correct Logic

While big banks offer great convenience and high-tech tools, their main loyalty is to their shareholders, not necessarily to providing the lowest fees for you. A big name usually means higher overhead costs, which can sometimes be passed down to you in the form of lower interest rates on your savings or higher fees for basic services.

What is a Credit Union? (The Member-Owned Cooperative)

A credit union is a non-profit financial cooperative. This sounds fancy, but it is actually a very simple concept. Instead of being owned by outside investors on Wall Street, a credit union is owned by the people who keep their money there. These people are called members, not customers.

When you open an account at a credit union, you are technically buying a “share” of the organization. Because they are non-profit, they do not have to worry about making a huge profit to please stockholders. Instead, any extra money they make is returned to the members. This usually happens in the form of lower interest rates on loans, higher interest rates on savings accounts, and fewer “hidden” fees.

Credit unions are usually built around a specific community. This could be people who live in a certain city, employees of a specific company like Walmart or Amazon, or members of the military.

A Real-World Example

Consider a credit union like Navy Federal Credit Union. If you are a member of the military or their family, you can join. Because Navy Federal is a non-profit, they might offer a car loan with an interest rate that is much lower than what a big bank would offer. If a bank offers a loan at 7 percent, the credit union might offer it at 5 percent because they aren’t trying to squeeze extra profit out of you to pay dividends to stockholders.

Common Beginner Misconception

New investors often think credit unions are “exclusive clubs” that are impossible to join. They see the “requirements” and think, “I don’t qualify, so I’ll just stick with a big bank.”

The Correct Logic

While credit unions do have “fields of membership,” these rules have become much more flexible over time. Many credit unions now allow you to join if you live, work, or worship in a specific area. Some even let you join just by making a small ten-dollar donation to a specific charity. It is much easier to “get in” than most people realize.

The Battle of Fees: Where Does Your Money Go?

When comparing Banks vs. Credit Unions, fees are often the first thing you will notice. Large banks often have a laundry list of fees: monthly maintenance fees, overdraft fees, ATM fees, and even fees for talking to a human teller in some cases.

Credit unions, by contrast, are famous for having “fee-free” checking accounts. Since they are not focused on profit, they don’t have the same pressure to “nickel and dime” their members. This can save you hundreds of dollars over the course of a year.

A Real-World Example

Let’s say you accidentally spend 10 dollars more than you have in your account. A major bank might charge you a 35 dollar overdraft fee immediately. A credit union might only charge you 15 dollars, or they might even offer a “grace period” where they give you 24 hours to put the money back before charging you anything at all.

Common Beginner Misconception

Many beginners believe that “small fees don’t matter.” They think a 10 dollar monthly fee is just the price of having a bank account.

The Correct Logic

Small fees act like a “leak” in your financial bucket. If you pay 12 dollars a month in fees, that is 144 dollars a year. Over ten years, that is 1,440 dollars that could have been invested in a company like Apple (AAPL) or Tesla (TSLA) to grow your wealth. Choosing an institution with lower fees is like giving yourself an immediate raise.

Interest Rates: Making Your Money Work Harder

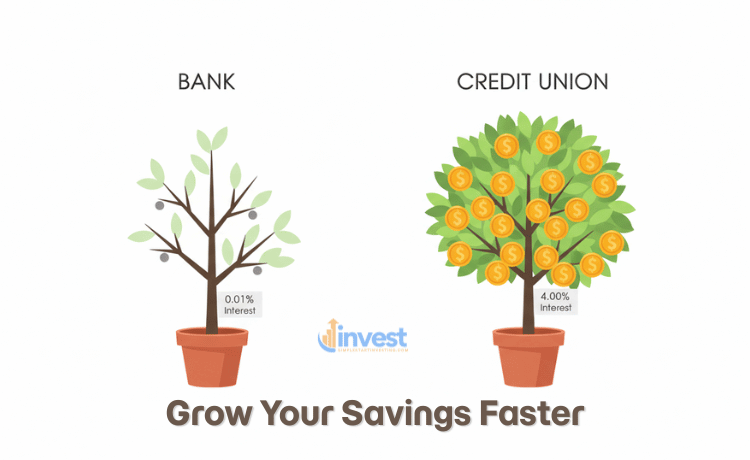

This is where the difference becomes very clear. Because the Federal Reserve has adjusted interest rates recently, banks and credit unions are changing what they pay you.

Generally, credit unions offer higher interest rates on savings accounts and Certificates of Deposit (CDs). They also tend to charge lower interest rates on loans (like mortgages or auto loans). Banks, especially the big ones with lots of physical buildings, often have very low interest rates on basic savings accounts—sometimes as low as 0.01 percent.

A Real-World Example

If you have 10,000 dollars in a “big bank” savings account earning 0.01 percent interest, you will earn only 1 dollar in interest after a full year. If you move that same 10,000 dollars to a credit union offering 4 percent interest, you would earn 400 dollars in that same year. That is a massive difference for doing no extra work!

Common Beginner Misconception

People often think that interest rates are the same everywhere because they are “set by the government.”

The Correct Logic

While the Federal Reserve sets a “benchmark” rate, individual institutions decide how much of that they want to share with you. For-profit banks often keep more of that interest for themselves to pay their stockholders. Non-profit credit unions are more likely to pass that interest directly to you, the member.

Technology and Convenience: The Digital Divide

This is the area where big banks usually win. Because they have billions of dollars to spend on research and development, their mobile apps are often top-tier. They have features like mobile check deposit, advanced fraud alerts, and integration with digital wallets that work seamlessly.

Credit unions have improved a lot, but they might not have the same “flashy” tech. Their apps might be a bit simpler, and they might have fewer physical branches if you travel across the country.

A Real-World Example

If you use a bank like JPMorgan Chase, you can find a branch or an ATM in almost every major city in the US. Their app might allow you to track your spending, invest in stocks, and send money to friends all in one place. If you travel a lot for work, this convenience is a huge benefit.

Common Beginner Misconception

Beginners often worry that if they join a small credit union, they won’t be able to find an ATM and will be stuck paying fees whenever they travel.

The Correct Logic

Most credit unions belong to a “Shared Branching” network. This means you can walk into a different credit union across the country and do your banking just like you were at your home branch. They also often belong to massive ATM networks (like Allpoint or Co-op) that give you access to more fee-free ATMs than even the biggest banks have.

Security: Is Your Money Safe?

One of the most important questions for a beginner is: “What happens if the bank goes out of business?”

The good news is that both types of institutions are extremely safe, provided they have federal insurance.

- Banks are insured by the Federal Deposit Insurance Corporation (FDIC).

- Credit Unions are insured by the National Credit Union Administration (NCUA).

Both organizations provide the same level of protection: your money is insured up to 250,000 dollars per person, per institution. If the bank or credit union fails, the US government steps in to make sure you get your money back (up to that limit).

A Real-World Example

If you have 50,000 dollars in a savings account at a local credit union and that credit union suddenly closes its doors, the NCUA will ensure you receive every penny of your 50,000 dollars back. It is just as safe as keeping it at a massive bank like Wells Fargo.

Common Beginner Misconception

There is a common myth that credit unions are “less stable” because they are smaller or “not real banks.”

The Correct Logic

The NCUA insurance fund is backed by the full faith and credit of the United States government, exactly like the FDIC. As long as you see the “NCUA Insured” or “FDIC Insured” logo, your money is protected by the highest level of security available in the US financial system.

Customer Service: Customer vs. Member

Because you are an owner of a credit union, the service often feels more personal. If you have a problem, you are talking to someone who technically works for you. They are often more willing to look at your whole financial picture rather than just your credit score.

Banks, due to their size, can sometimes feel impersonal. You might feel like just a number in a giant database. However, banks often have 24/7 customer service lines, which is helpful if you lose your card at 3:00 AM on a Sunday.

A Real-World Example

Imagine you are applying for your first home loan. A big bank might look strictly at your computer-generated credit score and say “No” if it is one point too low. A credit union might sit down with you, look at your steady job history at a company like Costco, and decide to give you the loan anyway because they know the local community.

Common Beginner Misconception

Many people think that “better service” only matters when things go wrong.

The Correct Logic

Good service matters every day. It means fewer errors on your statements, better advice when you’re trying to save for a goal, and a financial partner that actually wants to see you succeed rather than just trying to sell you a new credit card.

How to Choose: The Decision Matrix

So, which one is better for your wallet? There is no “one size fits all” answer, but here is a simple way to decide.

Choose a Big Bank if:

- You travel constantly and need physical branches everywhere.

- You want the absolute best, most cutting-edge mobile app technology.

- You need specialized international banking services.

Choose a Credit Union if:

- You want to earn the highest possible interest on your savings.

- You want to pay the lowest possible interest on a car or home loan.

- You hate being charged small, annoying monthly fees.

- You prefer a more personal, community-focused experience.

Many people actually choose to do “both.” They might keep a checking account at a big bank for convenience and a savings account or a car loan at a credit union to get the best rates.

Summary Checklist for Beginners

- Check for Insurance: Always ensure the institution is FDIC or NCUA insured.

- Compare the “Fine Print”: Look specifically for “Monthly Maintenance Fees.”

- Look at the APY: APY stands for Annual Percentage Yield. This is the “real” interest rate you will earn. A higher APY means more money in your pocket.

- Test the App: If you do all your banking on your phone, download the app and see if it is easy to use before you move all your money.

- Check Eligibility: For a credit union, see if you qualify through your job, your family, or where you live.

The choice of where you put your money is the foundation of your financial life. Whether you choose the high-tech power of a bank or the community-focused savings of a credit union, the most important step is to be an active manager of your own cash. Don’t let your money sit in an account that is draining you with fees—move it to a place where it can grow!