Imagine you are standing in line at a local Costco in a busy American suburb. You see two people buying the exact same high-end television. One person pays the price on the tag. The other person, for some reason, has to pay twenty percent more for the same item. In the world of home buying, this is exactly what happens when you have a lower credit score. You aren’t just buying a house; you are “buying” the money to pay for that house. Your credit score is the price tag of that money.

If you are a beginner looking to step into the US real estate market this year, understanding the relationship between your credit score and your mortgage rate is the single most important financial lesson you can learn. It determines whether you can afford a modest condo or a spacious family home in a good school district. It determines how much money stays in your pocket and how much goes to the bank over the next thirty years.

In this guide, we will break down exactly how this “magic number” works, why it holds so much power over your future home, and how you can position yourself to win.

What Exactly is a Credit Score in Simple Terms?

Think of your credit score as a Financial Trust Score. In the United States, when you want to borrow a large sum of money—like a mortgage to buy a home—the lender (the bank) doesn’t know you personally. They don’t know that you are a hard worker at Amazon or that you have been saving every penny. They need a quick, standardized way to guess if you will pay them back.

That guess is your credit score. It is a three-digit number, usually ranging from 300 to 850, that summarizes your entire history with debt. If you always pay your bills on time and don’t owe too much money, your score goes up. If you miss payments or max out your credit cards, your score goes down.

An Everyday Example

Think about two friends, Sarah and John.

- Sarah always pays her friends back the next day. When she borrows a lawnmower, she returns it clean and full of gas. Everyone trusts Sarah.

- John often forgets to pay people back. He once borrowed a car and returned it with an empty tank and a new scratch.

If both Sarah and John asked you for a five thousand dollar loan, who would you trust more? You would likely give Sarah a lower “interest rate” (or no interest at all) because you are certain she will pay you back. For John, you might say no, or you might charge him a very high fee because you are worried you might never see that money again. Banks treat you exactly the same way.

The Common Beginner Misconception

Many beginners believe that having a high income or a large balance in their JPMorgan Chase savings account automatically means they have a high credit score.

The Correction: This is not true. You can earn a million dollars a year and still have a terrible credit score if you forget to pay your bills. Your credit score tracks your behavior, not your wealth. A person making a modest salary at Walmart who pays every bill on time will often have a much better credit score than a high-earner who is reckless with their credit cards.

How Your Score Becomes a “Discount Code” for Your Mortgage

When you apply for a home loan, the lender looks at your score and places you into a “bucket.” These buckets determine the interest rate you are offered. In the current market, even a small difference in your score can change your interest rate by one percent or more.

The Logic of the Interest Rate

Lenders see a high credit score (usually 740 or higher) as a sign of low risk. To attract these “safe” borrowers, they offer their lowest possible interest rates. If your score is lower (for example, in the 620 to 660 range), the bank sees you as a higher risk. To protect themselves, they charge you a higher interest rate.

Think of it like a “risk tax.” The lower your score, the higher the tax you pay on every dollar you borrow.

A Real-World Calculation (The Narrative Version)

Let’s look at how this plays out for a house priced at 400,000 dollars.

Imagine two coworkers at Tesla. Both want to buy the same type of house.

- Borrower A has an excellent credit score of 760. The bank offers them an interest rate of 6 percent. Their monthly payment for the loan (principal and interest) might be around 2,400 dollars.

- Borrower B has a fair credit score of 640. Because of the higher risk, the bank offers them a rate of 7 percent. For the exact same 400,000 dollar house, their monthly payment would be around 2,660 dollars.

That is a difference of 260 dollars every single month. Over the course of a thirty-year mortgage, Borrower B will end up paying nearly 94,000 dollars more than Borrower A for the exact same house. That is almost one hundred thousand dollars essentially “thrown away” just because of a credit score.

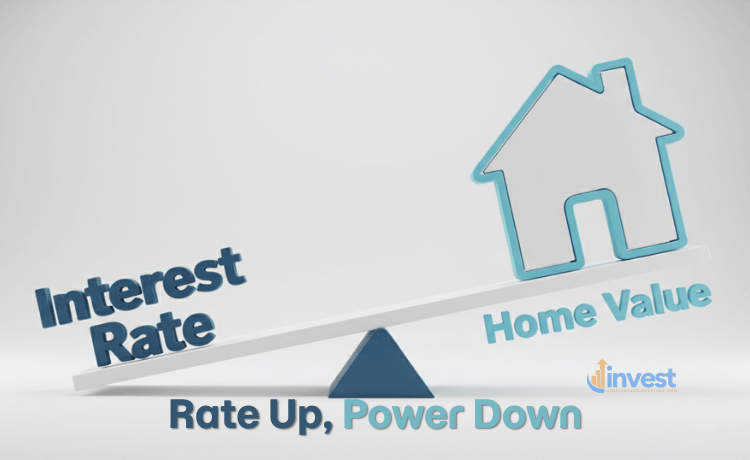

Understanding “Buying Power” – Your Invisible Ceiling

Most people focus on the monthly payment, but the real impact of your credit score is on your Buying Power. Buying power is the maximum amount of money a bank is willing to let you borrow.

Banks use a specific logic: they decide that your total monthly housing costs cannot exceed a certain percentage of your income. Let’s say, based on your salary, the bank decides you can afford a maximum monthly payment of 2,500 dollars.

How Rates Shrink Your Options

If you have a great credit score and get a lower interest rate, that 2,500 dollars might allow you to borrow 420,000 dollars. You can look at nicer neighborhoods or homes with an extra bedroom.

However, if your credit score is lower and your interest rate is higher, that same 2,500 dollars a month might only allow you to borrow 370,000 dollars.

The result? Your credit score literally “shrinks” the map of where you can afford to live. You are forced to look at smaller homes or neighborhoods further away from work, even though your salary hasn’t changed.

The Common Beginner Misconception

Many people think, “I’ll just buy a cheaper house if my credit is bad.”

The Correction: While buying a cheaper house helps, a low credit score often comes with other hidden costs. You might be required to put down a much larger down payment—sometimes twenty percent instead of the usual three or five percent. This means you need more cash upfront, which is often the biggest hurdle for new buyers.

The “Tiers” of Credit: Where Do You Stand?

In the US mortgage world, credit scores aren’t just “good” or “bad.” They are divided into tiers. Knowing which tier you fall into can help you decide if you should buy now or wait six months to improve your score.

The Exceptional Tier (800 – 850)

If you are in this group, you are a “unicorn” to lenders. You will get the absolute best rates available in the country. You have maximum leverage to shop around and make banks compete for your business.

The Very Good Tier (740 – 799)

This is the “sweet spot.” Most lenders give their best rates to anyone with a score above 740 or 760. If you are here, you are doing great. There is very little practical benefit to moving from a 760 to an 820 when it comes to a mortgage.

The Good Tier (670 – 739)

You are a solid candidate, but you might not get the “advertised” rates you see on TV. You might pay a slightly higher interest rate than the top tiers. If you are at the lower end of this range (around 680), a few months of focused effort could push you into the next tier and save you tens of thousands of dollars.

The Fair Tier (580 – 669)

You can still get a house, but it will be expensive. You may need to look at government-backed loans like FHA loans, which are designed for people with lower scores. However, these often come with extra fees like mortgage insurance that stay with you for a long time.

The Poor Tier (Under 580)

It will be very difficult to get a standard mortgage. Most experts recommend pausing your home search to rebuild your credit.

Moving the Needle: How to Improve Your Score Before You Buy

If you aren’t in the tier you want to be in, don’t panic. Your credit score is not a life sentence; it is a moving average. Here is how you can improve it using logic that lenders love.

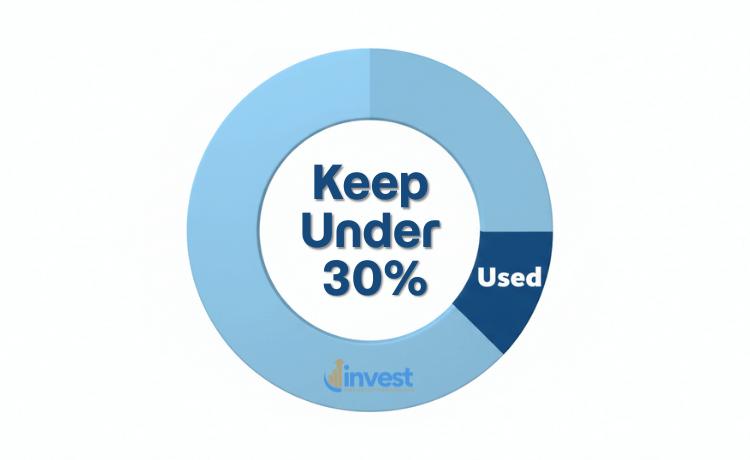

1. The “Utilization” Trick

Imagine you have a credit card with a 10,000 dollar limit. If you spend 9,000 dollars on it every month, the bank thinks you are stressed for cash, even if you pay it off in full. This hurts your score. If you keep your balance below 3,000 dollars (which is thirty percent of your limit), your score will likely jump up. Lenders love to see that you have credit available but choose not to use it.

2. Guard Your “Age”

If you have an old credit card that you haven’t used in years, do not close it! The “age” of your credit history matters. A person who has successfully managed a card for ten years is seen as more stable than someone who just opened their first account last month.

3. Avoid New Debt

When you are getting ready to buy a house, do not go to a dealership and buy a new car or use a “Buy Now Pay Later” service for a new Apple MacBook. Every time you apply for new credit, your score takes a small hit. More importantly, that new monthly car payment reduces the amount the bank will let you borrow for your home.

The Hidden Penalty: Private Mortgage Insurance (PMI)

Your credit score doesn’t just affect your interest rate; it also affects your Private Mortgage Insurance (PMI). If you put down less than twenty percent of the home’s value, the lender requires you to pay for PMI. This is a monthly fee that protects the bank if you stop making payments.

The cost of PMI is directly tied to your credit score.

- A person with a 760 score might pay 100 dollars a month for PMI.

- A person with a 640 score might pay 300 dollars a month for the exact same insurance on the exact same house.

This is another example of how a lower score slowly drains your bank account every single month.

Why “Wait and See” Might Be Your Best Strategy

If your credit score is currently in the “Fair” range, you might feel rushed to buy a house because you are worried prices will go up. However, let’s look at the logic of waiting.

If waiting six months allows you to move your score from 640 to 740, you could lower your interest rate by one full percent. As we saw earlier, that could save you 260 dollars a month on a 400,000 dollar house. Even if the house price goes up by 10,000 dollars while you wait, the savings from the lower interest rate will far outweigh the higher purchase price over time.

The Common Beginner Misconception

Many beginners think they should pay off all their collections or old debts right before applying for a mortgage.

The Correction: Be careful! Sometimes, paying off a very old debt can actually “wake up” the account and temporarily lower your score. Always talk to a mortgage professional or a credit counselor before making large payments on old debts when you are close to buying a home.

A Final Word for Future Homeowners

Your credit score is the foundation of your home-buying journey. It isn’t just about “passing a test”; it’s about giving yourself the most options and the lowest costs. In the US market, where home prices can be high in places like California or New York, every advantage counts.

Take the time to check your report. Look for errors. Pay down your balances. By treating your credit score with respect, you are ensuring that when you finally get the keys to your new home, you aren’t overpaying for the privilege of living there.

Note: Regulations regarding credit scoring and mortgage lending can change; please check current guidelines or consult with a qualified financial professional.

Disclaimer: This content is for educational purposes only and does not constitute financial advice.