Imagine waking up on a Tuesday morning, checking your bank account, and seeing an extra 50 dollars sitting there. You didn’t trade any hours of your life for it. You didn’t sell any items on the internet. Instead, a company like Coca-Cola or Starbucks simply sent you a “thank you” for being a part-owner of their business. This is the heart of dividend investing, a strategy that has helped millions of Americans build wealth without needing to watch stock charts every single minute of the day.

For most people, the stock market feels like a giant, confusing roller coaster. You buy a stock, hope the price goes up, and sell it later for a profit. But dividend investing changes the game. It allows you to earn money while you hold the stock, regardless of whether the market price is up or down that day. It is one of the most reliable ways to create a stream of passive income that can support your lifestyle or grow your retirement nest egg over time.

In this guide, we are going to break down everything you need to know about starting your journey with dividend investing. We will skip the complex jargon and the math-heavy formulas. Instead, we will look at how real companies in the US market share their success with people just like you. Whether you have 100 dollars or 10,000 dollars to start, understanding these basics is the first step toward financial freedom.

What Exactly Are Dividends?

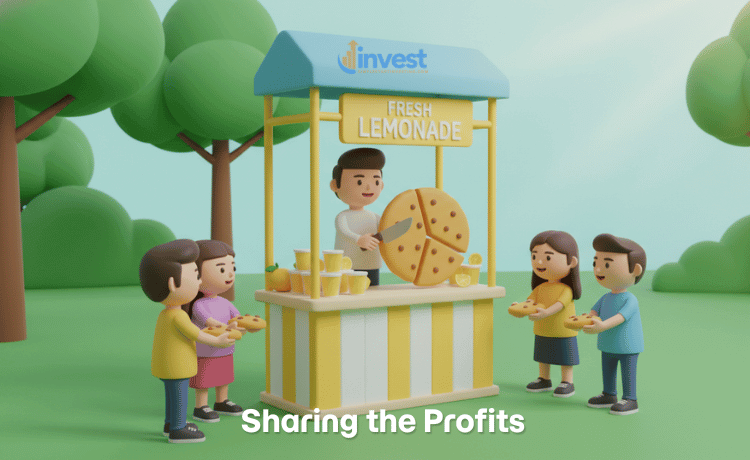

At its simplest level, a dividend is a distribution of a portion of a company’s earnings to its shareholders. When a company makes a profit, they have a few choices. They can use that money to build new factories, hire more workers, or buy other companies. However, many established and successful companies decide to give a slice of that profit back to the people who own their stock.

Think of it like owning a small piece of a local lemonade stand. If the stand makes 100 dollars in profit after paying for lemons and sugar, the owners might decide to keep 80 dollars to buy a bigger pitcher for tomorrow. The remaining 20 dollars is then split among the people who helped start the stand. That 20 dollars is the dividend.

A Real-World Example in the US Market

Let’s look at a company almost everyone knows: PepsiCo (PEP). Pepsi doesn’t just sell soda; they own Frito-Lay snacks and Quaker Oats. Because they sell products that millions of people buy every single day, they generate a lot of cash. This year, Pepsi might decide to pay a certain amount of money for every single share of stock you own. If you own ten shares, and they pay one dollar per share every three months, you get ten dollars deposited into your account four times a year. You still own the shares, but you also get the cash.

The Common Newbie Misconception

Many beginners think that dividends are “extra” money that magically appears on top of the stock price. They assume that if a stock is worth 100 dollars and pays a 5 dollar dividend, they now have 105 dollars in total value instantly.

The Mindset Shift

In reality, when a company pays a dividend, its total value decreases by the amount of the payment. If a company is worth 1 billion dollars and gives away 10 million dollars to shareholders, the company is now worth 990 million dollars. However, for you as an investor, this doesn’t matter much in the long run. Why? Because you are looking for companies that are so profitable they can “refill” that cash bucket every single year. You aren’t just looking for a payout; you are looking for a cash-generating machine.

Why Should You Care About Dividend Investing?

You might be wondering why you should focus on dividend investing instead of just trying to find the next big tech stock like Nvidia or Tesla that might double in price. The answer lies in two words: stability and compounding.

When you invest in a company that doesn’t pay dividends, the only way you make money is if someone else is willing to buy your stock for more than you paid for it. This is called “capital appreciation.” But with dividend investing, you get a tangible return on your investment while you wait. Even if the stock market has a bad year and prices stay flat, those dividend checks keep arriving in your account.

A Daily Life Comparison

Think about owning a house. You can make money in two ways. First, you can hope the value of the neighborhood goes up so you can sell the house for a profit in ten years. Second, you can rent the house out and collect a check every month. Dividend investing is like being a landlord for the biggest companies in the world. You collect “rent” (dividends) while the “property” (the stock) hopefully grows in value over decades.

The Newbie Trap: Ignoring the “DRIP”

A common mistake for beginners is taking their dividend checks and spending them on a fancy dinner or a new pair of shoes. While that feels good in the moment, it kills the greatest tool in your financial belt: the Dividend Reinvestment Plan, or “DRIP.”

The Right Way to Think

If you want to build real wealth, you should use your dividends to buy even more shares of the stock. Imagine you start with 100 shares of Coca-Cola (KO). Those shares pay you a dividend, and you use that money to buy 2 more shares. Now you have 102 shares. Next time, those 102 shares pay you an even bigger dividend, which you use to buy more. Over twenty years, this “snowball effect” can turn a small investment into a massive fortune. You aren’t just saving money; you are building an army of dollars that works for you.

How to Tell if a Dividend is “Safe”

Not all dividends are created equal. Sometimes, a company offers a very high dividend to lure in investors, even though the company is actually struggling. This is known as a “yield trap.” To avoid this, you need to look at how much of their profit they are actually giving away. We call this the payout ratio, but let’s explain it without using a single formula.

Simple Explanation of Safety

Imagine a friend asks to borrow money and promises to pay you back with interest. To see if they can afford it, you look at their monthly paycheck. If they earn 5,000 dollars a month and their rent and food cost 4,000 dollars, they have 1,000 dollars left over. If they promise to pay you 200 dollars a month, they can easily afford it. They are only using a small portion of their “leftover” money. But if they promise to pay you 1,200 dollars a month, they are in trouble. They are trying to pay you more than they actually have.

A Real-World Example: Retail Giants

Look at a company like Walmart (WMT). They make billions of dollars in profit. If they only spend about half of that profit on paying dividends to people like you, the dividend is very safe. They still have plenty of money left to fix their stores or handle an emergency. However, if a struggling clothing store is paying out 95 percent of its profit as a dividend, one bad holiday season could force them to cancel that payment entirely.

The Misunderstanding: “Higher is Always Better”

Beginners often look for the stock with the highest percentage payout. If Stock A pays 2 percent and Stock B pays 12 percent, the beginner almost always picks Stock B. They think they are being smart by getting more “free money.”

The Correct Logic

A dividend that is too high is often a warning sign. In the US market, a yield between 2 percent and 5 percent is often considered the “sweet spot” for many stable companies. When you see a company paying 10 percent or 15 percent, it usually means the stock price has crashed because investors are worried the company is failing. It is better to have a 3 percent dividend that grows every year than a 10 percent dividend that disappears next month.

Meet the Royalty: Dividend Aristocrats and Kings

In the world of dividend investing, there is a special club for the most reliable companies in America. These companies have proven they can survive recessions, wars, and changing technology while still paying their shareholders.

- Dividend Aristocrats: These are companies in the S&P 500 index that have increased their dividend every single year for at least 25 years in a row.

- Dividend Kings: This is an even more exclusive group. These companies have increased their dividends for at least 50 years straight.

Why This Matters for You

When you buy a “Dividend King” like Johnson & Johnson (JNJ) or Procter & Gamble (PG), you are buying a company that has raised its payout since the mid-1970s. Think about all the things that have happened in the world since then. High inflation, the invention of the internet, the 2008 financial crisis, and a global pandemic. Through all of that, these companies didn’t just keep paying dividends—they gave their owners a raise every single year.

The Common Newbie Fear

“But what if the company goes bankrupt?” New investors often worry that a single bad year will wipe out their investment. They see the news about a startup failing and assume all stocks are that risky.

The Stable Reality

Dividend Aristocrats are usually “boring” companies. They sell things people need regardless of the economy: toothpaste, diapers, bottled water, and electricity. People might stop buying a new iPhone every year during a recession, but they will still brush their teeth and wash their clothes. This “boring” nature is exactly what makes them the bedrock of a safe dividend investing strategy.

The Two Types of Dividends: Cash vs. Stocks

While most people think of dividends as cash landing in their brokerage account, there are actually a couple of ways a company can reward you.

Cash Dividends (The Standard)

This is what we have been talking about. You own the stock, and the company sends you cash. You can use this cash to buy a coffee, pay a bill, or—as we recommended—reinvest it into more shares. This is the most common form of dividend investing in the US.

Stock Dividends

Sometimes, instead of sending cash, a company will give you more shares of the stock itself. For example, if you own 100 shares, they might give you 5 extra shares for free. This increases your ownership in the company without you having to spend a dime.

The Confusion for Beginners

Newcomers sometimes get frustrated with stock dividends because they don’t see the “cash” hit their bank account. They feel like they didn’t actually get paid.

The Value Adjustment

Think of a stock dividend like a pizza. If you have a pizza cut into 4 large slices, and you decide to cut those into 8 smaller slices, you still have the same amount of pizza. However, in the stock market, having more “slices” (shares) is great because as the company grows, you have more pieces that are gaining value. Most long-term investors in the US prefer cash dividends because it gives them the choice of what to do with the money.

Understanding Taxes (The US Reality)

When you make money through dividend investing, the government (the IRS) will eventually want a slice. However, the US tax system actually rewards people for being long-term investors. There are two main categories of dividends, and they are taxed very differently.

Qualified Dividends

Most dividends from major US companies like Home Depot (HD) or McDonald’s (MCD) are considered “qualified.” To qualify, you usually just have to hold the stock for more than 60 days. The best part? These are taxed at a lower rate than your normal job income. For many Americans, the tax rate on these dividends is 15 percent, and for some, it is even 0 percent!

Ordinary Dividends

These are dividends that don’t meet the special requirements. They are taxed at the same rate as the money you earn from your 9-to-5 job. This is often a higher tax rate. Some specific types of investments, like certain real estate stocks, always pay ordinary dividends.

A Common Mistake

Many beginners forget to set aside a little bit of money for taxes at the end of the year. They spend 100 percent of their dividends and are shocked when they owe the IRS in April.

The Proper Approach

It is always smart to keep a small “tax buffer” or, better yet, hold your dividend stocks in a tax-advantaged account like a Roth IRA. In a Roth IRA, you can collect dividends and grow your wealth completely tax-free as long as you follow the rules for retirement.

Note: Tax regulations can change; please check current guidance or consult a professional.

How to Get Started with Your First 100 Dollars

You don’t need to be a millionaire to start dividend investing. In fact, starting small is the best way to learn. Most modern US brokerages allow you to buy “fractional shares.” This means if a share of a big company costs 200 dollars, you can just buy 10 dollars worth of it.

The Step-by-Step Path

- Choose a Brokerage: Look for well-known US platforms that offer commission-free trading.

- Research Stable Companies: Look for names you recognize in your daily life. Companies like Target (TGT) or Costco (COST) are great places to start your research.

- Check the History: Use a financial website to see if the company has a habit of raising its dividend every year.

- Turn on the DRIP: Make sure your account is set to automatically reinvest your dividends. This ensures your “money snowball” starts rolling immediately.

The Newbie Hurdle: “It’s Too Small to Matter”

Many people see their first dividend check of 25 cents and think, “Why bother? This won’t make me rich.” They get discouraged and stop investing.

The Power of Time

Every giant oak tree started as a tiny acorn. That 25-cent dividend is proof that the system works. If you keep adding a little bit every month, that 25 cents becomes 5 dollars. Then 50 dollars. Eventually, it becomes 5,000 dollars. The key to dividend investing is not how much you start with, but how long you stay in the game.

Common Risks to Keep in Mind

While dividend investing is generally safer than betting on risky startups, it isn’t perfect. Companies are not legally required to pay dividends. If a company hits a major crisis, the board of directors can vote to cut or cancel the dividend to save cash.

A Real-World Example: The 2020 Pandemic

During the global shutdowns, many travel-related companies like airlines and cruise lines had to stop paying dividends because they had no customers. Investors who relied solely on those checks were left with nothing. This is why you should never put all your eggs in one basket.

The Strategy for Success

Instead of buying just one company, try to own a “basket” of companies from different industries. Own some tech, some healthcare, some retail, and some utility companies. This way, if one industry has a bad year, the others can keep your income steady.

Final Thoughts for the Beginner

Dividend investing is a marathon, not a sprint. It is a strategy built on patience, discipline, and the incredible power of American businesses. By focusing on high-quality companies that share their profits, you are taking control of your financial future. You are moving from being just a consumer of products to being an owner of the companies that make them.

Start small, stay consistent, and let your dividends do the heavy lifting for you. Over time, you’ll find that getting paid just for owning a piece of a great company is one of the most satisfying feelings in the world of finance.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Always do your own research or consult with a qualified financial advisor before making investment decisions.