When you sit down to do your taxes, one of the first questions you have to answer is about your tax filing status. It sounds like a simple checkbox, but this single choice is the “master key” to your entire tax return. It decides how much of your income is tax-free, which tax rate you pay, and which credits you can claim.

Choosing the right tax filing status is often the difference between getting a nice refund or owing the IRS money. For a beginner, the names of these statuses might seem obvious—if you are not married, you are single, right? Not always. The IRS has very specific rules that might allow you to pay less tax if you know which category you actually fit into.

In this guide, we will break down the five official statuses used in the United States. We will explain them in plain English, look at real-world examples from companies you know like Walmart or Amazon, and help you avoid the most common traps that catch new taxpayers off guard.

What Exactly Is a Tax Filing Status?

Think of your tax filing status as a category that describes your family and living situation on the last day of the year. The IRS uses this category to determine your “Standard Deduction.” This is a flat dollar amount that you get to subtract from your total income before the government even starts calculating your taxes.

If you earn 50,000 dollars a year and your status gives you a 15,000 dollar deduction, the IRS only looks at the remaining 35,000 dollars to decide what you owe. The higher your deduction, the lower your taxable income. This is why getting your status right is the most basic way to save money on your taxes.

1. The Single Filing Status

This is the default for most young professionals and people who have never been married. If you are not legally married by December 31st and you don’t have children or dependents living with you, this is likely your status.

- Simple Explanation: You are on your own. You don’t have a spouse, and you aren’t providing the main financial support for a child or a relative living in your home.

- Real-World Example: Imagine Sarah, who just started her first “big girl” job as a software developer at Amazon. She rents an apartment in Seattle, lives alone, and has no children. On New Year’s Eve, Sarah is legally unmarried. Her tax filing status is Single.

- Common Misconception: Many people think that if they live with a boyfriend or girlfriend, they should file as “Married” or something else.

- The Right Mindset: Unless you have a marriage certificate or live in a state that recognizes common-law marriage (and you meet those specific rules), the IRS sees you as two separate Single individuals.

2. Married Filing Jointly (MFJ)

For most couples, this is the most beneficial status. It allows you to combine your incomes and your deductions onto one single tax return.

- Simple Explanation: You and your spouse act as one single financial unit in the eyes of the IRS. You add your two salaries together and take one large deduction.

- Real-World Example: Let’s look at Mark and Elena. Mark works at Walmart and Elena works at Costco. They got married in November of this year. Even though they were “single” for most of the year, the IRS considers them “Married” for the entire year because they were married by December 31st. They file one return together to take advantage of the highest standard deduction available.

- Common Misconception: Some beginners think that if one spouse doesn’t work, they shouldn’t file jointly.

- The Right Mindset: Filing jointly is almost always better if one spouse has a much lower income. It “pulls” the higher earner’s income into a lower tax bracket, saving the couple a significant amount of money overall.

3. Married Filing Separately (MFS)

This is the “emergency” or “special case” status for married couples. You are married, but you choose to keep your tax lives completely separate.

- Simple Explanation: You file your own return, and your spouse files theirs. You only report your own income and your own individual deductions.

- Real-World Example: Imagine a couple where one spouse works for Tesla and has significant student loans on an income-driven repayment plan. Sometimes, filing separately keeps their individual “Adjusted Gross Income” lower, which might keep their monthly loan payments more affordable. They choose MFS even if it means paying slightly more in total taxes.

- Common Misconception: People think filing separately is “easier” if they have separate bank accounts.

- The Right Mindset: Filing separately usually results in a higher tax bill. You lose out on many credits, like the Child and Dependent Care Credit. Only choose this if you have a specific legal or financial reason, such as protecting yourself from a spouse’s tax debt.

4. Head of Household (HoH)

This is the “sweet spot” for many unmarried people. It offers a higher deduction and lower tax rates than the Single status.

- Simple Explanation: You are unmarried, but you are not “alone.” You are the main person paying the bills for a home where a “qualifying person” (usually a child or a dependent parent) lives.

- Real-World Example: David is a single father who works at Apple. He is divorced and his daughter lives with him for more than half of the year. David pays for more than half of the rent, groceries, and utilities for their home. Instead of filing as Single, David files as Head of Household. This gives him a much larger tax-free cushion than his single coworkers.

- Common Misconception: Beginners often think that just having a child makes them Head of Household.

- The Right Mindset: To qualify, you must meet three strict tests: you must be unmarried, you must pay more than half the cost of keeping up a home, and a qualifying person must live with you for more than half the year. If you live with your parents and they pay the rent, you cannot be the Head of Household even if you have a child.

5. Qualifying Surviving Spouse (QSS)

This status is designed to help people who have recently lost a spouse and are still caring for children at home.

- Simple Explanation: If your spouse passed away, the IRS allows you to keep using the high “Married Filing Jointly” deduction and tax rates for two years after the year of death, provided you have a dependent child.

- Real-World Example: Suppose a woman’s husband passed away last year. She has a young son and works at Target. For this year and next year, she can still use the Qualifying Surviving Spouse status. This gives her a larger financial shield while she adjusts to being a single-income household.

- Common Misconception: Thinking you can use this status forever.

- The Right Mindset: This is a temporary “grace period.” After two years, you will usually move to the Head of Household status if you still have children at home.

Why Your Choice Changes Your Bill: The Standard Deduction

We mentioned the Standard Deduction earlier, but let’s look at how the numbers work in simple terms. Every year, the IRS sets a specific amount of money that you don’t have to pay taxes on.

Imagine the IRS gives you a “coupon” for tax-free income.

- If you file as Single, your coupon might be worth 15,000 dollars.

- If you file as Head of Household, your coupon jumps up to about 23,000 dollars.

- If you are Married Filing Jointly, your combined coupon is worth about 31,000 dollars.

If you are a single parent working at Walmart making 40,000 dollars, and you accidentally file as “Single” instead of “Head of Household,” you are telling the IRS you want a 15,000 dollar coupon instead of a 23,000 dollar one. That mistake means you are paying taxes on an extra 8,000 dollars of your hard-earned money!

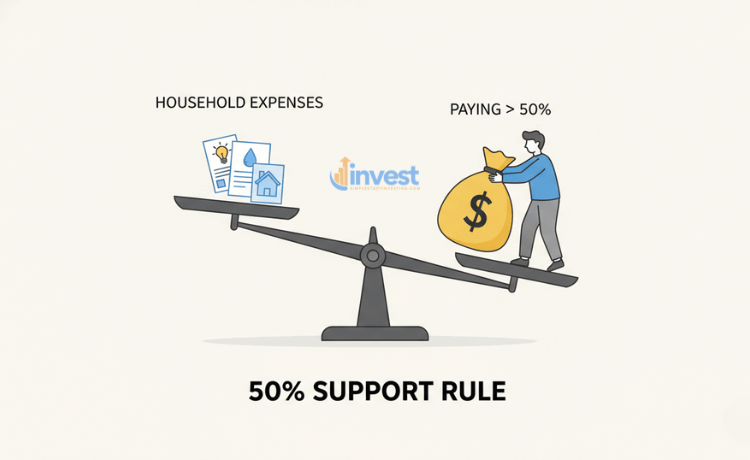

Understanding the “50% Rule” for Head of Household

The biggest area of confusion for new taxpayers is the “Head of Household” status. The IRS is very strict about who gets this “better” rate. The most important hurdle is the support test.

You must pay more than half the cost of keeping up a home. The IRS looks at things like:

- Rent or mortgage interest

- Property taxes

- Utilities (gas, electric, water)

- Property insurance

- Repairs and maintenance

- Food eaten in the home

If you earn 20,000 dollars at a local McDonald’s but you live with your brother who earns 80,000 dollars and pays all the rent and bills, you are not the Head of Household. Your brother is the one supporting the home. Even if you have a child, you would likely still file as Single because you didn’t pay for more than half of the household expenses.

What If Your Situation Changed During the Year?

Life doesn’t always follow the calendar. You might get married in June, or your divorce might be finalized in October.

The IRS has a very simple (but sometimes harsh) rule: Your status on December 31st is your status for the whole year.

If you get married on December 30th, the IRS considers you married for the entire twelve months of that year. You can choose to file Jointly or Separately, but you can no longer file as Single.

If you were married but your divorce became final on December 15th, you are considered “Unmarried” for the whole year. You would then look at whether you qualify for Single or Head of Household status.

Common Mistakes Beginners Make

Choosing a tax filing status seems easy until you have to sign the form. Here are the errors that get caught most often by the IRS:

- Filing as Single when you are still legally married: Even if you are separated and haven’t lived together for months, if you are still legally married on December 31st, you cannot file as Single. You must file as Married (Jointly or Separately) or meet very specific “considered unmarried” rules for Head of Household.

- Two people in the same house filing as Head of Household: Usually, there can only be one “Head” of a household. If two roommates both try to claim this status for the same address, the IRS will likely flag it. Only one person can provide “more than half” of the support for the home.

- Missing the Surviving Spouse benefit: Many widows or widowers move straight to “Single” or “Head of Household” and miss out on the much larger deduction of the Qualifying Surviving Spouse status for those first two years.

How to Decide: A Step-by-Step Logic

When you are ready to file, follow this mental path:

- Step 1: Were you married on December 31st?

- If Yes, your best bet is usually Married Filing Jointly.

- If No, go to Step 2.

- Step 2: Did you have a “qualifying person” (child or dependent relative) living with you for more than half the year?

- If No, you are Single.

- If Yes, go to Step 3.

- Step 3: Did you pay for more than half of the household costs (rent, food, utilities) with your own money?

- If Yes, you are Head of Household.

- If No, you are Single.

Summary of the Impact

Choosing your tax filing status is the foundation of your financial relationship with the government. It determines the size of your “tax-free” shield (the Standard Deduction) and which tax brackets your income will fall into.

For example, a Single person might start paying a higher tax rate once they earn over 50,000 dollars. But a Head of Household person might not hit that same high tax rate until they earn over 65,000 dollars. This “wider” bracket allows you to keep more of every dollar you earn at your job, whether you are working at Amazon, Walmart, or your own small business.

Always take the time to double-check these rules, as they can change slightly every year based on new laws or inflation adjustments. If your living situation is complicated—perhaps you are caring for an elderly parent or are in the middle of a legal separation—it is always a good idea to check the current IRS guidelines or speak with a professional.

Disclaimer: This content is for educational purposes only and does not constitute financial or tax advice. Tax laws are subject to change; please consult with a qualified tax professional or refer to current IRS publications for your specific situation.