Deciding whether to continue renting or finally buy a house is one of the biggest financial crossroads you will ever face. For decades, the “American Dream” has told us that buying a home is always the superior choice. We are told that renting is “throwing money away” and that homeownership is the only true path to wealth. But in today’s market, where home prices remain high and mortgage rates have shifted, is that old advice still true?

The choice between renting vs. buying a house isn’t just about a monthly payment. it is a complex comparison of flexibility, hidden costs, and long-term equity. To make the right choice for your wallet, you need to look past the surface level and understand how the math actually works in the current economy. This guide will break down the true costs of both paths so you can stop guessing and start building a solid financial foundation.

What Does “Renting vs. Buying” Actually Mean?

At its simplest level, the debate of renting vs. buying a house is a choice between two different ways to pay for the roof over your head. When you rent, you are paying for “shelter as a service.” You pay a set fee to a landlord, and in exchange, you get a place to live without the responsibility of maintaining the building. When you buy, you are taking on a long-term loan to eventually own the asset.

The 4-Step Breakdown of the Basics

1. Simple Explanation Renting is like a subscription service for a home. You pay a monthly fee, and the landlord handles the “bugs”—the leaky roof, the broken heater, and the property taxes. Buying is like taking a massive loan to start a small business where the business is your house. You get to keep the profit if the value goes up, but you are also the CEO, the janitor, and the person who pays the bills when something breaks.

2. Real-World US Example Imagine two friends, Sarah and Mike, living in a city like Dallas, Texas. Sarah rents a modern apartment for 2,000 dollars a month. If her sink breaks, she calls the building manager, and it is fixed for free. Mike buys a similar-sized townhouse nearby. His mortgage payment is also 2,000 dollars, but when his water heater explodes, he has to spend 1,500 dollars of his own money to replace it immediately.

3. Common Beginner Mistake Many beginners only compare the monthly rent check to the monthly mortgage payment. They see a rent of 2,200 dollars and a mortgage of 2,100 dollars and think, “I’ll save 100 dollars a month by buying!”

4. The Right Financial Mindset The correct way to think is this: Rent is the maximum you will pay for housing each month. A mortgage is the minimum you will pay. Once you pay your rent, you are done. Once you pay your mortgage, you still have to worry about property taxes, insurance, and the “surprise” costs of owning a home.

The Concept of Home Equity: Paying Yourself vs. Paying a Landlord

One of the most common reasons people want to buy is to build home equity. Equity is the portion of the home you “truly own.” If your house is worth 400,000 dollars and you owe the bank 300,000 dollars, you have 100,000 dollars in equity.

The 4-Step Breakdown of Equity

1. Simple Explanation Think of a mortgage as a forced savings account. Every month, a small part of your payment goes toward the “principal,” which is the actual price of the house. Over thirty years, those tiny slivers of ownership add up until you own the whole thing. In contrast, 100 percent of a rent payment goes to the landlord’s bank account, not yours.

2. Real-World US Example Suppose you buy a home for 350,000 dollars using a standard 30-year loan. In the first few years, most of your monthly payment goes toward interest (the fee the bank charges you). However, after five years, you might have paid off 25,000 dollars of the actual house price. If the house value also grew to 380,000 dollars, you now have 55,000 dollars in “wealth” tied up in that house. If you had rented, that 55,000 dollars wouldn’t exist unless you saved it separately.

3. Common Beginner Mistake Beginners often think that they “own” the house the moment they get the keys. In reality, the bank owns most of it for the first twenty years. If you sell too early, you might walk away with zero dollars after paying the bank back and paying real estate agents.

4. The Right Financial Mindset Equity is a slow-motion wealth builder. It only works if you stay in the home long enough for the principal payments to become significant and for the property value to increase. Do not view a house as a “get rich quick” scheme; view it as a long-term anchor for your net worth.

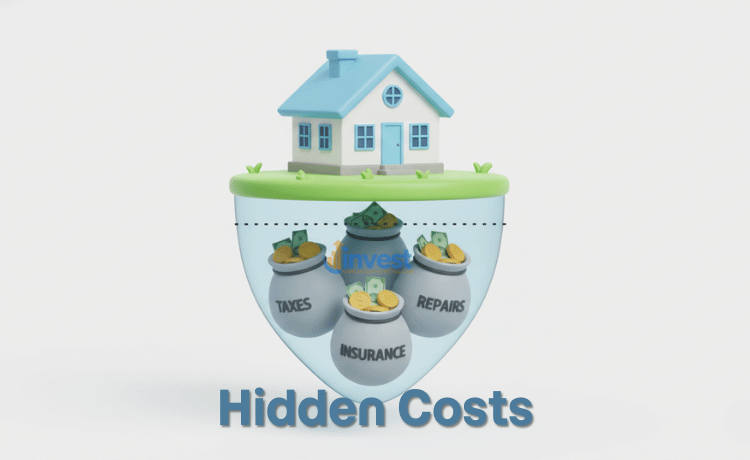

The “Hidden” Costs of Buying a Home

When people search for renting vs. buying a house, they often forget about the “unrecoverable costs” of ownership. These are the dollars you spend that you never get back, similar to rent.

The 4-Step Breakdown of Maintenance and Taxes

1. Simple Explanation Owning a home comes with “leaking” expenses. Property taxes are paid to the local government every year. Homeowners insurance protects you but costs money monthly. Maintenance is the cost of keeping the house from falling apart. None of these costs build equity; they are just the “price of admission” for being an owner.

2. Real-World US Example Let’s look at a homeowner in Florida. They might pay 4,000 dollars a year in property taxes and another 3,000 dollars for insurance because of hurricane risks. On top of that, if the roof needs replacing for 15,000 dollars every 15 years, that averages out to 1,000 dollars per year. That is 8,000 dollars a year—or roughly 666 dollars a month—in “hidden rent” that the homeowner pays despite “owning” the home.

3. Common Beginner Mistake New buyers often spend every penny of their savings on the down payment. When the first pipe bursts or the AC unit dies two months after moving in, they have no cash left and have to put the repair on a high-interest credit card.

4. The Right Financial Mindset A good rule of thumb is the One Percent Rule. You should expect to spend one percent of your home’s value on maintenance every single year. If your home is worth 500,000 dollars, set aside 5,000 dollars a year (about 417 dollars a month) just for repairs. If you can’t afford that, you might not be ready to buy.

Understanding the “Break-Even Point”

The “break-even point” is the moment when the total cost of buying becomes cheaper than the total cost of renting. Because buying a home involves massive “entry costs” (like closing costs) and “exit costs” (like agent fees), it takes years to make up that money through equity and price growth.

The 4-Step Breakdown of the Break-Even Timeline

1. Simple Explanation Imagine you are running a race. When you buy a house, you start 20,000 dollars behind the renter because you had to pay for inspections, lawyers, and bank fees (closing costs). Every year you stay, you slowly “catch up” because your rent isn’t going up and you are building equity. Eventually, you pass the renter. That “passing” moment is the break-even point.

2. Real-World US Example In many US markets currently, the break-even point is between seven and ten years. If you buy a house in Phoenix, Arizona, but move for a new job after only three years, you will likely lose money. Even if the house price went up a little, the 6 percent fee you pay to sell the house plus the 3 percent you paid to buy it will eat all your profits.

3. Common Beginner Mistake Beginners often buy “starter homes” with the plan to move in two years. They assume that since the market is “hot,” they will make a profit. They forget that selling a house is expensive.

4. The Right Financial Mindset Ask yourself: “Can I commit to living here for at least seven to ten years?” If the answer is “no” or “I’m not sure,” renting is almost always the safer and more profitable financial move. Renting provides the flexibility to move for a better-paying job, which often grows your wealth faster than a house ever could.

Tax Benefits: Are They Still a Big Deal?

In the past, the “Mortgage Interest Deduction” was a massive reason to buy. However, US tax laws have changed significantly. Today, many homeowners don’t actually get a “bonus” tax break from owning a home.

The 4-Step Breakdown of the Standard Deduction

1. Simple Explanation The IRS gives everyone a “Standard Deduction,” which is a flat amount of income you don’t have to pay taxes on. To get a special tax break for your mortgage, your total “itemized” deductions (like mortgage interest and property taxes) must be higher than that standard amount. For many people, the standard amount is so high that the “house tax break” doesn’t actually save them any extra money.

2. Real-World US Example Currently, for a married couple, the standard deduction is around 32,200 dollars. If a couple pays 20,000 dollars in mortgage interest and 5,000 dollars in property taxes, their total is 25,000 dollars. Since 25,000 is less than 32,200, they will just take the standard deduction like everyone else. They get zero “extra” tax benefit from owning the home.

3. Common Beginner Mistake Relying on “tax write-offs” to make a home purchase affordable. They assume they will get a giant check from the government every spring just because they have a mortgage.

4. The Right Financial Mindset Treat any tax benefits as a “maybe” or a small “extra” rather than a core reason to buy. Base your decision on your monthly cash flow and your ability to maintain the property. Regulations can change; please check current guidelines or consult a professional regarding your specific tax situation.

When Renting is the Smarter Move

Despite the pressure to buy, renting is often the superior choice for your personal finance journey, especially when you are just starting out.

The 4-Step Breakdown of Rental Logic

1. Simple Explanation Renting allows you to keep your capital (your cash) “liquid.” Instead of locking 50,000 dollars into a house down payment, you could invest that money in the stock market (like an S&P 500 index fund). Sometimes, the growth of your investments can outpace the growth of a house’s value.

2. Real-World US Example Consider a young professional in Seattle. Rent is expensive, but buying is even more expensive. If they rent and invest their extra 1,000 dollars a month into a diversified portfolio of companies like Apple (AAPL) or Amazon (AMZN), they might end up with more wealth after ten years than if they had spent all their money on a high-priced mortgage, taxes, and repairs.

3. Common Beginner Mistake Feeling like a “failure” because they are still renting at age 30. They rush into a bad house in a bad neighborhood just to say they are homeowners.

4. The Right Financial Mindset Renting is not “throwing money away.” It is “buying flexibility.” It is buying the right to move to a new city for a 20,000-dollar raise. It is buying the right to not care if the roof leaks during a rainstorm. Renting is a valid financial strategy.

How to Decide: The Final Checklist

To choose between renting vs. buying a house, ask yourself these three questions:

- How long will I stay? If it is less than 7 years, rent.

- Is my emergency fund ready? If you don’t have 10,000 to 20,000 dollars saved after your down payment for repairs, rent.

- Is it a lifestyle choice or an investment? If you want a garden and a place to paint the walls, buy. If you just want a place to sleep while you grow your career, rent.

Ultimately, the best choice is the one that lets you sleep at night without worrying about your bank account. Both paths can lead to wealth if you are disciplined with your savings.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. The rules and tax regulations may change; please consult with a professional advisor for your specific situation.