If you have ever looked at your paycheck and wondered why a chunk of your hard-earned money disappears under the label FICA, you are already looking at the foundation of the American retirement system. That money is not just a tax; it is a contribution to a massive insurance program designed to protect you and your family. For most Americans, Social Security Basics are the difference between a stressful retirement and a stable one.

Understanding how this system works is one of the most important steps you can take in your financial journey. It is often the largest single source of income for retirees in the United States. However, it is also one of the most misunderstood. Many people view it as a personal savings account, while others fear it will completely disappear before they can use it. Neither of those views is quite right.

In this guide, we will break down the essential Social Security Basics you need to know. We will explore how you qualify for benefits, how the government determines your monthly check, and how the choices you make today will impact your lifestyle decades from now. Let’s peel back the layers of this safety net to see how it actually supports you.

What Exactly Is Social Security?

At its heart, Social Security is a federal insurance program. It is officially called the Old-Age, Survivors, and Disability Insurance (OASDI) program. Unlike a private 401k or an IRA where you put money into your own personal account, Social Security is a “pay-as-you-go” system. The money you pay into the system today is used to pay benefits to people who are retired right now. When you retire, the workers of that time will pay for your benefits.

The Simple Explanation Think of Social Security as a massive community pot. Every time you get paid, you put a small slice of your “income pizza” into the pot. In exchange, the government promises that when you reach a certain age, or if you become disabled and cannot work, you will get a monthly slice of the pot for the rest of your life. It acts as a floor for your income, ensuring that no matter what happens to your other investments, you have something to fall back on.

A Real-World Example Imagine a worker at a company like Walmart named Sarah. Every two weeks, Sarah sees a deduction for Social Security on her paystub. She isn’t just “losing” that money. She is buying into a system that provides her with a monthly check later in life, and also provides protection for her children if something were to happen to her before she retires.

Common Beginner Mistake Many beginners think Social Security is like a high-yield savings account where their specific dollars are sitting in a vault waiting for them. They might say, “I want my money back with interest!”

The Right Mindset Social Security is insurance, not a standard savings account. You are paying for “protection” against the risk of outliving your money or becoming unable to work. The “return” you get is the guarantee of a lifetime monthly payment, which is backed by the US government.

The “Credit” System: How You Qualify

You cannot just decide to collect Social Security because you feel like retiring. You have to “earn” your way into the system. The Social Security Administration uses a Credit System to track your eligibility. To qualify for retirement benefits, most people need to earn 40 credits over their working life.

The Simple Explanation Think of these credits as “stamps” on a loyalty card. You can earn a maximum of four credits per year. Since you need 40 credits to “unlock” your retirement benefits, this usually means you need to work and pay Social Security taxes for at least ten years. The amount of money you need to earn to get one credit changes slightly every year to keep up with inflation.

A Real-World Example Let’s look at David, who works part-time at Costco. To earn one credit this year, David needs to earn a specific amount of money, which is currently less than 2,000 dollars. If he earns four times that amount over the course of the year, he gets his four credits for the year. Even if David earns 200,000 dollars this year at a high-tech job like Amazon, he still only gets four credits. You cannot “fast-track” the 10-year requirement by earning more money in a single year.

Common Beginner Mistake A common error is thinking that if you haven’t worked for ten years, you get nothing. While you do need those 40 credits for your own retirement benefit, you might still qualify for benefits based on a spouse’s work history or if you become disabled.

The Right Mindset The credit system is a marathon, not a sprint. Your goal in the early stages of your career is simply to ensure you are “covered.” Most full-time workers will hit this 40-credit milestone easily within their first decade of work.

How Your Benefit Amount Is Actually Calculated

This is where many people get confused because they think the government just looks at their last paycheck to decide their retirement amount. In reality, the calculation is much more thorough. The Social Security Administration looks at your 35 highest-earning years.

The Simple Explanation The government takes your career earnings, adjusts them for inflation so that 100 dollars from thirty years ago is compared fairly to 100 dollars today, and then picks the top 35 years. They add those years up and divide them by the total number of months in 35 years. This gives them your “Average Indexed Monthly Earnings.” If you worked fewer than 35 years, the government puts “zero” in the remaining slots, which can significantly lower your monthly check.

A Real-World Example Imagine Maria, who worked for 20 years at Target and then stayed home to raise her children for 15 years. When the government calculates her benefit, they will take her 20 years of earnings and then add 15 years of “zeros” to reach the 35-year total. This average will be much lower than if she had worked for all 35 years.

Common Beginner Mistake Many beginners think that only their “best year” or their “final year” of salary matters. They might work really hard for one year at a company like Tesla and expect a huge retirement check based on that single high salary.

The Right Mindset Consistency is king. To maximize your benefit, you want to aim for at least 35 years of solid earnings. If you have a few years with low or no income, working a few extra years later in life can “replace” those zeros in the calculation and boost your monthly check for the rest of your life.

The Timing Game: When Should You Claim?

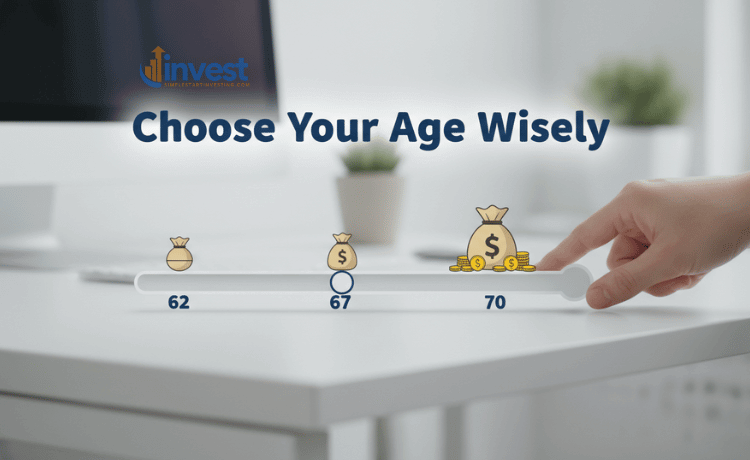

One of the most critical Social Security Basics is choosing the right age to start receiving your checks. You have a window of time—usually starting at age 62 and ending at age 70—to make this choice.

The Simple Explanation You have a “Full Retirement Age,” which for most people born after 1960 is 67. If you take your money at age 67, you get 100 percent of what you earned. If you decide to take it early at age 62, the government gives you the money for more years, so they “shrink” each monthly check to compensate. If you wait past 67, they “grow” your check as a reward for waiting.

A Real-World Example Let’s say your “full” benefit is 2,000 dollars a month at age 67.

- If you claim at age 62, your check might be reduced by about 30 percent, leaving you with 1,400 dollars.

- If you wait until age 70, your check could grow by about 8 percent for every year you wait past age 67. This could result in a monthly check of roughly 2,480 dollars.

Common Beginner Mistake Many people rush to claim at age 62 because they fear the money will run out or they just want the cash now. They don’t realize that this reduction is permanent. They will receive that smaller check for the rest of their lives, even if they live to be 100.

The Right Mindset Think of your claiming age as a “multiplier.” Claiming early is a permanent pay cut, while waiting is a permanent raise. Unless you have an immediate health concern or a desperate need for cash, waiting often provides a much higher “guaranteed” return than almost any other investment.

Working While Receiving Benefits: The “Earnings Test”

Can you have your cake and eat it too? Many people want to start collecting Social Security while still working a part-time job at a place like Home Depot or Starbucks. This is possible, but there are rules you must follow if you haven’t reached your full retirement age yet.

The Simple Explanation If you are younger than your full retirement age and you earn more than a certain limit (which is roughly 24,000 dollars this year), the government will temporarily hold back some of your Social Security money. For every two dollars you earn above that limit, they withhold one dollar of benefits. Once you reach your full retirement age, this limit disappears completely, and you can earn as much as you want without any withholding.

A Real-World Example Consider John, who is 63 years old. He starts his Social Security but also takes a job earning 30,000 dollars a year. Since he is about 6,000 dollars over the “limit,” the government will withhold 3,000 dollars of his Social Security benefits for that year. However, this money isn’t “lost” forever. When John reaches age 67, the government will recalculate his monthly check to pay him back for those withheld months.

Common Beginner Mistake Beginners often think the government is “taxing” their benefits at 50 percent if they work. They feel like they are being punished for having a job.

The Right Mindset The earnings test is a deferral, not a tax. It is the government’s way of saying, “If you are still working and making good money, you don’t actually need the ‘retirement’ safety net yet.” If your benefits are withheld, your future monthly checks will be slightly higher to make up for it.

Does Uncle Sam Take a Cut? (Taxes on Benefits)

It might seem unfair, but you may have to pay federal income taxes on your Social Security benefits. This depends on your “combined income,” which is the sum of your adjusted gross income, any tax-exempt interest, and half of your Social Security benefits.

The Simple Explanation If your total income stays below a certain level, you pay zero tax on your benefits. If your income is higher—perhaps because you have a pension or you are selling stocks like Apple or JPMorgan Chase—you might have to pay taxes on up to 50 percent or even 85 percent of your benefit amount. Note that you are not taxed at 85 percent; rather, 85 percent of the money is subject to your normal income tax rate.

A Real-World Example Imagine a retired couple who has a modest income from a part-time job and their Social Security. If their combined income is less than 32,000 dollars, they likely won’t pay any federal tax on their Social Security. But if they have a large 401k withdrawal that pushes their income to 50,000 dollars, a large portion of their Social Security will be treated as taxable income.

Common Beginner Mistake Many people are shocked to find out they owe money to the IRS in retirement. they assume that since they paid taxes into the system while working, the money coming out must be tax-free.

The Right Mindset Tax planning doesn’t stop when you retire. You need to look at your “taxable” income sources (like traditional IRAs) and your “non-taxable” sources (like Roth IRAs) to manage how much of your Social Security is hit by the tax man.

Spousal and Survivor Benefits: Protecting the Family

One of the most beautiful parts of the Social Security Basics is that the safety net extends to your family. You don’t just earn benefits for yourself; you earn them for your spouse and even your ex-spouse in some cases.

The Simple Explanation A spouse can receive up to 50 percent of the other spouse’s full retirement benefit. If the higher-earning spouse passes away, the surviving spouse can typically switch to a “Survivor Benefit,” which allows them to receive 100 percent of the deceased spouse’s check if it is higher than their own. This ensures that the household income doesn’t drop to zero if the primary breadwinner dies.

A Real-World Example Consider Robert and Susan. Robert worked at Ford for 40 years and has a large Social Security check. Susan stayed home and has a very small check of her own. Susan can choose to take a “spousal benefit,” which gives her half of what Robert gets. If Robert passes away, Susan’s small check stops, and she starts receiving Robert’s full, larger check instead.

Common Beginner Mistake Couples often claim their benefits independently without a strategy. They don’t realize that the higher-earner’s decision to wait until age 70 isn’t just about their own check—it is also about providing a much larger “insurance policy” for the surviving spouse later in life.

The Right Mindset If you are married, Social Security is a team sport. Coordinate your claiming ages to maximize the total amount of money that will come into the household over both of your lifetimes.

The Future of Social Security: Will It Be There for You?

You have probably seen headlines claiming that Social Security is “going bankrupt.” This is a major source of anxiety for beginners, but the reality is more nuanced.

The Simple Explanation Social Security has a “Trust Fund” that acts like a reserve tank. Currently, the system is paying out more in benefits than it is taking in from taxes, so it is dipping into that reserve. If the reserve runs dry (which some estimate could happen in the mid-2030s), the system will still be taking in tax money from workers. This means it could still pay out about 75 to 80 percent of promised benefits even if the “reserve tank” is empty.

A Real-World Example Think of a water tower. Usually, the tower is full. If the water stops flowing into the tower, it eventually goes dry. But in Social Security’s case, the “pipes” (tax revenue from workers) are still bringing in water every day. Even if the tower itself is empty, the water coming through the pipes can still supply most of the houses in the neighborhood.

Common Beginner Mistake The biggest mistake is assuming you will get zero and therefore failing to include Social Security in your retirement plan. This leads people to be overly aggressive with risky investments because they feel they have no safety net.

The Right Mindset While it is wise to save as much as you can in your own accounts, it is highly likely that Social Security will still be there in some form. Congress has a long history of making “last-minute” adjustments (like raising the retirement age or increasing the tax cap) to keep the system solvent because it is so vital to the American economy.

How to Get Started with Your Own Plan

Now that you understand the Social Security Basics, the next step is to see where you personally stand. You don’t have to wait until you are 60 to do this.

- Create a “my Social Security” account: Go to the official Social Security website (ssa.gov) and set up an account. This is the only way to see your actual earnings history.

- Check for Errors: Look at your earnings for every year. If you worked at McDonald’s in 1995 but the record shows zero dollars, you need to fix that now. An error in your 20s can shrink your check in your 60s.

- Review Your Estimates: The website will show you what your monthly check might look like at ages 62, 67, and 70. Use these numbers as a baseline for your retirement planning.

Summary of Action Your Social Security benefit is an asset, just like a house or a stock portfolio. The more you know about how it grows and how it is taxed, the better you can integrate it into your overall plan for financial freedom.