If you have ever felt a pit in your stomach when hearing the words “IRS” or “tax season,” you are certainly not alone. For many of us, the way the United States collects money from our paychecks feels like a mystery wrapped in a riddle. One of the most confusing parts of this entire puzzle is the concept of tax brackets.

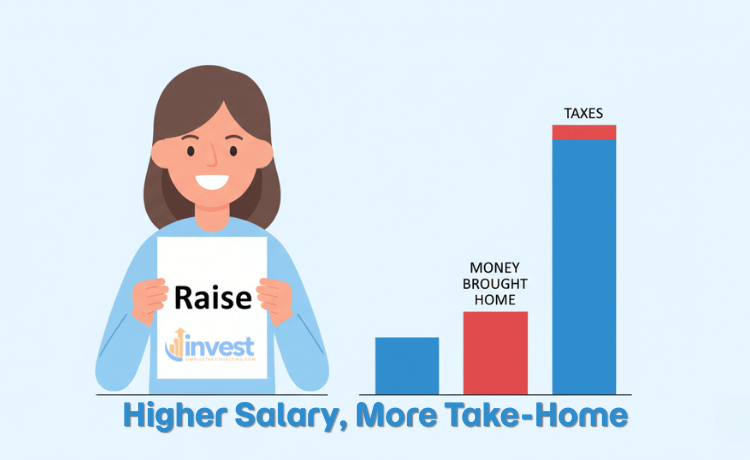

You might have heard a coworker say they turned down a bonus because it would “push them into a higher tax bracket,” or perhaps you are worried that a hard-earned raise might actually leave you with less money in your pocket at the end of the month.

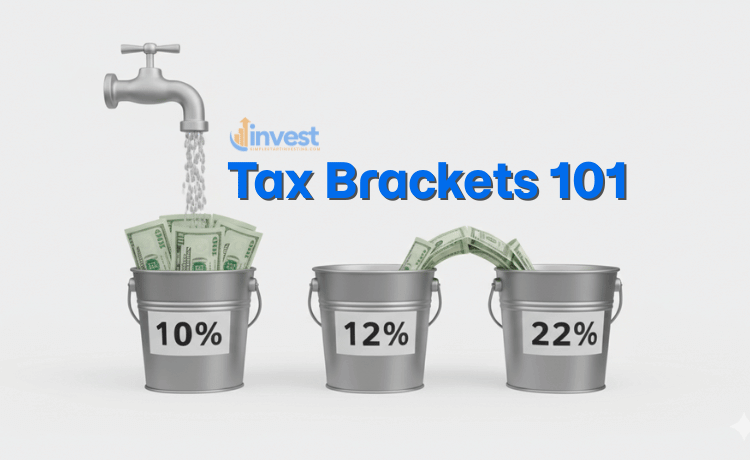

In this guide, we are going to pull back the curtain. We will explain exactly how tax brackets work, why that coworker was probably wrong, and how you can look at your income through the eyes of a financial expert. By the end of this, you will see that the tax system is not a trap, but a series of “buckets” designed to tax different parts of your income at different rates.

What Exactly Is a Tax Bracket?

At its simplest level, a tax bracket is just a range of income. The United States uses what is called a “progressive” tax system. This is a fancy way of saying that the more money you make, the higher the percentage of tax you pay—but only on the specific dollars that fall into those higher ranges.

Imagine you are at a grocery store like Walmart or Costco. Imagine if the first ten apples you bought cost 10 cents each, the next ten apples cost 12 cents each, and any apple after that cost 22 cents. You wouldn’t say that because you bought 21 apples, every single apple now costs 22 cents. You would still pay the lower prices for those first twenty apples.

That is exactly how the tax system works. Your income is not taxed at one single rate. Instead, it is chopped up into slices, and each slice is taxed separately.

Real-World Example

Let’s look at a hypothetical worker named Sarah who works at Amazon. Sarah earns a taxable income that puts her in the 22 percent tax bracket. Many people think this means the government takes 22 percent of her entire paycheck.

However, Sarah only pays 10 percent on her first “slice” of income. Then, she pays 12 percent on the next “slice.” She only pays that 22 percent rate on the dollars that actually landed in that specific 22 percent bucket.

The Common Beginner Mistake

The most frequent mistake beginners make is believing that their “tax bracket” applies to every dollar they earn. They think that if they move from the 12 percent bracket to the 22 percent bracket, their whole salary is suddenly hit with a massive tax increase.

The Correct Financial Logic

The truth is that moving into a higher bracket only affects the extra money you earned. You never lose money by moving into a higher tax bracket. You will always have more money after taxes than you did before the raise, even if the government takes a slightly bigger bite out of that new, higher portion of your income.

The “Bucket” Analogy: How Your Money Fills the Brackets

To truly visualize this, think of the US tax system as a series of buckets. Each bucket has a limit on how much money it can hold and a specific tax rate attached to it. For this year, the rates start at 10 percent and go up to 37 percent.

- Bucket One (10 percent): The first few thousand dollars you earn go into this bucket. The IRS takes 10 percent of whatever is inside.

- Bucket Two (12 percent): Once the first bucket is full, your next dollars flow into the second bucket. Only the money in this second bucket is taxed at 12 percent.

- Bucket Three (22 percent): If you earn enough to fill the first two, the overflow goes here. Only the overflow is taxed at 22 percent.

This continues all the way up through seven different buckets. When someone says, “I am in the 24 percent tax bracket,” what they really mean is that their last dollar earned fell into the 24 percent bucket. Their earlier dollars are still sitting in the 10 percent, 12 percent, and 22 percent buckets, being taxed at those lower rates.

Real-World Example

Consider a professional working at a tech company like Apple or Tesla. If they earn 100,000 dollars in taxable income, they don’t pay 24,000 dollars in tax. They pay 10 percent on the first portion, 12 percent on the middle portion, and 22 percent on the rest. The final “blended” amount they pay is much lower than 24 percent of their total income.

The Common Beginner Mistake

Beginners often look at the tax tables and get discouraged. They see a high percentage like 32 percent or 35 percent and assume they are being “punished” for being successful.

The Correct Financial Logic

Financial experts focus on the “Effective Tax Rate” rather than just the “Marginal Tax Bracket.” While your bracket tells you what you pay on your next dollar, your effective rate tells you what you pay on your total income. Usually, your effective rate is significantly lower than your tax bracket because of those lower-priced “buckets” at the bottom.

Taxable Income: Why You Don’t Pay Tax on Every Dollar

Before your money even touches those buckets we talked about, the IRS gives you a head start. You do not pay taxes on every single dollar you earn. This is thanks to something called the Standard Deduction.

Think of the standard deduction as a “tax-free shield.” For most people, the first 15,000 to 30,000 dollars they earn (depending on if they are single or married) is completely invisible to the IRS.

If you earn 50,000 dollars at a company like Target, and your standard deduction is 15,000 dollars, the IRS acts as if you only earned 35,000 dollars. That 35,000 dollars is what we call your Taxable Income. Only this amount gets poured into the tax buckets.

Real-World Example

Imagine a young teacher starting their career. They earn 45,000 dollars a year. Because of the standard deduction, they might only be taxed on roughly 30,000 dollars of that income. This means a large portion of their paycheck stays in their pocket before the tax brackets even begin to apply.

The Common Beginner Mistake

Many beginners forget about the standard deduction when calculating their potential tax bill. They take their total salary and try to fit the whole thing into the tax brackets, which leads them to overestimate how much they will owe.

The Correct Financial Logic

Always subtract your deductions first. Smart tax planning starts with knowing how much of your income is “protected” by the standard deduction or other adjustments. By lowering your taxable income, you keep more of your money regardless of which bracket you fall into.

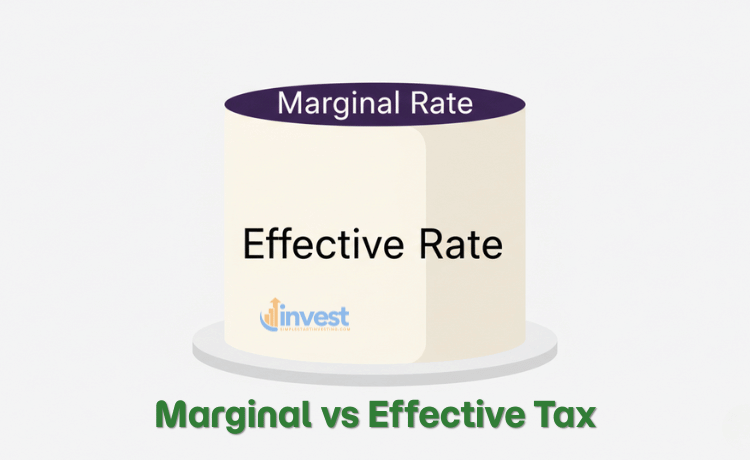

Marginal vs. Effective Tax Rates: The Numbers That Matter

If you want to sound like a pro, you need to know the difference between these two terms.

- Marginal Tax Rate: This is the rate of the highest bucket your money reaches. It tells you how much tax you will pay on the next dollar you earn. If you are in the 22 percent bracket, your marginal rate is 22 percent.

- Effective Tax Rate: This is the actual percentage of your total income that goes to the IRS after all the math is done.

Let’s use a simple numerical example. Suppose you earn 100 dollars.

- The first 50 dollars is taxed at 10 percent (which is 5 dollars).

- The next 50 dollars is taxed at 20 percent (which is 10 dollars).

- You paid a total of 15 dollars in tax.

In this scenario, your Marginal Rate is 20 percent (because that was the rate on your last dollar). But your Effective Rate is 15 percent (because 15 dollars is 15 percent of your total 100 dollars).

Real-World Example

Investors in stocks like JPMorgan or Visa often look at their marginal rate to decide if they should put money into a traditional 401k or a Roth IRA. If their marginal rate is high, they might prefer the traditional 401k because it lowers their taxable income right now, saving them 24 cents or 32 cents on every dollar they contribute.

The Common Beginner Mistake

Beginners often focus only on the marginal rate. They see “24 percent” and think, “I’m losing a quarter of my life to the government!”

The Correct Financial Logic

Focus on your effective rate to understand your true tax burden, but use your marginal rate to make decisions about raises, side hustles, and retirement contributions. Knowing that your next dollar is taxed at a specific rate helps you decide if the extra work for a side job is “worth it” to you.

Filing Status: Does It Change Your Brackets?

Your tax brackets are not just determined by how much you make, but also by your life situation. The IRS has different sets of “buckets” for different people. These are called Filing Statuses.

The most common ones are:

- Single: For individuals who are not married.

- Married Filing Jointly: For couples who combine their incomes on one return.

- Head of Household: For unmarried people who pay more than half the cost of keeping up a home for a qualifying person (like a child).

Married couples generally have “wider” buckets. For example, while a single person might hit the 22 percent bracket at 50,000 dollars, a married couple might not hit that same bracket until they earn 100,000 dollars together. This is designed to prevent a “marriage penalty” and recognizes that a household has different expenses than an individual.

Real-World Example

Imagine two people working at Walmart. If they are both single, they each fill their own buckets. If they get married and file jointly, they essentially pour all their money into one giant set of buckets. Often, this results in them paying less total tax than they did when they were single, especially if one spouse earns significantly more than the other.

The Common Beginner Mistake

Beginners often assume that getting married automatically means they will pay more in taxes because their combined income is higher.

The Correct Financial Logic

In the US system, filing jointly often provides a tax advantage. It “doubles” the width of the lower tax brackets, allowing more of the couple’s total income to be taxed at the 10 percent and 12 percent rates. It is important to check which status fits you best to ensure you aren’t overpaying.

Why Do I Get a Tax Refund?

Many people celebrate when they get a big check from the IRS in the spring. They treat it like a “bonus” or a gift from the government. However, when you understand tax brackets, you realize that a refund is actually just the government returning your own money.

Throughout the year, your employer (like Home Depot or FedEx) takes money out of your paycheck based on an estimate of what you will owe. This is called “withholding.”

If your employer withholds 5,000 dollars over the year, but after you do your taxes you find out you only actually owed 4,000 dollars according to the brackets, the IRS sends you back the 1,000 dollar difference.

Real-World Example

Think of it like a “change” from a transaction. If you go to McDonald’s and buy a meal that costs 8 dollars but you give them a 20 dollar bill, they give you 12 dollars back. You didn’t “win” 12 dollars; you just overpaid at the start.

The Common Beginner Mistake

Many beginners try to maximize their refund. They feel like the bigger the refund, the “better” they did at their taxes.

The Correct Financial Logic

A massive refund means you gave the government an interest-free loan all year. Financial experts often prefer to have a “zero” refund. This means they kept more of their money in every paycheck throughout the year, allowing them to invest it in things like Apple stock or a high-yield savings account where it could grow, rather than sitting idle in the government’s hands.

Summary: Taking Control of Your Taxes

Understanding tax brackets is the first step toward financial literacy in the United States. You now know that:

- The system is progressive: you only pay higher rates on the additional dollars you earn.

- The standard deduction protects a big chunk of your income from being taxed at all.

- Your marginal rate is the tax on your last dollar; your effective rate is the average on all your dollars.

- Your filing status changes how “wide” your tax buckets are.

Don’t let the complexity of tax forms scare you away from seeking a raise or starting a business. The math is always on your side: earning more money will always result in more money in your pocket, even after the IRS takes its share.

Tax regulations and specific bracket numbers can change every year due to new laws or inflation adjustments. It is always a good idea to check the current IRS guidelines or speak with a qualified tax professional when planning your finances.

Disclaimer: This content is for educational purposes only and does not constitute financial or tax advice. Tax laws are subject to change; please consult with a professional or check current IRS guidance for your specific situation.