If you are like most people in the US, you probably have a savings account with one of the “big four” banks. You might check your balance once a month, see that everything is safe, and feel a sense of security. But have you ever looked closely at the interest you are earning? For many, that monthly interest payment is only a few pennies.

In the world of personal finance, this is what we call “sleeping money.” While your cash sits in a traditional account, it is actually losing value over time because prices for things like groceries and gas are going up faster than your bank is paying you. The good news is that there is a better way to save without taking any extra risk.

A High-Yield Savings Account is the secret weapon for anyone starting their financial journey. It works exactly like the savings account you already have, but it pays you significantly more just for keeping your money there. This guide will show you how to wake up your money and make it work for you.

What Exactly Is a High-Yield Savings Account?

A High-Yield Savings Account, often called an HYSA, is a type of savings account that typically pays an interest rate much higher than the national average. While a traditional bank might pay you almost nothing, these accounts are designed to help your balance grow.

To understand this, let’s look at how a bank works. When you put money in a bank, they don’t just put it in a box with your name on it. They use that money to provide loans to other people. In exchange for letting them use your money, they pay you interest. A “high-yield” account simply gives you a bigger “thank you” in the form of a higher interest rate.

Most of these accounts are offered by online-only banks. Because these banks do not have to pay for thousands of physical buildings or thousands of tellers in every city, they save a lot of money. They pass those savings on to you by offering better rates.

A Real-World Look at the Numbers

Imagine you have 10,000 dollars saved for an emergency. If you leave that 10,000 dollars in a big traditional bank paying a rate of 0.01 percent, at the end of one year, you will have earned exactly 1 dollar. You can’t even buy a cup of coffee with that.

Now, imagine you move that same 10,000 dollars into a High-Yield Savings Account paying a rate of 4.00 percent. At the end of that same year, your money would have earned 400 dollars. That is 400 dollars you earned just for moving your money to a different “bucket.”

The Common Mistake Beginners Make

Many new savers believe that if an interest rate looks “too high,” it must be a scam or a high-risk investment like the stock market. They worry that they might lose their initial deposit if the economy takes a turn.

The Financial Logic Shift

In reality, a High-Yield Savings Account is not an “investment” in the risky sense. It is a cash deposit. As long as the bank is insured by the federal government, your money is just as safe there as it is at a bank on your street corner. You aren’t “betting” your money; you are simply choosing a store that pays you more for your patronage.

Why Do Online Banks Pay So Much More?

It can feel strange to put your hard-earned money into a bank that doesn’t have a physical building you can walk into. You might wonder, “How can they afford to pay me 400 dollars when my local bank only gives me 1 dollar?”

The answer is simple: overhead costs. A traditional bank like Chase or Bank of America has to pay for electricity, rent, property taxes, and security for thousands of branches across the country. They also have to pay a massive workforce to staff those locations. All of those costs eat into the money they could be paying you.

Online banks operate differently. They usually have a few central offices and a very efficient website and mobile app. By cutting out the cost of “bricks and mortar,” they have a much lower cost of doing business. This allows them to compete for your business by offering the highest rates in the market.

An Everyday Example

Think of it like buying a brand-name shirt at a fancy mall versus buying a similar high-quality shirt directly from the manufacturer’s website. The mall store has to charge more (or give you less value) because they have to pay for the expensive mall rent. The online store doesn’t have that problem, so they can give you a better deal for the exact same quality.

The Common Mistake Beginners Make

People often think that a bank with a physical building is “more stable” than an online bank. They feel that if there is a problem, they can go talk to someone in person to get their money back.

The Financial Logic Shift

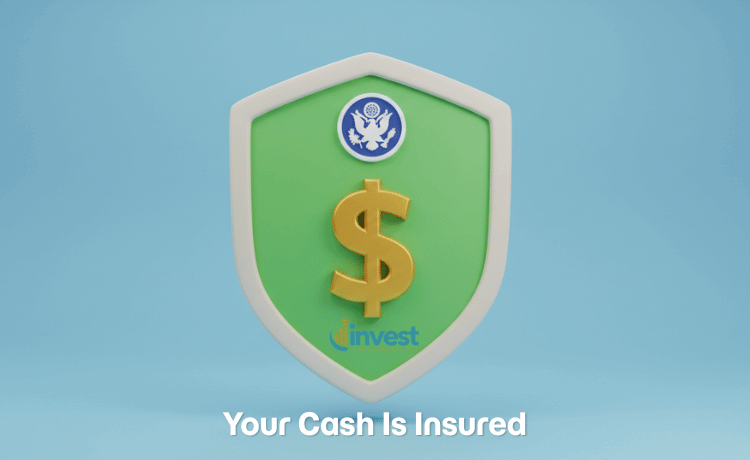

The safety of your money has nothing to do with the building. It has everything to do with federal insurance. In the US, the government protects your deposits up to a certain limit. Whether the bank has ten thousand branches or zero branches, if they are federally insured, your money is protected by the same law.

Is My Money Safe in a High-Yield Savings Account?

Safety is the number one priority for anyone starting out. You don’t want to work hard for your money only to have it disappear. This is where FDIC insurance comes in.

The Federal Deposit Insurance Corporation (FDIC) is a government agency that protects people who put their money in banks. If a bank fails or goes out of business, the FDIC steps in and makes sure you get your money back, up to 250,000 dollars per person, per bank.

When you are looking for a High-Yield Savings Account, the most important thing to check is that the bank is “Member FDIC.” If you see that logo, you can sleep soundly knowing your cash is backed by the full faith and credit of the United States government.

A Safety Example

Let’s say you have 50,000 dollars in an online High-Yield Savings Account. One morning, you wake up and see a news report that your online bank has gone out of business. Because the bank was FDIC insured, you do not lose a single penny. The government will either move your money to another bank or send you a check for the full 50,000 dollars.

The Common Mistake Beginners Make

Beginners often confuse high-yield accounts with “Money Market Funds” or “Brokerage Accounts.” They think that “high-yield” means the money is being put into stocks or bonds that could go down in value.

The Financial Logic Shift

An HYSA is a “deposit account,” not a “market investment.” Your balance will never go down unless you personally withdraw the money. It only goes up as interest is added. The “yield” is just a fancy word for the interest rate the bank promises to pay you.

Understanding APY: How Your Money Actually Grows

When you look at different banks, you will see a number followed by the letters APY. This stands for Annual Percentage Yield. It is the most important number to understand because it tells you exactly how much you will earn over one year, including the effect of “compounding.”

Compounding is a powerful force in finance. It means you earn interest on your original deposit, and then you earn interest on the interest you already received. This creates a snowball effect that helps your money grow faster over time.

A Simple Math Story

If you start with 1,000 dollars in a High-Yield Savings Account with a 4.00 percent APY, you don’t just get one payment at the end of the year. Most banks pay you a little bit of interest every single month.

After the first month, you might have 1,003 dollars. In the second month, the bank calculates your interest based on 1,003 dollars, not just the original 1,000 dollars. By the end of the year, those tiny extra amounts add up to a total of 40 dollars in earnings.

The Common Mistake Beginners Make

Many people wait until they have a “large amount” of money before they bother opening a high-yield account. They think it isn’t worth the effort for a few hundred dollars.

The Financial Logic Shift

Financial habits are more important than the amount of money you have right now. Starting with 500 dollars in an HYSA teaches you how to manage your cash and lets you see the growth happen in real-time. Plus, because these accounts are variable, the sooner you get in, the sooner you start benefit from the current high rates.

Taxes and the IRS: What You Need to Know

In the US, the money you earn from interest is considered “income,” just like the money you earn from your job. This is something that often surprises new savers during tax season.

If you earn more than 10 dollars in interest in a single year, your bank is required to send a form called a 1099-INT to both you and the IRS. You will need to report this amount when you file your taxes.

An Example of Taxes

If you earned 400 dollars in interest last year, you will receive a form in January or February showing that amount. When you do your taxes, you will add that 400 dollars to your total income. If your tax rate is 10 percent, you might owe 40 dollars in taxes on those earnings. You still come out ahead with 360 dollars in profit!

The Common Mistake Beginners Make

Some people think that because the money is in a “savings” account, the government doesn’t tax it. They are then surprised when they get a tax bill or a notice from the IRS.

The Financial Logic Shift

Always remember that “Interest Earned = Taxable Income.” It is a good problem to have because it means your money is actually growing. Just keep a little bit of your earnings in mind for when tax time comes around.

When Should You Use a High-Yield Savings Account?

A High-Yield Savings Account is not for every type of money. It is a specific tool for a specific job. Because these are “savings” accounts, they are meant for money you don’t need to spend today, but might need in a few months or years.

The best uses for an HYSA include:

- Emergency Funds: This is the 3 to 6 months of expenses you keep “just in case.” You want this money safe and accessible, but you also want it to keep up with inflation.

- Short-Term Goals: If you are saving for a wedding, a down payment on a house, or a new car in the next two years, an HYSA is the perfect home for that cash.

- Large Annual Expenses: You can use an HYSA to save for your annual car insurance or holiday gifts so that the money earns interest while it waits to be spent.

The Common Mistake Beginners Make

Some people try to use an HYSA as a “checking account.” They try to pay their rent and buy groceries directly from it.

The Financial Logic Shift

Savings accounts often have limits on how many times you can take money out each month. If you pull money out too often, the bank might charge you a fee or even turn the account into a regular checking account with a lower interest rate. Keep your “spending money” in checking and your “future money” in your High-Yield Savings Account.

How to Choose the Best Account for You

Choosing a bank can feel overwhelming because there are so many options. However, for a beginner, you really only need to look at three things:

- The APY: Obviously, you want a high rate. Look for banks that are consistently near the top of the market.

- Fees: A good High-Yield Savings Account should have zero monthly maintenance fees. You should never have to pay the bank to hold your money.

- Minimum Balance: Some banks require you to keep 5,000 dollars in the account to get the high rate. Others let you start with just 1 dollar. Choose one that fits your current situation.

A Real-World Comparison

Company A offers a 4.50 percent APY but charges a 10 dollar monthly fee unless you keep 10,000 dollars in the account. Company B offers a slightly lower 4.10 percent APY but has no fees and no minimum balance. For someone just starting with 1,000 dollars, Company B is the much better choice. The “higher” rate at Company A would actually cost you money because of the fees.

The Common Mistake Beginners Make

Many people choose a bank solely based on the highest advertised rate today. They don’t realize that these rates are variable.

The Financial Logic Shift

“Variable” means the bank can change the interest rate at any time based on what the Federal Reserve does. A bank that is paying 4.20 percent today might pay 3.80 percent next month. Instead of chasing the absolute highest number every week, look for a bank with a good reputation and a user-friendly app.

How to Get Started Today

Moving your money to a High-Yield Savings Account is one of the easiest financial wins you can achieve. It usually takes less than ten minutes to open an account online.

First, you will need your Social Security number and a way to transfer money from your current bank. Most online banks use a secure system to link to your old bank so you can move money back and forth with a few clicks.

Once you have opened the account, set up an automatic transfer. Even if it is just 25 dollars a paycheck, getting that money into a high-yield environment early is the best way to build wealth over the long term.

Summary Checklist for Beginners

- Check if the bank is Member FDIC.

- Look for an APY that is significantly higher than 0.50 percent.

- Ensure there are no monthly “maintenance” or “service” fees.

- Link your checking account for easy transfers.

- Understand that you will pay taxes on the interest you earn.

By taking these steps, you are ensuring that your money is no longer sleeping. You are putting it to work, allowing it to grow safely while you focus on the rest of your life.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Interest rates are subject to change, and you should always verify the current terms with your financial institution before opening an account.