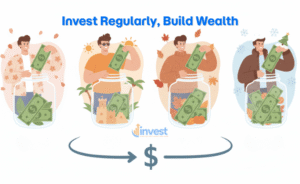

Most people think that building wealth requires a high IQ, a complex spreadsheet, and hours spent staring at stock market charts. They believe they need to wait for the “perfect moment” to buy shares of a big company like Amazon or Apple. But the truth is much simpler. The most successful investors aren’t necessarily the smartest or the luckiest; they are the most consistent.

The secret to consistency is removing human emotion and willpower from the equation. This is where automated investing comes in. By setting up systems that move your money into the market without you having to lift a finger, you stop being your own worst enemy. You transition from a person who “tries to save” to a person who builds wealth on autopilot.

In this guide, we will break down exactly how automated investing works, why it is the ultimate “cheat code” for beginners, and how you can set up your own system today to start growing your future.

What is Automated Investing?

At its core, automated investing is a system where you schedule regular contributions from your bank account or paycheck into an investment account. Instead of deciding every month if you have “enough money left over” to invest, the system makes that decision for you. It treats your future wealth like a recurring bill that must be paid first.

Think of it like a subscription service, but instead of paying for movies or gym memberships you don’t use, you are paying your future self. Once you set it up, the technology handles the transfers and, in many cases, the actual buying of stocks or funds.

Example: The Coffee Shop Habit

Imagine you decide to invest 100 dollars every single month into a diversified fund. If you do this manually, you might forget one month, or you might see a new pair of shoes you want and skip your investment. With automated investing, that 100 dollars leaves your bank account the day after you get paid. You never even “see” the money, so you don’t feel the urge to spend it. Over ten years, that consistency builds a massive pile of wealth that a manual investor would likely struggle to match.

Common Beginner Misconception

Many beginners believe they should only invest when the market is “doing well” or when they have a large lump sum of money. They think, “I’ll wait until I have 5,000 dollars, and then I’ll buy some Tesla stock.”

The Reality Shift

Waiting for the perfect moment usually leads to never starting at all. By the time you save that 5,000 dollars, the price of the stock might have already doubled. Automated investing teaches you that “time in the market” is more important than “timing the market.” Starting with just 50 dollars a month right now is often better than waiting a year to start with a larger amount.

The Power of “Paying Yourself First”

The “Pay Yourself First” philosophy is the foundation of automated investing. Most people follow a “Pay Everyone Else First” strategy: they pay the landlord, the grocery store, and the electric company, then they hope there is money left at the end of the month to invest. Usually, there isn’t.

When you automate, you flip the script. You become the first person on your list of expenses. This ensures that your long-term goals are prioritized over short-term impulses.

How it Works in Practice

If you earn 4,000 dollars a month and have 200 dollars automatically sent to an investment account on payday, you learn to live on the remaining 3,800 dollars. Your brain treats that 3,800 dollars as your total income. You naturally adjust your spending on dining out or entertainment to fit your actual “available” cash.

Common Beginner Misconception

Beginners often worry that if they automate their investments, they might run out of money for an emergency. They fear the system will take money they “need” for a flat tire or a medical bill.

The Reality Shift

Financial experts suggest building a small emergency fund first. Once you have a safety net, automation actually reduces stress. If a real emergency happens, you can always pause or adjust your automation with a few clicks. The risk of “losing money” because you automated is far lower than the risk of “losing wealth” because you never stayed consistent.

Method 1: The Workplace 401(k)

For most Americans, the easiest way to start automated investing is through a workplace retirement plan like a 401(k). This is the gold standard of automation because the money is taken out of your paycheck before it even hits your bank account.

Many large companies, such as Walmart or Costco, offer these plans to their employees. If your employer offers a “match,” they are essentially giving you free money just for participating.

A Simple Illustration

If you tell your employer to put 5 percent of your salary into your 401(k), and they promise to match that 5 percent, you are effectively doubling your money instantly. If you earn 1,000 dollars in a pay period, 50 dollars goes into your account, and your boss adds another 50 dollars. You now have 100 dollars growing for your future, but it only “felt” like you gave up 50 dollars.

Common Beginner Misconception

A lot of people think they can’t afford to contribute to a 401(k) because they need every cent of their paycheck right now. They look at the “Gross Pay” vs “Net Pay” and get nervous about the difference.

The Reality Shift

Because 401(k) contributions are often “pre-tax,” putting 100 dollars into your retirement account doesn’t actually lower your take-home pay by 100 dollars. It might only lower it by 75 or 80 dollars because you aren’t paying income tax on that 100 dollars today. You are saving for the future while simultaneously lowering your tax bill today.

Method 2: The Automated IRA (Individual Retirement Account)

If you don’t have a 401(k), or if you want to save even more, you can open an Individual Retirement Account (IRA) at a brokerage like Fidelity, Vanguard, or Charles Schwab.

Unlike a workplace plan, you are in the driver’s seat here. You link your personal checking account to the IRA and tell the brokerage to “pull” a certain amount of money every week or month.

Real-World Example

Let’s say you want to max out your IRA for the year. The current limit for most people under age 50 is 7,500 dollars. Instead of trying to find 7,500 dollars in December, you can set up an automatic transfer of 625 dollars every month. This makes a huge goal feel manageable and ensures you don’t miss out on the tax advantages that IRAs offer.

Common Beginner Misconception

Many beginners set up the transfer but forget to actually invest the money. They see the 625 dollars leave their bank account and think they are done. They don’t realize that the money is just sitting in the brokerage account as “cash,” earning almost nothing.

The Reality Shift

Method 3: Taxable Brokerage Accounts and Apps

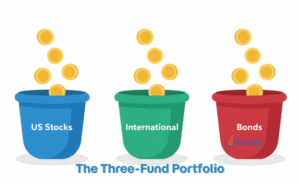

Sometimes you want to invest for goals that aren’t thirty years away, like buying a home or starting a business. In this case, you can use a regular “taxable” brokerage account. You don’t get the same tax breaks as an IRA, but you can take your money out whenever you want without penalties.

Apps like Robinhood or Acorns have made this incredibly popular for beginners by using features like “round-ups.”

How Round-Ups Work

Imagine you buy a sandwich at Subway for 8 dollars and 40 cents. An automated app can “round up” that purchase to 9 dollars and take the 60 cents of “spare change” to invest in the stock market. While 60 cents seems small, if you do this 50 times a month, you are investing 30 dollars without even thinking about it.

Common Beginner Misconception

People often think these “micro-investing” apps are enough to fund their entire retirement. They see their account grow to 500 dollars and feel like they have “solved” their financial future.

The Reality Shift

While spare change is a great way to build the habit, it is rarely enough to build significant wealth. Think of round-ups as the “gateway drug” to investing. Use them to get comfortable with the market, but eventually, you should set up a larger, fixed monthly transfer (like 100 dollars or 500 dollars) to really move the needle.

Understanding Dollar-Cost Averaging (DCA)

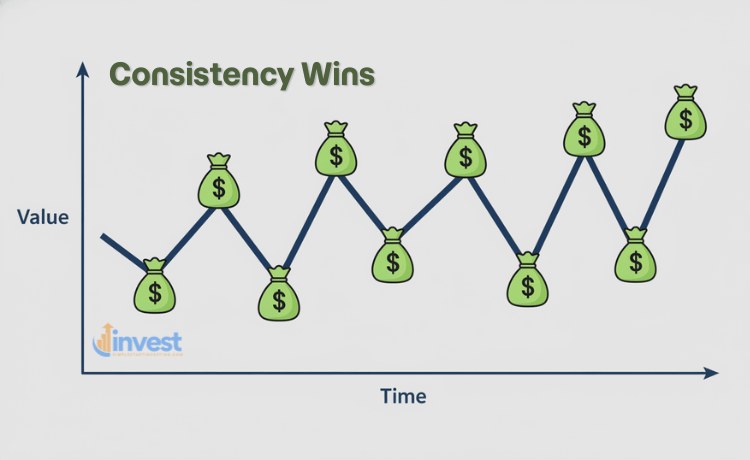

The biggest technical benefit of automated investing is a strategy called Dollar-Cost Averaging (DCA). This sounds like a complex math term, but it is actually a very simple way to protect yourself from market crashes.

When you invest the same amount of money every month, you naturally buy more shares when prices are low and fewer shares when prices are high.

A Simple Math-Free Example

Imagine you invest 100 dollars every month into a fund.

- In Month 1, the stock market is “expensive,” and the shares cost 50 dollars each. Your 100 dollars buys you 2 shares.

- In Month 2, the market “crashes,” and shares now cost only 25 dollars each. Your 100 dollars now buys you 4 shares.

- By Month 3, you have 6 shares in total.

Because you automated, you “forced” yourself to buy more when things were on sale. If you had been a manual investor, you might have been too scared to buy anything in Month 2 because the news was full of “scary” headlines. DCA removes the need for bravery; the system does the brave work for you.

Reinvesting Dividends (DRIP)

Another key part of “wealth on autopilot” is something called a Dividend Reinvestment Plan, or DRIP.

Many big companies like JPMorgan Chase or Johnson & Johnson pay their shareholders a small piece of their profits every few months. This is called a dividend. When you have a DRIP set up, you don’t take that cash and spend it. Instead, the brokerage automatically uses that cash to buy even more shares of that company.

The Snowball Effect

Imagine you own enough shares of a company to receive 10 dollars in dividends. If you spend that 10 dollars on a burrito, it’s gone. But if your account is automated to reinvest, that 10 dollars buys a “tiny slice” of a new share. Next time, you will have more shares, so you will get 11 dollars in dividends. Over decades, this creates a “snowball” that grows faster and faster without you ever adding more of your own money.

Common Beginner Misconception

New investors sometimes think they should wait until they have “a lot of shares” before they turn on dividend reinvestment. They think a 2 dollar dividend isn’t worth the trouble.

The Reality Shift

Every single penny counts in the world of compounding. By turning on DRIP from day one, you ensure that every cent your money earns is immediately put back to work. There is no minimum amount required for most DRIP programs. Whether it is 5 cents or 5,000 dollars, keep it in the market.

Common Mistakes to Avoid

Even with a great automated system, beginners can still trip up. Here are the most frequent errors people make when trying to build wealth on autopilot.

1. Stopping During a Downturn

When the stock market drops, the headlines often look like a disaster movie. Beginners often panic and “pause” their automatic transfers because they are afraid of “losing more.”

The Fix: Realize that a market drop is actually the best time for your automated system to work. As we saw with Dollar-Cost Averaging, a crash allows your 100 dollars to buy more shares. If you stop the transfers, you miss out on the “sale prices.” Keep the system running unless you have a true personal financial emergency.

2. Ignoring Fees

Some automated platforms or “Robo-Advisors” charge a management fee for their services. While convenience is worth paying for, you need to make sure the fee isn’t too high.

The Fix: Look for the “Expense Ratio” or “Management Fee.” If a platform charges you 1 percent of your total balance every year, that might sound small. But over thirty years, that fee could take away a massive chunk of your final wealth. Aim for low-cost index funds or platforms that charge very low flat fees.

3. “Set it and Forget it” for Too Long

Automation is great, but your life changes. Your salary might go up, or your expenses might go down. If you set an automation for 50 dollars a month when you are twenty years old and never touch it again, you will be vastly under-invested by the time you are forty.

The Fix: Set a “Financial Checkup” once a year. Check your accounts to make sure the transfers are still happening and, if you got a raise, try to increase your automation by just 1 percent or 2 percent. Small increases today lead to huge differences later.

The Mindset Shift: Habit Over Intelligence

The most important thing to understand about automated investing is that it changes your relationship with money. It turns investing from an “event” into a “habit.”

In the US, we are constantly bombarded with advertisements telling us to spend. We are told that we need the newest phone or a better car. Automation acts as a protective shield against this consumer culture. When your money is moved to an investment account automatically, it is “out of sight, out of mind.” You don’t feel the pain of saving because you never had the money in your hand to begin with.

Final Thoughts for the Beginner

You don’t need to be an expert on Wall Street to be a successful investor. You just need a system that is more disciplined than you are. By automating your 401(k), setting up an IRA transfer, and reinvesting your dividends, you are building a wealth-generating machine.

This machine doesn’t get tired, it doesn’t get scared when the market drops, and it doesn’t get tempted by a flashy new TV. It just keeps buying, day after day, year after year.

Start small. Even if it is just 25 dollars a pay period. The goal is to start the machine. Once it is running, the power of time and consistency will do the heavy lifting for you.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investment involves risk, and past performance is no guarantee of future results. Regulations regarding retirement accounts and taxes can change; please consult with a qualified professional or check current IRS guidelines.