Have you ever felt like the world of investing is just too fast? Everywhere you look, people are talking about “day trading,” “flipping stocks,” or checking their phones every five minutes to see if their money went up or down. It feels like you need to be a professional athlete of finance just to keep your head above water.

But what if the most powerful way to build wealth was actually to do nothing at all?

Welcome to the Coffee Can Portfolio. This is a strategy built for people who want to get rich slowly and surely without the stress of the daily news. It is a method that turns “laziness” into a competitive advantage. In this guide, we are going to break down exactly how this works, why it is so effective in today’s market, and how you can start your own “can” today.

What is a Coffee Can Portfolio?

The term Coffee Can Portfolio comes from a time in Old West America before banks were on every corner. Back then, people would put their most valuable items—gold coins, land deeds, or cash—into an old coffee can and hide it under a mattress or bury it in the backyard. They didn’t check it every day. They didn’t trade their gold for silver every time the wind blew. They just let it sit there for decades.

In 1984, an investment expert named Robert Kirby realized that this “old-fashioned” way of thinking was actually the secret to incredible wealth in the stock market. He noticed that while professional investors were busy buying and selling to try and “beat the market,” the people who simply bought great companies and “forgot” they owned them often ended up much richer.

How it works in plain English: You find a handful of world-class companies—the kind of businesses you think will still be around in twenty or thirty years. You buy their stock, and then you virtually “put them in a coffee can.” You don’t sell them when the news gets scary. You don’t sell them even when the price doubles. You just let them grow.

A real-world example: Imagine a person who bought shares of Amazon (AMZN) or Costco (COST) twenty years ago. At many points during those years, the stock market crashed, or experts said those companies were “too expensive.” A typical beginner might have sold their shares to “lock in” a small profit or out of fear. But the Coffee Can investor did nothing. By simply ignoring the noise, their original investment would have grown hundreds of times over.

The common beginner mistake: Most new investors think that “investing” means “trading.” They believe they need to be active to be successful. They think that if they aren’t constantly moving their money around, they are falling behind.

The mindset shift: In the world of the Coffee Can Portfolio, your best work is done when you are sitting on your hands. Activity is often the enemy of high returns because every time you sell, you pay taxes and fees, and you risk missing out on the biggest growth spurts of a great company.

The Secret Power of the “Do Nothing” Edge

Why is doing nothing so hard, yet so rewarding? To understand the Coffee Can Portfolio, we have to look at how the stock market actually works over long periods.

1. Avoiding the “Tax Man”

In the United States, the way you are taxed on your investments depends heavily on how long you hold them. If you buy a stock and sell it in less than a year, you usually pay “Short-Term Capital Gains Tax.” This is often the same high rate as your normal paycheck tax.

However, if you hold for more than a year, you move into “Long-Term Capital Gains.” For the current tax years of 2025 and 2026, many people pay 15 percent or even 0 percent on these gains, depending on their total income. By using a Coffee Can Portfolio and never selling, you essentially delay paying taxes for decades. This allows your “tax money” to stay in your account and earn even more money for you.

The common beginner mistake: Many beginners sell a stock as soon as they see a 20 percent profit because they want to “feel” the win. They don’t realize that after paying taxes and brokerage fees, their actual “win” is much smaller, and they now have to find a new stock to buy.

The mindset shift: Think of taxes as a hole in your bucket. The more you “trade,” the more holes you poke in the bucket. The Coffee Can strategy keeps your bucket sealed tight so the wealth can pile up.

2. The Power of Asymmetric Returns

This is a fancy way of saying that one “home run” can pay for all your other mistakes. In a Coffee Can Portfolio, you might buy ten different companies. Some might stay flat. One or two might even go out of business over twenty years.

But if just one of those companies becomes the next Apple (AAPL) or Microsoft (MSFT), that single winner will grow so large that it makes the losses from the others irrelevant. If you are constantly selling your winners to “take profits,” you never give them the chance to become those life-changing “home runs.”

How to Pick Your “Coffee Can” Stocks

Since you aren’t going to touch these stocks for at least ten years, you can’t just pick any random company. You need “forever” companies. Here is what to look for, explained simply:

1. Look for a “Moat”

Think of a business like a castle. A “moat” is a ditch filled with water that protects the castle from enemies. In business, a moat is something that makes it very hard for other companies to compete.

- Brand Power: People will always buy a Coca-Cola or a Disney movie because of the brand name.

- Switching Costs: It is very hard for a big hospital to stop using Johnson & Johnson medical supplies once they are set up.

- Network Effect: People use Visa or Mastercard because every store accepts them, and every store accepts them because every person has one.

2. Consistent Growth (The 10/15 Rule)

While we don’t use complex math, we can look at two simple signs of health over the last ten years:

- The 10 percent rule: Has the company increased its total sales (revenue) by about 10 percent every year? This shows people want what they are selling.

- The 15 percent rule: For every 100 dollars the company spends on its business, does it make at least 15 dollars in profit? This shows they are efficient and smart with their money.

A real-world example: Think about a company like Walmart (WMT). Year after year, they sell more goods and find ways to do it more efficiently. They aren’t a “flash in the pan” tech startup. They are a staple of American life. That is a Coffee Can candidate.

The common beginner mistake: New investors often look for “the next big thing” or a “hot tip” on a company that hasn’t made any money yet. They are gambling on the future rather than investing in a proven track record.

The mindset shift: You aren’t looking for the fastest horse; you are looking for the horse that can run for twenty miles without stopping. Quality matters more than speed.

The Psychology: Why “Doing Nothing” is the Hardest Part

The Coffee Can Portfolio is mathematically simple but psychologically difficult. The biggest threat to your wealth isn’t the stock market—it’s the person you see in the mirror.

The “Itch” to Act

When the stock market drops (which happens often!), your brain’s “fight or flight” response kicks in. You will feel a massive urge to “do something” to protect your money. You might want to sell everything and wait for things to “calm down.”

Conversely, when the market is booming, you will feel the urge to sell your “boring” Coffee Can stocks to buy whatever is currently “mooning” or trending on social media.

How to Stay in the Can

- Stop Checking the Score: If you were growing a tree, would you dig it up every morning to see if the roots grew an inch? Of course not. Treat your portfolio the same way. Check it once or twice a year, not once or twice a day.

- Automate Everything: Set up your account so that a portion of your paycheck goes into your chosen stocks automatically. The less you have to think about it, the better you will perform.

A real-world example: During the high-stress periods of recent years, many investors sold their stocks in a panic. Those who held onto high-quality companies like Alphabet (Google) saw their investments recover and reach new heights within a year or two. The “doers” lost money; the “non-doers” gained wealth.

Building Your First Coffee Can: Step-by-Step

If you are ready to try the Coffee Can Portfolio strategy, here is the roadmap for a beginner in the US market:

Step 1: Clear the Path

Before you put money in a “can” for ten years, make sure you have an emergency fund in a standard high-yield savings account. This ensures that if your car breaks down or you lose your job, you won’t be forced to “break the can” and sell your stocks at a bad time.

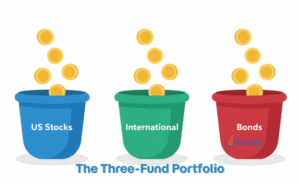

Step 2: Choose 10 to 15 Leaders

Don’t put all your eggs in one basket. Choose companies from different industries. For example:

- One from technology (like Microsoft)

- One from retail (like Home Depot)

- One from healthcare (like UnitedHealth)

- One from consumer goods (like PepsiCo)

Step 3: Buy and “Lose the Key”

Once you buy these shares through a reputable US brokerage, your job is effectively over. You aren’t “watching” these stocks. You are “owning” these businesses.

Step 4: The 10-Year Rule

Promise yourself that you will not sell any of these shares for at least a decade, unless the company fundamentally changes (for example, if they go from selling smartphones to selling fax machines). Short-term price drops are not a reason to sell.

The “Coffee Can” and Your Retirement

The Coffee Can Portfolio is a perfect partner for retirement accounts like a 401(k) or an IRA. Because these accounts already have tax advantages, the “buy and hold” strategy becomes even more powerful.

Imagine you are thirty years old today. If you start a Coffee Can now and add to it consistently, by the time you reach retirement age, you will have decades of “untouched” growth. You won’t have wasted money on “trading fees” or lost sleep over what a TV commentator said about the economy in a random Tuesday in October.

The common beginner mistake: Thinking they are “too late” to start. They see a company that has already grown a lot and think they missed the boat.

The mindset shift: The best time to plant a tree was twenty years ago. The second best time is today. High-quality companies tend to stay high-quality for a long time. Buying a “great” company at a “fair” price today is much better than waiting for a “perfect” price that may never come.

Summary: Is the Coffee Can Right for You?

The Coffee Can Portfolio isn’t for everyone. If you enjoy the thrill of the gamble, the fast pace of day trading, or the feeling of being “active” in the market, you might find it boring.

But if your goal is to build long-term wealth while spending as little time as possible worrying about your money, this is the ultimate “cheat code.” By picking quality, diversifying your holdings, and—most importantly—having the discipline to do absolutely nothing, you allow the greatest companies in the world to work for you.

Remember, in the stock market, you don’t get paid for how hard you work or how many trades you make. You get paid for being right and being patient.