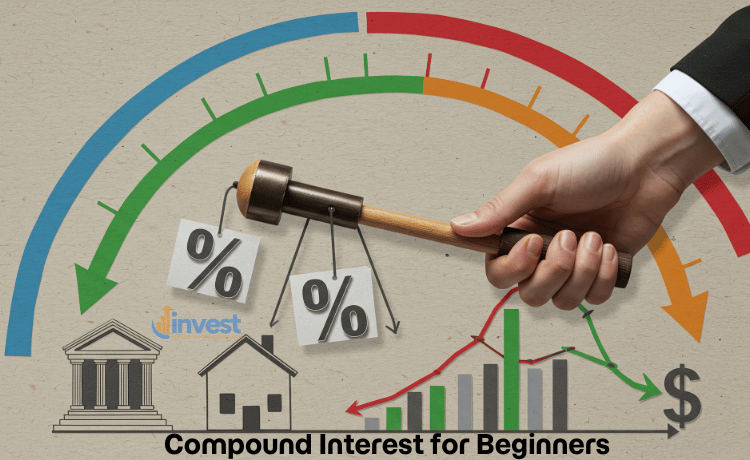

Many people wait for the “perfect” moment to start investing. They wait for a higher salary, a lower stock price, or until they feel like they “know enough.” But in the world of money, the most expensive thing you can spend is time.

If you are looking for compound interest for beginners, the most important lesson isn’t about picking the right stock or predicting the market. It is about understanding that time does the heavy lifting so you don’t have to.

What Exactly is Compound Interest?

Imagine you are rolling a small snowball down a long, snowy hill. At first, you have to push it yourself. It picks up a little bit of snow with each turn. But as the ball gets bigger, it starts to pick up more and more snow on its own. By the time it reaches the bottom, it is a massive boulder, moving with its own momentum.

Compound interest for beginners works exactly like that snowball. It is the process where your money earns interest, and then that interest earns its own interest.

In the United States, this is how wealth is built over decades. Whether you are using a 401(k) at work or opening your own IRA, you aren’t just saving money; you are hiring your money to go to work for you.

How the Magic Works (Without the Math)

Let’s look at how this works in a real-world scenario. Let’s say you decide to start with a small amount of money, perhaps 1,000 dollars, and you put it into a fund that tracks the top companies in the U.S., like Apple (AAPL), Microsoft, or Walmart.

- Year 1: You start with 1,000 dollars. If the market grows by 10 percent that year, your account earns 100 dollars. You now have 1,100 dollars.

- Year 2: This is where the “magic” happens. You aren’t just earning 10 percent on your original 1,000 dollars anymore. You are earning 10 percent on the new total of 1,100 dollars. So, you earn 110 dollars this year. Your new total is 1,210 dollars.

- Year 10: After ten years of this repeating cycle, your money hasn’t just grown by a flat amount each year. It has started to accelerate.

The “compound” part means your gains are stacking on top of previous gains. Over 30 or 40 years, the amount of money earned from interest becomes much larger than the original money you put in.

Common Misconception: Many beginners think they need to be a “math genius” to understand investing.

The Reality: You don’t need to know the formulas. You just need to know that the longer your money stays in the market, the harder it works. You are essentially letting time be your most productive employee.

The Cost of Waiting: Why “Perfect” is the Enemy of “Rich”

One of the biggest mistakes new investors make is “Waiting for the Dip.” They see news about the stock market being at an “all-time high” and decide to wait until prices go down.

While it sounds logical to “buy low,” the reality is that the U.S. market has historically spent a lot of time at or near all-time highs. If you waited for the “perfect” price to buy shares of a company like Costco or Amazon five years ago, you likely missed out on massive growth while sitting on the sidelines.

A Tale of Two Investors

Let’s compare two people to see the “Cost of Waiting.”

- Early Emma: She starts at age 25. She puts 500 dollars a month into her retirement account. She does this for only 10 years and then stops entirely at age 35, but she leaves the money there to grow.

- Late Larry: He waits until he is 35 to start because he wanted to “be stable” first. He puts in the same 500 dollars a month, but he does it for 30 years until he turns 65.

Even though Larry put in three times as much money as Emma, Emma will likely end up with a much larger account balance at retirement. Why? Because her money had an extra 10 years at the beginning to start the compounding process. Those early years are the most powerful.

Common Misconception: “I’ll just save more later when I have a bigger salary.”

The Reality: Money added in your 20s or 30s is worth significantly more than money added in your 40s or 50s because it has more “compounding cycles” to go through. Doubling your contribution later rarely makes up for losing a decade of time.

The 2026 Context: Rules You Should Know

As we move through 2026, the IRS has adjusted the rules for how much you can put into these “wealth-building machines.”

- For an Individual Retirement Account (IRA), the limit is now 7,500 dollars per year if you are under age 50.

- If you have a 401(k) through your employer, you can contribute up to 24,500 dollars.

These limits exist because the government knows how powerful compound interest for beginners can be. They actually limit how much you can put in because the tax advantages combined with compounding are a massive benefit for your future self.

Note: Regulations can change; please check current IRS guidelines or consult a professional.

Why You Don’t Need Much to Start

Another barrier for beginners is the belief that you need 10,000 dollars or more to “really” invest. In the modern U.S. market, this is no longer true. Many apps and brokerage firms allow you to start with as little as 1 dollar or 5 dollars.

Think about it this way: If you spend 5 dollars a day on a fancy coffee, that is about 150 dollars a month. If you invested that 150 dollars into a broad market fund (like one that holds stocks of companies like Tesla, JP Morgan, and Disney) and it earned an average return, over 40 years, that “coffee money” could turn into over 300,000 dollars.

The lesson here is that consistency beats intensity. You don’t need to be rich to start investing; you need to start investing to become rich.

Common Beginner Traps to Avoid

When you first start looking into compound interest for beginners, you might run into these common pitfalls:

1. Checking the Balance Every Day

Compound interest is a slow process at first. If you check your account every day, you might get discouraged because the growth looks small. Remember the snowball? In the first few feet, it doesn’t look like much is happening. The real growth happens in the final third of the hill.

2. Thinking You Can “Time” the Market

Many people try to guess when the market will go up or down. Even professional investors rarely get this right. For a beginner, “Time in the market” is always better than “Timing the market.”

3. Fear of Risk

Yes, the stock market goes up and down. Companies like Apple or Walmart will have bad years. However, when you are investing for the long term (20+ years), those short-term drops are just small bumps on the road. Compound interest works best when you leave the money alone and let it recover.

Re-aligning Your Mindset for Success

To truly benefit from compound interest, you have to stop thinking about “spending” and start thinking about “buying time.”

When you put 100 dollars into an investment account today, you aren’t “losing” that 100 dollars for your budget. You are buying 1,000 dollars (or more) for your future self.

Logic Shift: * Old way of thinking: “I will start investing when I have enough money to make it worth it.”

- New way of thinking: “Every day I wait is a day of interest I will never get back. I will start with whatever I have today.”

How to Start Right Now

Starting doesn’t have to be complicated. Here is a simple path for a beginner in the U.S.:

- Check your 401(k): If your employer offers a “match,” that is free money that also compounds. Start there first.

- Open an IRA: If you don’t have a 401(k), or you want more options, open a Roth or Traditional IRA at a reputable firm like Fidelity, Schwab, or Vanguard.

- Automate it: Set up a small amount (even 20 dollars) to be moved from your bank to your investment account automatically every payday.

- Pick a “Total Market” Fund: Instead of trying to guess which single stock will win, buy a fund that owns a little bit of everything in the U.S. market.

Conclusion

The “perfect” time to start was ten years ago. The second best time is today. Don’t let the fear of not being “perfect” stop you from building the wealth you deserve. Compound interest for beginners is a quiet, powerful force. All you have to do is get the ball rolling and then stay out of its way.

Disclaimer: This content is for educational purposes only and does not constitute financial advice.