Imagine you have been saving for years to buy your first home. You finally have your 20 percent down payment ready in your bank account. You find a beautiful house, your offer is accepted, and you are ready to sign the papers. Then, your loan officer hands you a document showing you need to bring an extra 10,000 dollars or 15,000 dollars to the table just to finish the deal.

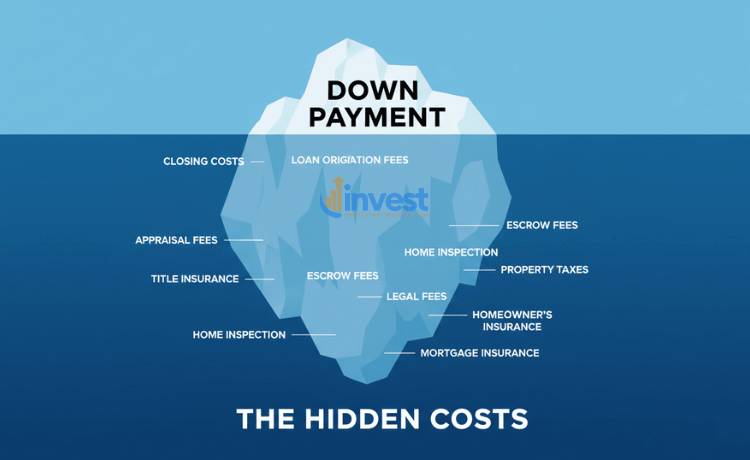

This surprise is exactly what happens when you do not plan for home closing costs. Many beginners focus entirely on the purchase price and the down payment, but they forget that the “processing” of a home sale is a massive legal and financial event. There are bankers, inspectors, government officials, and insurance companies all involved in the background, and they all require payment for their services.

In this guide, we will break down exactly what these costs are, why they exist, and how you can prepare so you are never caught off guard on your big day.

What Exactly Are Home Closing Costs?

At its simplest, home closing costs are the collection of fees and expenses you pay at the very end of a real estate transaction. Think of it like the “shipping and handling” fees when you buy something online, but on a much larger scale. While the down payment goes toward the equity of your home, closing costs go toward the professionals who made the sale possible.

In the United States, these costs typically range between 2 percent and 5 percent of the total home price. If you are buying a home for 400,000 dollars, you should expect to pay anywhere from 8,000 dollars to 20,000 dollars in closing fees. This money is usually paid on the day you sign the final paperwork, which is why it is called “closing.”

The Lender Fees: Paying for the Loan

The first major category of closing costs comes from your mortgage lender. They are the ones doing the heavy lifting to verify your income, check your credit, and provide the hundreds of thousands of dollars you need to buy the house. Naturally, they charge for this work.

What is a Loan Origination Fee? The most common lender fee is called the origination fee. This is essentially an administrative charge for the lender to “originate” or create your loan. It covers the cost of the people who review your pay stubs, verify your employment, and prepare the legal loan documents.

- Simple Explanation: Think of this as the “cover charge” for getting a mortgage. It pays for the bank’s staff and overhead.

- Real-World Example: If you are borrowing 300,000 dollars and the lender charges a 1 percent origination fee, you will pay 3,000 dollars at closing just for the service of setting up the loan.

- Common Mistake: Many beginners believe that the interest rate is the only way a bank makes money. They think the “fees” are optional or shouldn’t exist because they are already paying interest.

- Correct Logic: The interest rate is the cost of borrowing money over 30 years. The origination fee is the cost of the work done today to get that money into your hands. Both are part of the total cost of the loan.

The Appraisal Fee: Verifying the Value

Before a bank gives you a large sum of money, they want to make sure the house is actually worth what you are paying for it. They do not want to lend 500,000 dollars for a house that is only worth 400,000 dollars.

What is an Appraisal? An appraisal is an unbiased professional opinion of a home’s value. A licensed appraiser visits the property, looks at its condition, and compares it to similar homes that recently sold in the same neighborhood.

- Simple Explanation: This is a safety check for the bank to ensure they are making a smart investment.

- Real-World Example: Imagine you are buying a home in a popular area like Austin, Texas. You and the seller agree on a price of 450,000 dollars. The bank sends an appraiser who charges 600 dollars. If the appraiser says the home is only worth 440,000 dollars, the bank may refuse to lend the full amount, and you might have to pay the 10,000 dollar difference yourself.

- Common Mistake: Beginners often confuse an appraisal with a home inspection. They think that because the appraiser visited, they don’t need to hire an inspector to check for roof leaks or mold.

- Correct Logic: An appraiser looks at value (how much is it worth?), while an inspector looks at condition (is anything broken?). You need both to protect your finances.

Title Insurance: Protecting the Past

This is perhaps the most confusing part of home closing costs for new buyers. When you buy a house, you aren’t just buying the wood and the bricks; you are buying the “title” or the legal right to own that land.

What is Title Insurance? Sometimes, a house has a “clouded” history. Maybe a previous owner didn’t pay their property taxes, or perhaps there is a long-lost heir who claims they actually own the backyard. Title companies search through public records to make sure the seller has the legal right to sell the house to you. Title insurance protects you if a problem from the past pops up after you move in.

- Simple Explanation: It is like a background check for the house’s history. The insurance policy pays out if someone comes knocking later claiming they own your home.

- Real-World Example: Let’s say you buy a home in Florida. Three years later, a contractor shows up with a legal document showing that the previous owner never paid them 5,000 dollars for a new roof. Without title insurance, you might be responsible for that debt. With it, the insurance company handles the legal mess.

- Common Mistake: Beginners often ask, “Why do I have to pay for this every time a house sells? Didn’t the last guy already check the title?”

- Correct Logic: New problems can arise every time ownership changes. A lien (a legal claim for debt) could have been placed on the home just months before the sale. You are buying protection for your specific period of ownership.

Government and Recording Fees

Even the local government wants a seat at the table. When a property changes hands, the county or city needs to update their records to show that you are the new owner.

What are Recording Fees? These are fees paid to the local land records office to officially “record” the deed and the mortgage. This makes your ownership a matter of public record.

- Simple Explanation: This is the “clerical fee” the government charges to update their database with your name.

- Real-World Example: In many counties, this might be a flat fee of 150 dollars or 200 dollars. It seems small compared to the price of the house, but it is a mandatory part of the closing process.

- Common Mistake: Some buyers think they can skip this to save money or keep their purchase private.

- Correct Logic: If the deed is not recorded, you don’t legally “own” the home in the eyes of the public. This would make it impossible to sell the home later or prove you have the right to live there.

The “Prepaids” and Escrow: Looking Ahead

One of the largest chunks of your home closing costs doesn’t actually go to fees at all. It goes toward your future expenses. Lenders want to make sure that the property taxes and homeowners insurance are paid on time, so they often require you to pay several months’ worth of these items in advance.

What are Prepaids? Prepaids are items that you pay at closing that would normally be due later. This includes homeowners insurance premiums and property taxes. The lender holds this money in a special account called an “escrow account.”

- Simple Explanation: This is like a “savings bucket” the bank manages for you. You put money in now so that when the big tax bill comes in six months, the money is already there.

- Real-World Example: If your annual property taxes are 4,800 dollars, that means your taxes are 400 dollars per month. At closing, the lender might ask for six months of taxes upfront. That means you need to have 2,400 dollars ready just for this one “bucket.”

- Common Mistake: Beginners see this large number and think they are being “overcharged” by the bank. They feel like the bank is stealing their money.

- Correct Logic: This is still your money. It is simply being moved into a holding account to ensure your home isn’t taken away by the government for unpaid taxes. If you ever sell the home or pay off the loan, any leftover money in this bucket is returned to you.

Why Beginners Often Underestimate the Cost

The biggest reason new buyers struggle with home closing costs is a lack of transparency early in the process. Most online “mortgage calculators” only show the monthly payment. They don’t show the 15,000 dollars you need to bring to the lawyer’s office.

The Down Payment Trap Many people think that if they have 20,000 dollars saved and the down payment is 20,000 dollars, they are ready to buy. This is a dangerous mindset.

- The Error: Forgetting that the 2 to 5 percent in closing costs is on top of the down payment.

- The Correction: If you need a 20,000 dollar down payment, you actually need closer to 30,000 dollars in total cash to account for the closing fees and moving expenses.

- Strategic Thinking: Always ask your lender for a “Loan Estimate” document as soon as you start the process. This document is required by law and will give you a very close guess of what your final costs will look like.

Can You Lower Your Closing Costs?

While many of these fees are set in stone (like government taxes), some of them are negotiable. A smart buyer can significantly reduce their out-of-pocket expenses.

1. Seller Concessions In some markets, you can ask the seller to pay for a portion of your closing costs. This is called a “seller concession.” If the seller is motivated to move quickly, they might agree to pay 3 percent of the purchase price toward your fees.

2. Shopping for Services You don’t have to use the title company or the inspector your lender recommends. You are allowed to “shop around” for these services. Just like shopping for car insurance, getting three quotes for title insurance could save you 500 dollars or more.

3. Lender Credits Some lenders offer “no-closing-cost” mortgages. This is a bit of a misnomer. The closing costs still exist, but the lender pays them for you. In exchange, they will charge you a slightly higher interest rate for the life of the loan.

- Example: You could pay 10,000 dollars today for a 6 percent interest rate, or pay 0 dollars today for a 6.5 percent interest rate.

- The Math: If you plan on living in the house for 30 years, the lower interest rate is usually better. If you plan on moving in three years, the “no-closing-cost” option might actually save you more money.

The Importance of the Closing Disclosure

Three days before you sign the final papers, your lender is legally required to send you a document called the Closing Disclosure. This is the single most important piece of paper in the entire process.

It lists every single penny you are paying. It compares the final costs to the original “Loan Estimate” they gave you at the beginning. If the fees have changed significantly without a good reason, you have the right to ask why.

- Pro Tip: Do not wait until you are at the signing table to read this. Review it as soon as you get it. Check for “junk fees” like excessive document preparation charges or administrative fees that seem too high.

- Why it matters: Once you sign the papers at the closing table, it is very difficult to get your money back. The three-day window is your chance to catch mistakes.

Final Thoughts for the First-Time Buyer

Buying a home is the largest purchase you will likely ever make. It is exciting, but it is also a complex financial transaction involving many different parties. Home closing costs are simply the price of ensuring that the transaction is legal, the home is worth the price, and your ownership is protected for the future.

By budgeting an extra 2 percent to 5 percent of the home’s value, you can walk into your closing meeting with confidence instead of stress. Remember, the goal of a “Simple Start” is to be prepared. When you know the numbers, you are the one in control.