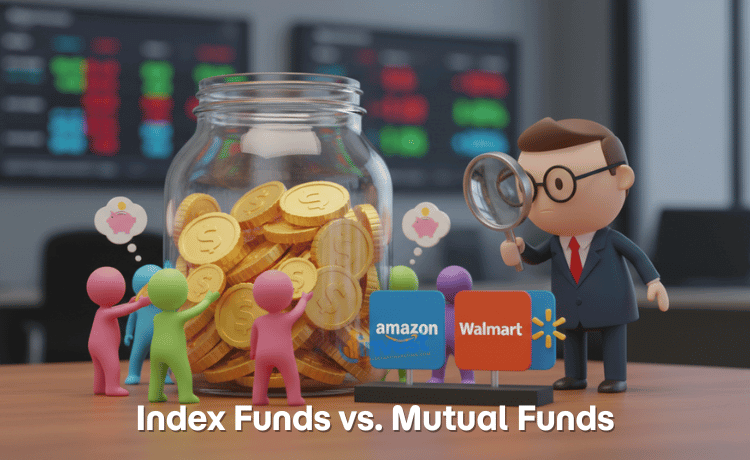

When you start your journey into the world of investing, you will likely encounter two terms almost immediately: Index Funds and Mutual Funds. If you are feeling a bit overwhelmed, don’t worry. Most people think these are two completely different things, like apples and oranges. In reality, it is more like comparing a self-service buffet to a restaurant with a personal chef.

Choosing between them is one of the most important decisions you will make. This choice dictates how much you pay in fees, how much work you have to do, and ultimately, how much money stays in your pocket over the next twenty or thirty years. Let’s break down the index funds vs. mutual funds debate so you can decide which path fits your financial goals.

What Exactly is a Mutual Fund?

To understand the difference, we first need to define what a mutual fund is. Imagine a large pot of money contributed by thousands of different investors. A professional manager takes that pot of money and decides which stocks or bonds to buy.

The goal of a traditional mutual fund is usually to “beat the market.” This means the manager is trying to pick the absolute best companies, like Amazon or Costco, at the perfect time to make more money than the average of the overall stock market. Because a human expert is making these calls, these are often called “actively managed funds.”

The Common Misconception

Many beginners believe that because a professional is “actively” watching the fund every day, it must be safer or more profitable. It feels logical to think that a human expert is better than a computer program.

The Reality Check

In the investing world, more activity does not always mean more money. Those professional managers charge high fees for their time and expertise. Even if the manager picks great stocks, the cost of their salary and the office building they work in comes out of your profits. Historically, many active managers actually fail to perform better than the simple market average after you subtract their expensive fees.

What Exactly is an Index Fund?

An index fund is actually a specific type of mutual fund, but it operates on autopilot. Instead of hiring a fancy manager to guess which stocks will go up, an index fund simply tracks a list of companies.

For example, an S&P 500 Index Fund aims to own a small piece of the 500 largest companies in the United States. If Apple is on that list, the fund buys Apple. If a company drops off the list, the fund sells it. There is no “guessing” involved. Because a computer can do this work, the costs are incredibly low. This is known as “passive investing.”

A Simple Example of How It Works

Imagine you have a basket that is designed to always hold the top 10 most popular snacks in America. You don’t need a chef to decide what goes in the basket; you just look at the sales data and put those 10 snacks in. If pretzels become more popular than potato chips, you swap them out. An index fund does exactly this with stocks like Microsoft or Walmart.

The Common Misconception

New investors often think index funds are “average” or “boring” because they only try to match the market, not beat it. They worry they are missing out on the next big “moon shot” stock.

The Reality Check

While “average” sounds boring, the “market average” has historically been quite strong over long periods. By accepting the market return and paying almost zero in fees, index fund investors often end up wealthier than people who try to chase the “hot” stocks but get weighed down by high costs.

The Silent Profit Killer: Expense Ratios

When comparing index funds vs. mutual funds, the biggest factor is the cost. In the financial world, this cost is called the Expense Ratio. It is a small percentage the fund takes every year to cover its running costs.

Why Small Percentages Matter

Let’s look at a simple scenario. Imagine you have 10,000 dollars invested.

If you put that money in an actively managed mutual fund with a 1 percent fee, you pay 100 dollars a year to the manager.

If you put that same 10,000 dollars in a low-cost index fund with a fee of 0.05 percent, you only pay 5 dollars a year.

That 95 dollar difference might not seem like much today. However, over 30 years, that extra money stays in your account, earns its own interest, and compounds. Over a lifetime, a 1 percent fee can actually eat up nearly a third of your total possible wealth.

The Beginner’s Mindset Shift

Beginners often focus on “how much can I make?” Successful investors focus on “how much am I losing to fees?” You cannot control what the stock market does, but you have 100 percent control over the fees you choose to pay.

Diversity: Not Putting Your Eggs in One Basket

Both mutual funds and index funds offer “diversification.” This is a fancy way of saying you aren’t putting all your money into one single company like Tesla.

If you buy one share of an individual stock and that company goes bankrupt, you lose everything. But if you buy an index fund that holds 500 companies, one company failing barely leaves a scratch on your total balance.

The Common Misconception

People sometimes think they need to own 10 different mutual funds to be “diversified.”

The Reality Check

One single total market index fund can give you ownership in thousands of companies at once. Buying too many different funds often leads to “overlap,” where you accidentally own the same stocks (like JPMorgan or Alphabet) in five different places. Keeping it simple with one or two broad index funds is usually more than enough for a beginner.

Taxes and Your Wallet

At the end of the year, the IRS (Internal Revenue Service) wants their cut. One hidden advantage of index funds is that they are generally more “tax-efficient.”

Because an active mutual fund manager is constantly buying and selling stocks to try and beat the market, those sales trigger taxes. Even if you didn’t sell your shares of the fund, the fund itself might send you a tax bill for the “capital gains” it made during the year.

Index funds rarely sell their stocks. They just buy and hold. This means fewer tax surprises for you at the end of the year.

Note: Tax laws in the U.S. can be complex and change frequently. It is always a good idea to check current IRS guidelines or talk to a tax professional about your specific situation.

Active vs. Passive: The Great Debate

The core of the index funds vs. mutual funds discussion is whether you believe a human can outsmart the market.

- Active (Traditional Mutual Funds): You are betting on the manager’s talent. You want them to protect you during a market crash or find the next big winner before anyone else does.

- Passive (Index Funds): You are betting on the growth of the entire U.S. economy. You accept that no one can consistently predict the future, so you choose to own everything for a very low price.

Why Beginners Often Choose the Wrong Side

The financial industry spends millions of dollars on advertising to make active mutual funds look exciting. They show pictures of energetic people in suits and charts pointing up. Beginners are often drawn to the “prestige” of having a pro manage their money.

The Logical Adjustment

In most areas of life, you get what you pay for. A more expensive car is usually better than a cheap one. But in investing, the less you pay, the more you usually keep. Many of the most successful investors in the world, including Warren Buffett, have famously recommended low-cost index funds for the average person.

How to Get Started

If you have decided that a low-cost approach is right for you, starting is easier than you think. You don’t need a private broker. Most major U.S. investment firms allow you to open an account online with a very small amount of money.

- Open an Account: Look for a reputable brokerage (like Vanguard, Fidelity, or Charles Schwab).

- Look for the Word “Index”: When searching for funds, look for “Total Stock Market Index” or “S&P 500 Index.”

- Check the Expense Ratio: Ensure the fee is low (ideally below 0.10 percent).

- Automate It: Set up a small amount to be taken from your bank account every month. This is called “Dollar Cost Averaging.”

A Common Mistake

Many beginners wait for the “perfect time” to buy. They wait for the news to say the economy is great.

The Correct Mindset

The best time to start was ten years ago; the second best time is today. By using index funds, you aren’t trying to “time” the market. You are just participating in it. Whether the market goes up or down next week doesn’t matter as much as where it will be in twenty years.

Summary of Key Differences

To help you decide, let’s look at how these two options function in the real world.

Traditional Mutual Funds (Active)

- Management: A human team chooses the stocks.

- Goal: Beat the average market performance.

- Cost: Higher fees (Expense Ratios) to pay for the experts.

- Risk: The manager might make a bad bet and lose more than the market.

Index Funds (Passive)

- Management: A computer tracks a fixed list of stocks.

- Goal: Match the average market performance.

- Cost: Very low fees because there are no “experts” to pay.

- Risk: You will go down if the whole market goes down, but you will never do worse than the market itself.

Which One is Better for Your Wallet?

For the vast majority of people just starting out, index funds are the clear winner. They are simpler to understand, require less maintenance, and—most importantly—they cost significantly less. Every dollar you don’t pay in fees is a dollar that stays in your account to grow.

Investing doesn’t have to be a high-stakes game of guessing. By choosing low-cost index funds, you are taking a proven, scientific approach to building wealth over time. You are choosing to be an owner of the largest companies in the world without paying a middleman to hold your hand.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investment involves risk, and past performance is not a guarantee of future results. Please consult with a qualified financial advisor or tax professional before making any investment decisions.