If you have ever wondered how ordinary people build extraordinary wealth over decades, the answer usually is not a lucky lottery ticket or a once-in-a-lifetime stock tip. Instead, it is a quiet, steady, and incredibly powerful force known as compound interest.

In the world of investing, compound interest is often called the eighth wonder of the world. It is the reason why a small amount of money saved in your twenties can grow into a massive nest egg by the time you retire. For any beginner entering the U.S. market today, understanding how this engine works is the single most important step you can take toward financial freedom.

This guide will break down exactly what compound interest is, how it works in the real world with companies you know like Apple or Walmart, and why waiting even one year to start can cost you thousands of dollars in the long run.

What Exactly Is Compound Interest?

At its simplest level, compound interest is the interest you earn on your original money, plus the interest you have already earned in the past. It is essentially “interest on interest.”

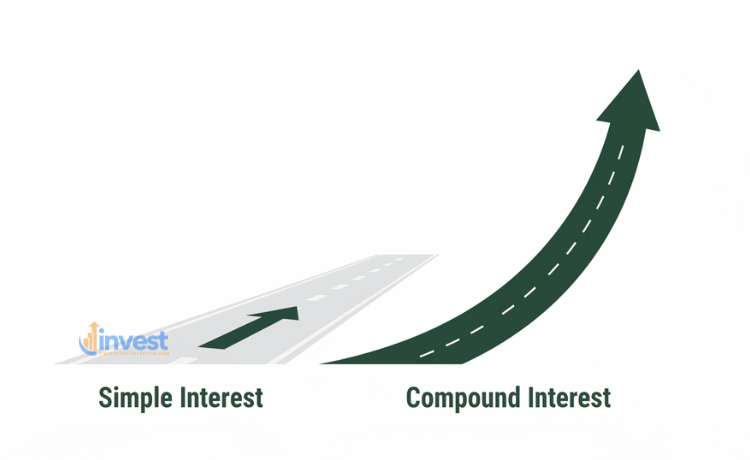

To understand this, let’s look at how most people think about money versus how it actually grows. Most beginners are used to “simple interest.” If you lend a friend 100 dollars and they pay you 5 percent interest every year, you get 5 dollars every single year. After ten years, you have your 100 dollars back plus 50 dollars in profit.

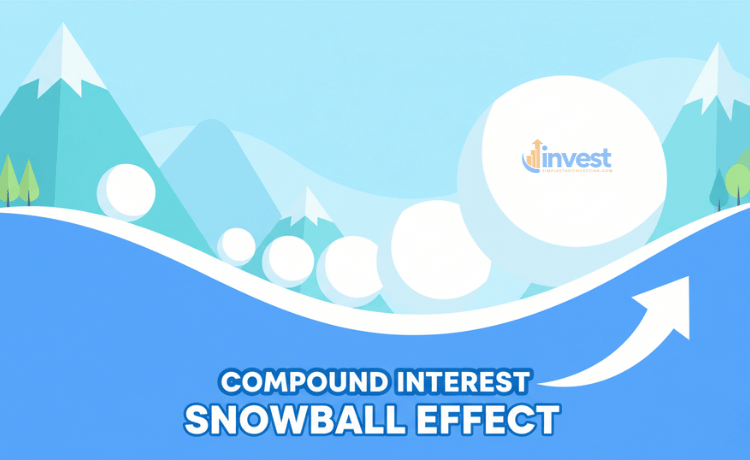

But compound interest changes the game. Instead of taking that 5 dollars and spending it, you leave it in the account. The next year, you aren’t just earning 5 percent on your 100 dollars; you are earning 5 percent on 105 dollars. That extra bit of interest starts to earn its own interest, and over time, this creates a snowball effect that grows faster and faster.

A Real-World Example: The Power of Five Dollars

Imagine you decide to put 100 dollars into a high-yield savings account or a diversified fund that tracks the S&P 500—an index of the 500 largest companies in the U.S. like Microsoft (MSFT) or Amazon (AMZN).

- Year 1: You start with 100 dollars. If you earn a 10 percent return, you earn 10 dollars. You now have 110 dollars.

- Year 2: You don’t just earn another 10 dollars. You earn 10 percent of your new total, which is 110 dollars. This means you earn 11 dollars this year. Your total is now 121 dollars.

- Year 10: If you keep this up, by the end of ten years, you would have nearly 260 dollars.

While an extra dollar here and there might not seem like much today, when you scale this up to thousands of dollars and dozens of years, the numbers become life-changing.

The Beginner’s Misconception: “It’s Only Pennies”

Many new investors look at their first month of returns and feel disappointed. They might see their account grow from 1,000 dollars to 1,007 dollars and think, “I only made 7 dollars? This isn’t worth the effort.”

The Mindset Shift: You must stop looking at the dollar amount in the short term and start looking at the percentage of the total. In the early stages, the “engine” of compound interest is just warming up. It takes time for the interest to build a large enough base to start generating its own massive returns. Thinking of it as a “get rich slow” scheme is the most accurate and profitable way to view your investments.

Why Time Is More Important Than Money

The most surprising fact about compound interest is that the amount of time you are invested matters more than the amount of money you put in. In the U.S. financial system, the “cost of waiting” is the highest tax you will ever pay.

Let’s look at a classic comparison involving two hypothetical investors in the American market.

Investor A (The Early Starter): Starts at age 25. They invest 200 dollars every month into a retirement account for only 10 years, then they stop adding money entirely at age 35. They leave the money there to grow until they are 65.

Investor B (The Late Starter): Waits until age 35 to start. To make up for lost time, they invest 200 dollars every month for 30 years straight until they hit age 65.

The Result: Even though Investor B put in three times as much money over a much longer period, Investor A will likely end up with more money at retirement. Why? Because Investor A gave their money an extra ten years to “compound” on itself. Those early years are the most powerful because every dollar earned in your twenties has four decades to double and double again.

Common Misunderstanding: “I’ll Just Invest More Later”

Beginners often think they can wait until they have a “real career” or a higher salary at age 40 to start. They assume that investing 1,000 dollars a month later in life will be the same as investing 100 dollars a month now.

The Logic Check: While a higher salary helps, you cannot buy back time. Every year you wait, you are chopping off the most productive years of your money’s growth. In the world of compound interest, the “last years” of the investment are when the most growth happens, but those years only exist if you started early enough.

The Role of the U.S. Market and Inflation

When we talk about compound interest today, we have to consider the current environment in the United States. As we move through the middle of the decade, interest rates and inflation play a massive role in how your money grows.

Reinvesting Dividends: The Turbocharger

When you buy stocks in companies like Costco (COST) or Walmart (WMT), they often pay you a portion of their profits called a dividend. To truly master compound interest, you should not take that cash and spend it. Instead, most U.S. brokerages offer a “Dividend Reinvestment Plan” or DRIP.

By automatically using your dividends to buy more shares, you are increasing your “principal” (your starting amount) without spending any more of your own paycheck. This adds a second layer of compounding to your wealth. You are earning interest on your original money, interest on your interest, and interest on your reinvested dividends.

The Impact of Inflation

It is important to remember that while your money is compounding, the cost of living is also changing. This is why “sitting on cash” in a standard bank account that pays almost no interest is actually a losing strategy. If inflation in the U.S. is 3 percent but your bank account only pays 0.01 percent, your money is technically shrinking in value every day.

Compound interest is your best defense against inflation. By investing in assets that grow faster than the cost of bread and gas, you ensure that your future self can still afford the same quality of life you have today.

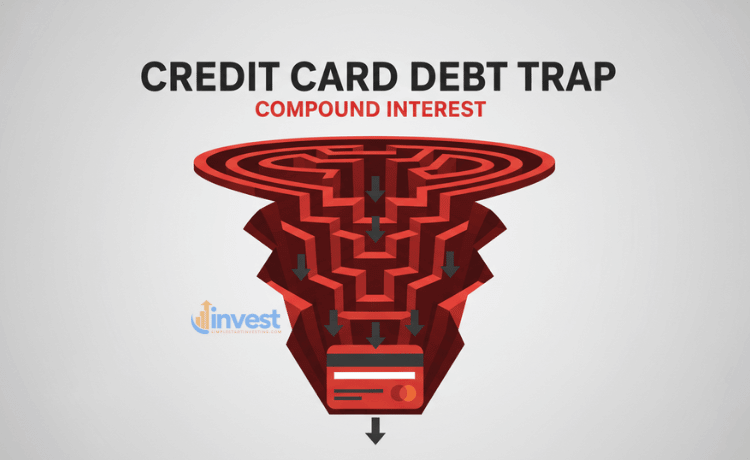

The “Dark Side” of Compounding: Debt

While compound interest is a hero when you are investing, it is a villain when you are in debt. Credit cards in the U.S. often have interest rates as high as 20 percent or 25 percent.

If you carry a balance on a credit card, the bank is using the power of compound interest against you. Every month you don’t pay off the full balance, they charge you interest. The next month, they charge you interest on the original debt plus the interest from the month before. This is how a small 1,000 dollar purchase can turn into a 5,000 dollar debt over several years if you only pay the minimum.

The Beginner’s Error: Focusing on Gains While Carrying Debt

A common mistake is trying to earn 8 percent in the stock market while paying 22 percent on a credit card.

The Financial Logic: You are essentially trying to swim upstream against a waterfall. Before you can let compound interest work for you, you must stop it from working against you. Paying off high-interest debt is a “guaranteed return” because you are instantly stopping the compounding loss of your wealth.

How to Start Your Compounding Engine Today

You do not need a lot of money to start. In fact, many U.S. investment platforms now allow for “fractional shares.” This means if a single share of Apple (AAPL) is too expensive, you can buy just 10 dollars worth of it.

Step 1: Utilize Tax-Advantaged Accounts

In the U.S., the IRS (Internal Revenue Service) provides special accounts like a 401(k) or an IRA (Individual Retirement Account). These are designed to help your money compound even faster because you don’t have to pay taxes on the growth every year.

Example: In a regular brokerage account, if you earn 100 dollars in interest, you might have to pay 15 or 20 dollars in taxes immediately, leaving you with less money to reinvest. In a Roth IRA, you keep the full 100 dollars to reinvest, allowing the “snowball” to stay larger and roll faster.

Step 2: Consistency Over Intensity

It is better to invest 50 dollars every month than to wait three years to invest 2,000 dollars. Consistency ensures you are buying in different market conditions—a strategy known as dollar-cost averaging—and it keeps your compounding engine running without interruption.

Step 3: Lower Your Fees

Every dollar you pay in management fees or “expense ratios” is a dollar that isn’t compounding for you. Over 30 years, a 1 percent fee can eat up nearly 20 percent of your final nest egg. Look for low-cost index funds or ETFs (Exchange Traded Funds) that offer broad exposure to the U.S. market for a very low fee.

Summary: The Logic of Long-Term Wealth

Compound interest is not a magic trick; it is a mathematical certainty. It rewards patience and punishes delay. To make it work for you, you must follow three simple rules:

- Start as early as possible to give the “snowball” more time to roll.

- Reinvest your earnings so your interest can start earning its own interest.

- Stay disciplined and avoid the temptation to pull your money out during market dips.

Remember, the largest gains in a compounding journey always happen at the very end. The “boring” middle years are where most people quit, but those who stay the course are the ones who wake up decades later with a fortune built on a foundation of small, smart choices.

Note: Regulations regarding tax accounts and interest reporting may change; please check the current IRS guidelines or consult with a financial professional for your specific situation.